Get the free Differential (MID)

Show details

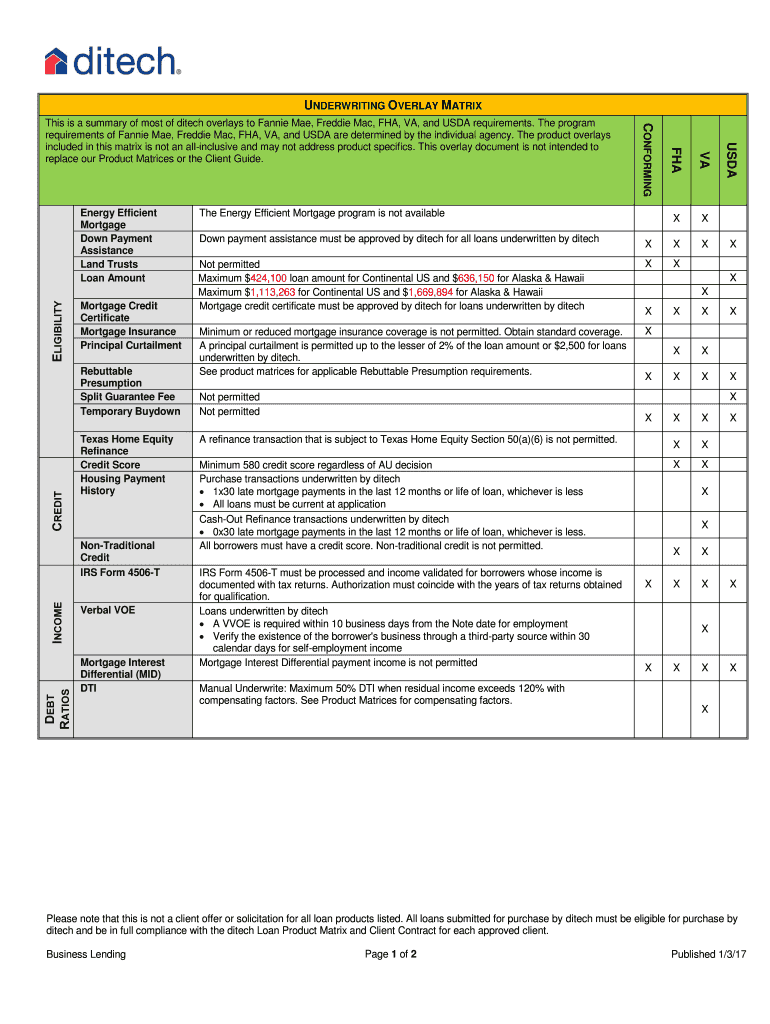

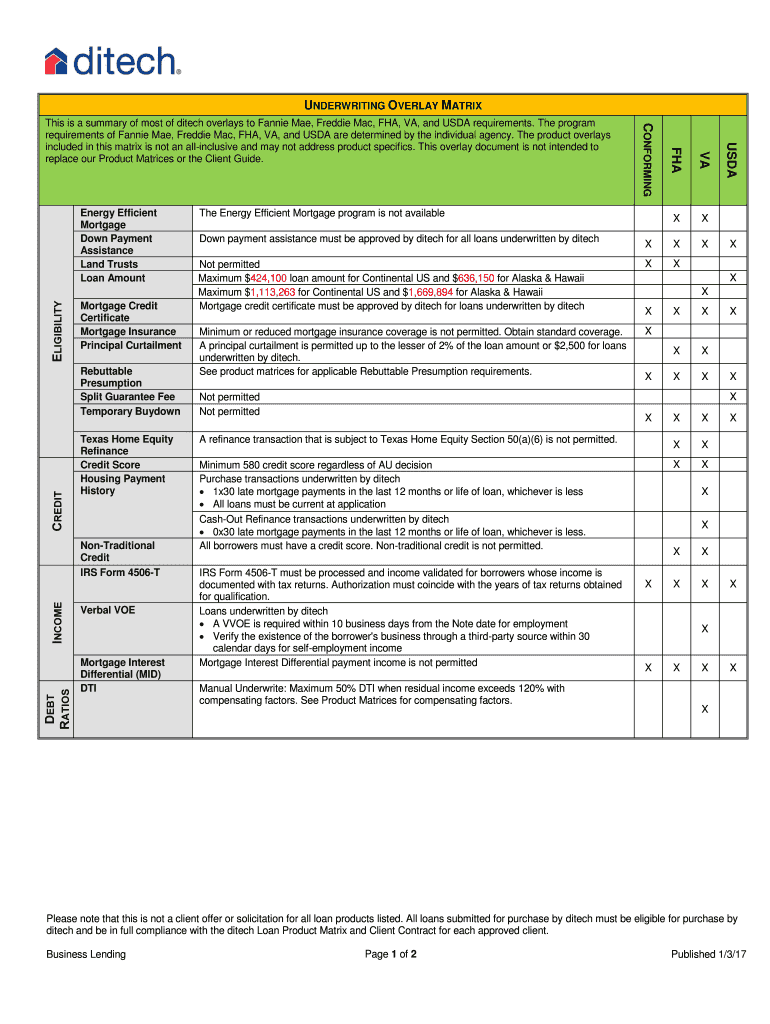

UNDERWRITING OVERLAY MATRIXELIGIBILITY CREDIT Texas Home Equity Refinance Credit Score Housing Payment HistoryDEBT RATIOSINCOMENonTraditional Credit IRS Form 4506TVerbal Remortgage Interest Differential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign differential mid

Edit your differential mid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your differential mid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit differential mid online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit differential mid. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out differential mid

How to fill out differential mid

01

Start by gathering all the necessary documents and information required to fill out the differential mid. This may include previous financial statements, banking details, tax forms, and any other relevant data.

02

Carefully review the form and instructions provided by the respective organization or institution requesting the differential mid. Familiarize yourself with the required sections, fields, and any specific guidelines.

03

Begin filling out the differential mid by entering your personal information accurately. This typically includes your full name, contact details, identification number, and any other requested details.

04

Proceed to provide the necessary financial information, including income sources, expenses, and any assets or liabilities. Be sure to double-check all numbers and calculations to ensure their accuracy.

05

If applicable, provide any additional supporting documentation or attachments as instructed. This may involve attaching scanned copies of relevant documents or uploading digital files.

06

Review the completed differential mid form carefully to ensure all information is accurate and complete. Make any necessary corrections or additions, if required.

07

Once you are confident that the form has been filled out correctly, sign and date the differential mid as instructed. This signifies your consent and agreement to the provided information.

08

Prepare any additional copies of the filled differential mid if required, keeping a copy for your own records.

09

Submit the completed differential mid as per the provided instructions. This may involve mailing the physical form, submitting it online through a secure portal, or hand-delivering it to the respective authority.

10

Finally, keep a record of the date and method of submission for future reference and follow up if necessary.

Who needs differential mid?

01

Individuals or businesses applying for loans or credit may need to fill out a differential mid form. Lenders often request this document to assess the borrower's financial situation and determine their eligibility for lending.

02

Government agencies or departments may require individuals to fill out a differential mid for various purposes, such as income tax assessment, welfare program eligibility, or statistical data collection.

03

Financial institutions, including banks, credit unions, and investment firms, may request customers to complete a differential mid for account opening, investment purposes, or compliance requirements.

04

Educational institutions or scholarship foundations may ask students or applicants to fill out a differential mid to assess their financial need and determine eligibility for financial aid or scholarships.

05

Insurance companies may request policyholders to fill out a differential mid to update their personal and financial information, assess risk factors, and calculate premium rates accurately.

06

Government contractors or vendors may need to complete a differential mid form to provide financial details, certifications, or declarations required for bidding on contracts or maintaining vendor relationships.

07

Non-profit organizations or charitable foundations may request individuals or entities to fill out a differential mid to determine eligibility for grants, funding, or other financial support.

08

Real estate agencies or property management companies may require tenants or prospective buyers to fill out a differential mid to assess their financial stability and ability to meet rental or mortgage obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my differential mid in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your differential mid along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit differential mid in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing differential mid and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit differential mid on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute differential mid from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is differential mid?

Differential MID stands for Differential Measurement Identifier. It is a unique number assigned to each measurement point in a power system to differentiate between them.

Who is required to file differential mid?

Transmission system operators and distribution system operators are required to file differential MID.

How to fill out differential mid?

Differential MID can be filled out by providing accurate information about the measurement point and its associated data.

What is the purpose of differential mid?

The purpose of the differential MID is to ensure accurate measurements and differentiate between different points in the power system.

What information must be reported on differential mid?

Information such as location, equipment type, and other relevant data related to the measurement point must be reported on differential MID.

Fill out your differential mid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Differential Mid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.