Get the free Experian/FICO Auto Risk Model v3

Show details

Experian/FICO Auto Risk Model v3

Score Range

Min

Max

250

464

465

482

483

494

495

504

505

512

513

519

520

525

526

532

533

537

538

544

545

549

550

555

556

560

561

565

566

571

572

577

578

582

583

587

588

592

593

598

599

604

605

609

610

614

615

620

621

625

626

631

632

636

637

641

642

645

646

650

651

654

655

658

659

663

664

667

668

672

673

676

677

680

681

684

685

688

689

692

693

696Cumulative

%

1×

2×

3×

4×

5×

6×

7×

8×

9×

10×

11×

12×

13×

14×

15×

16×

17×

18×

19×

20×

21×

22×

23×

24×

25×

26×

27×

28×...

We are not affiliated with any brand or entity on this form

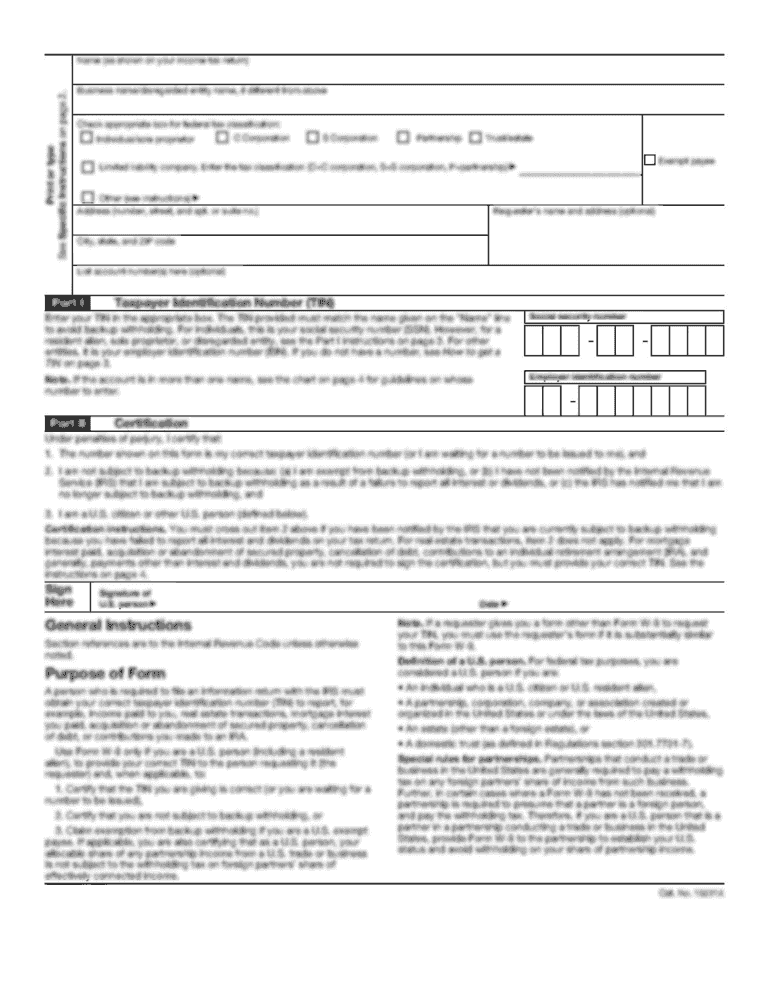

Get, Create, Make and Sign experianfico auto risk model

Edit your experianfico auto risk model form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your experianfico auto risk model form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit experianfico auto risk model online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit experianfico auto risk model. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out experianfico auto risk model

How to fill out experianfico auto risk model

01

To fill out the ExperianFICO Auto Risk Model, follow these steps:

02

Start by gathering all the necessary information for the model, including details about the borrower, vehicle, and loan.

03

Begin with the borrower's credit information, such as their credit score, credit history, and any previous auto loan information.

04

Provide details about the vehicle, including its make, model, year, and mileage.

05

Input the loan-specific information, such as the loan amount, interest rate, loan term, and down payment.

06

Consider additional factors that may impact the auto risk, such as the borrower's income, employment history, and debt-to-income ratio.

07

Evaluate any other relevant risk factors, such as the borrower's driving history, insurance coverage, or the purpose of the loan.

08

Finally, analyze the gathered information and use the ExperianFICO Auto Risk Model to assess the overall risk and determine the appropriate loan terms and conditions.

Who needs experianfico auto risk model?

01

Various entities and individuals can benefit from using the ExperianFICO Auto Risk Model, including:

02

- Lenders and financial institutions: The model helps them assess the creditworthiness and risk associated with providing auto loans to borrowers.

03

- Auto dealerships: They can use the model to evaluate potential customers' risk profiles and determine suitable financing options.

04

- Insurance companies: The model can aid in underwriting auto insurance policies by providing an additional risk assessment tool.

05

- Credit bureaus and credit reporting agencies: They can utilize the model to enhance their credit scoring systems and provide more accurate risk predictions.

06

- Researchers and analysts: The model's insights can be valuable in studying trends, risk management, and making informed decisions in the automotive finance industry.

07

- Borrowers: Although individuals themselves don't directly utilize the model, it helps lenders make fair lending decisions, which can ultimately benefit borrowers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in experianfico auto risk model?

With pdfFiller, the editing process is straightforward. Open your experianfico auto risk model in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my experianfico auto risk model in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your experianfico auto risk model and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit experianfico auto risk model on an Android device?

You can make any changes to PDF files, like experianfico auto risk model, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is experianfico auto risk model?

Experianfico auto risk model is a predictive model used to assess the risk associated with auto loans.

Who is required to file experianfico auto risk model?

Lenders and financial institutions are required to file experianfico auto risk model.

How to fill out experianfico auto risk model?

Experianfico auto risk model can be filled out online through the designated platform provided by Experian.

What is the purpose of experianfico auto risk model?

The purpose of experianfico auto risk model is to help lenders evaluate the creditworthiness of auto loan applicants.

What information must be reported on experianfico auto risk model?

Experianfico auto risk model requires information such as applicant's credit history, income, employment status, and loan amount.

Fill out your experianfico auto risk model online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Experianfico Auto Risk Model is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.