Get the free PERSONAL FINANCE MANAGER

Show details

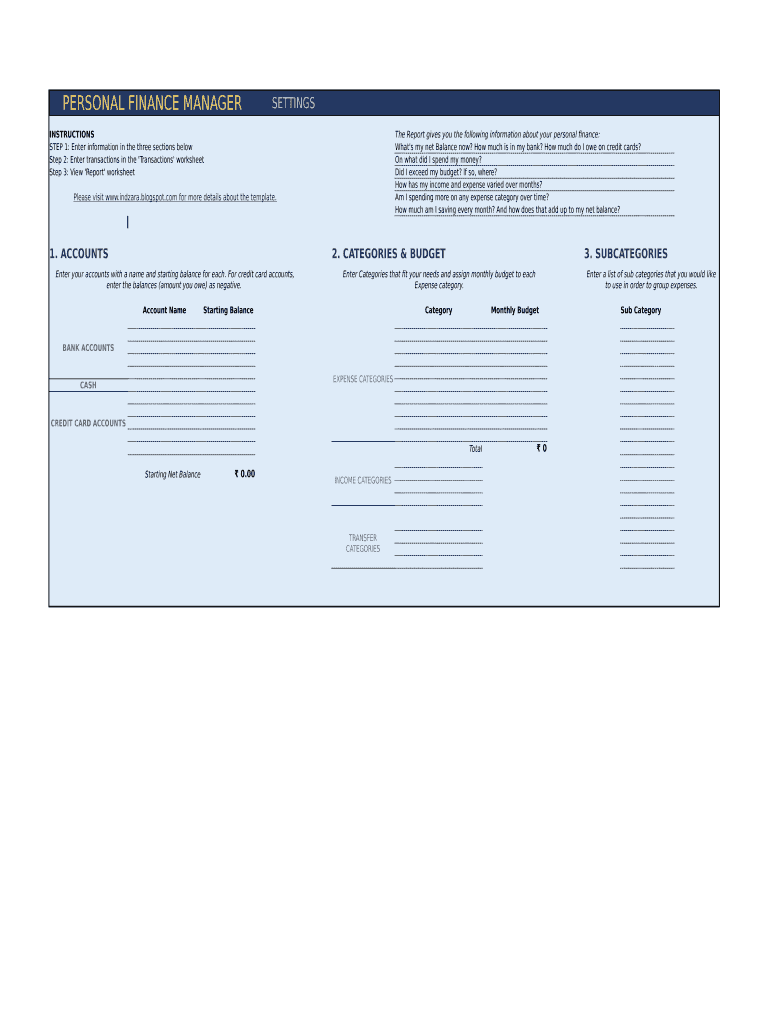

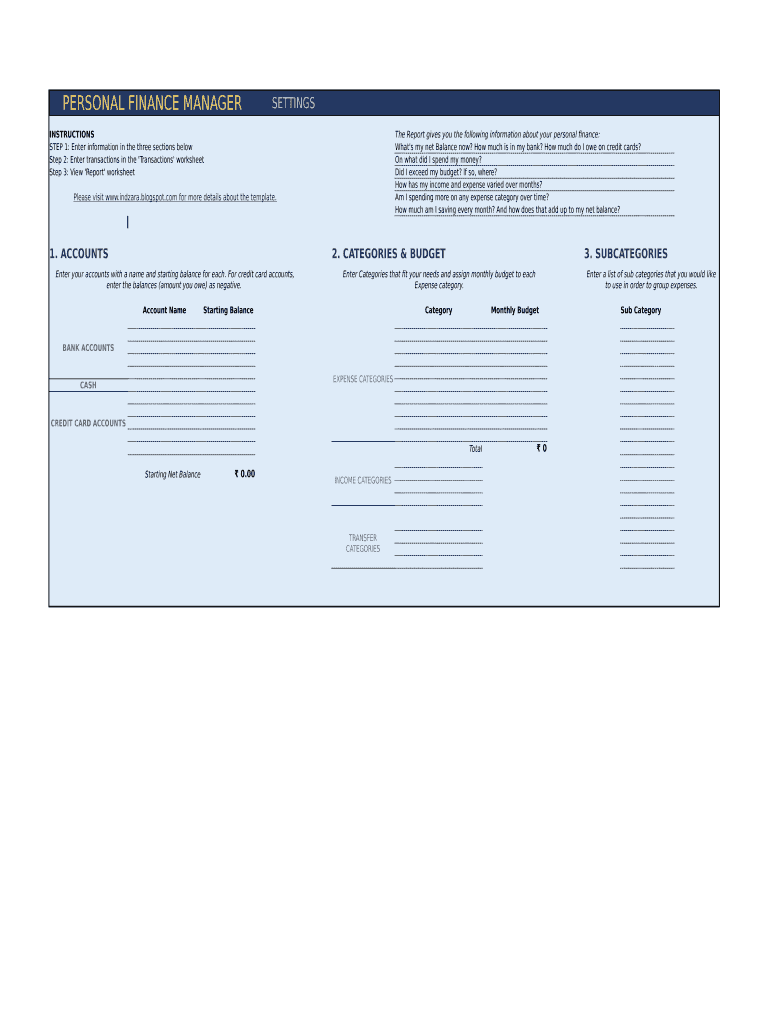

PERSONAL FINANCE MANAGERSETTINGSTRANSACTIONSINSTRUCTIONS STEP 1: Enter information in the three sections below Step 2: Enter transactions in the 'Transactions worksheet Step 3: View 'Report worksheet2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal finance manager

Edit your personal finance manager form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal finance manager form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal finance manager online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal finance manager. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal finance manager

How to fill out personal finance manager

01

To fill out personal finance manager, start by gathering all your financial documents such as bank statements, credit card statements, and pay stubs.

02

Create different categories for income and expenses, such as salary, rent, utilities, groceries, entertainment, etc.

03

Record all your income and expenses under their respective categories, ensuring accuracy and completeness.

04

Regularly update your personal finance manager with new financial transactions.

05

Use built-in tools or external software to calculate your total income, expenses, and savings.

06

Analyze your spending patterns and identify areas where you can cut back or save more.

07

Set financial goals and track your progress towards achieving them using the personal finance manager.

08

Review and reconcile your financial statements regularly to ensure the information in your personal finance manager matches your actual financial situation.

09

Make adjustments to your budget and financial plans as needed based on the information provided by your personal finance manager.

Who needs personal finance manager?

01

Anyone who wants to effectively manage their personal finances can benefit from using a personal finance manager.

02

Individuals who struggle with budgeting, tracking expenses, or saving money can find personal finance managers helpful.

03

Families or couples who need to track their combined household income and expenses can use a personal finance manager to streamline their financial management.

04

People who want to gain better control over their financial situation, set financial goals, and save for the future can utilize personal finance managers.

05

Entrepreneurs and small business owners can also benefit from using personal finance managers to manage their personal and business finances separately.

06

Students who want to track their income, expenses, and student loans can utilize personal finance managers to stay organized.

07

Individuals who are planning for retirement and want to track their investments, savings, and retirement accounts can benefit from using personal finance managers.

08

Anyone who wants a comprehensive view of their financial health, including net worth, debt management, and asset allocation, can utilize personal finance managers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in personal finance manager?

With pdfFiller, it's easy to make changes. Open your personal finance manager in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the personal finance manager electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your personal finance manager in seconds.

Can I create an eSignature for the personal finance manager in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your personal finance manager right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is personal finance manager?

A personal finance manager is a tool or software that helps individuals track their income, expenses, savings, investments, and overall financial health.

Who is required to file personal finance manager?

There is no requirement to file a personal finance manager. It is up to individuals to voluntarily use a personal finance manager to manage their finances.

How to fill out personal finance manager?

To fill out a personal finance manager, individuals need to input their financial transactions, income, expenses, savings, and investments on a regular basis to track and manage their finances effectively.

What is the purpose of personal finance manager?

The purpose of a personal finance manager is to help individuals budget, track expenses, save money, plan for financial goals, and monitor their overall financial health.

What information must be reported on personal finance manager?

Individuals must report their income, expenses, savings, investments, debts, and any other financial transactions on a personal finance manager.

Fill out your personal finance manager online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Finance Manager is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.