Get the free Deptola, MS Tax, MBA

Show details

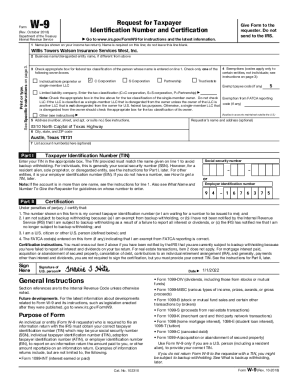

Frank Deltona & Associates, LLC Frank A. Deltona, MS Tax, MBA CA Insurance License # 0F34992 2400 E. Patella Ave. Suite 800 Anaheim, CA 92806 7143488979 7143499431 frank. Deltona lpl.com www.deptola.comThe

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deptola ms tax mba

Edit your deptola ms tax mba form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deptola ms tax mba form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deptola ms tax mba online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deptola ms tax mba. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deptola ms tax mba

How to fill out deptola ms tax mba

01

Gather all the required information and documents before starting to fill out the Deptola MS Tax MBA application.

02

Visit the official Deptola website and navigate to the application section.

03

Create an account, if required, and log in to access the online application form.

04

Carefully read through the instructions provided on the application form.

05

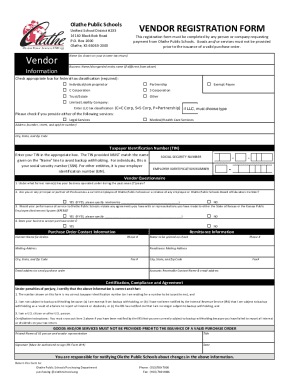

Enter your personal details, such as name, contact information, and social security number.

06

Provide details about your educational background, including previous degrees and institutions attended.

07

Fill out information regarding your work experience, if applicable.

08

Include any relevant certifications or licenses you hold.

09

Complete the section related to your desired program, specifying your interest in the MS Tax MBA program offered by Deptola.

10

Provide additional supporting materials, such as a resume, statement of purpose, or letters of recommendation, if required.

11

Review the filled-out application form for any errors or missing information.

12

Submit the completed application form electronically or through the specified method provided by Deptola.

13

Pay any required application fee or provide proof of fee waiver, if applicable.

14

Wait for confirmation of receipt and further instructions from Deptola.

15

Follow up with Deptola if you have not received any communication within the specified timeframe.

Who needs deptola ms tax mba?

01

Individuals who are interested in pursuing a career in taxation and want to gain expertise in both tax laws and business management.

02

Professionals who already have a background in tax and want to enhance their knowledge and skills in order to advance their careers.

03

Accountants and financial professionals who want to specialize in taxation and broaden their career opportunities.

04

Entrepreneurs and business owners who want to manage their own tax strategies effectively.

05

Individuals who aspire to work in accounting firms, tax consulting agencies, or government organizations dealing with tax-related matters.

06

Students who want to build a strong foundation in tax laws and business principles before entering the workforce.

07

Those who seek opportunities to network with professionals in the taxation field and build valuable connections.

08

Individuals who value the reputation and quality education offered by Deptola in the field of tax and business management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get deptola ms tax mba?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific deptola ms tax mba and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out deptola ms tax mba on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your deptola ms tax mba. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out deptola ms tax mba on an Android device?

Use the pdfFiller mobile app and complete your deptola ms tax mba and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

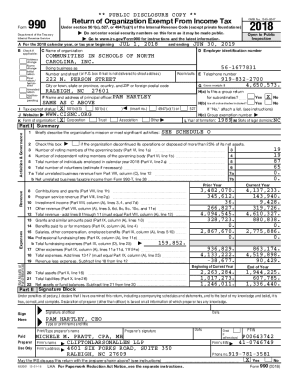

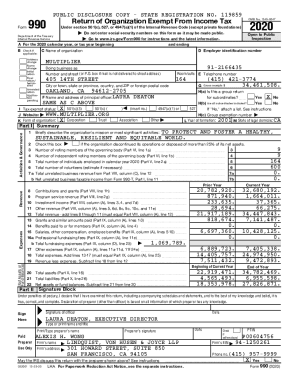

What is deptola ms tax mba?

Deptola MS Tax MBA is a tax form for reporting income and expenses related to business activities.

Who is required to file deptola ms tax mba?

Individuals or businesses that have taxable income from business activities are required to file Deptola MS Tax MBA.

How to fill out deptola ms tax mba?

Deptola MS Tax MBA can be filled out by providing accurate information about income, expenses, deductions, and credits related to business activities.

What is the purpose of deptola ms tax mba?

The purpose of Deptola MS Tax MBA is to calculate the taxable income from business activities and determine the tax liability.

What information must be reported on deptola ms tax mba?

Information such as income from business activities, expenses, deductions, and credits must be reported on Deptola MS Tax MBA.

Fill out your deptola ms tax mba online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deptola Ms Tax Mba is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.