Get the free Authorization to run credit

Show details

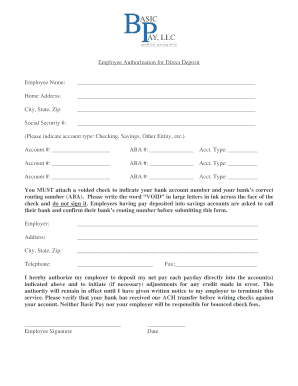

Authorization to run credit Card Authorization Form Samples in MS Word This helps them to recognize that you aren't running a flyby night operation and that they can entrust. Insert Logo Here. Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization to run credit

Edit your authorization to run credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization to run credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit authorization to run credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit authorization to run credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out authorization to run credit

How to fill out authorization to run credit

01

Step 1: Gather all the necessary information and documentation, including the applicant's full name, date of birth, social security number, and current address.

02

Step 2: Obtain an authorization form or template from a reliable source, such as a credit reporting agency or legal advisor.

03

Step 3: Fill out the applicant's personal information accurately and clearly on the authorization form, ensuring all details are up to date.

04

Step 4: Clearly state the purpose of running the credit check and specify whether it's for a specific transaction, employment, rental application, or any other legitimate reason.

05

Step 5: Include any additional terms or conditions related to the authorization, such as the duration of permission and the right to obtain and use credit reports.

06

Step 6: Provide a clear explanation of the applicant's rights, including their right to review the report, dispute inaccuracies, and be notified of adverse actions based on the credit information.

07

Step 7: Ensure the authorization form includes a signature line for the applicant to sign and date.

08

Step 8: Once the form is filled out correctly, securely store a copy for your records and give a copy to the applicant.

Who needs authorization to run credit?

01

Potential employers: Companies or organizations that use credit checks as part of their background screening process for job applicants.

02

Landlords: Property owners or management companies that want to assess the financial responsibility of potential tenants before signing a lease agreement.

03

Lending institutions: Banks, credit unions, or other financial institutions that require credit checks to evaluate loan or credit card applications.

04

Automobile dealerships: Dealerships that need to verify an individual's creditworthiness before approving financing options for purchasing a vehicle.

05

Insurance companies: Some insurance companies use credit information to assess the risk associated with insuring an individual and determining the premium rate.

06

Government agencies: Certain government agencies may request authorization to run credit checks for various purposes, such as issuing licenses or conducting background checks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the authorization to run credit form on my smartphone?

Use the pdfFiller mobile app to complete and sign authorization to run credit on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit authorization to run credit on an iOS device?

Create, edit, and share authorization to run credit from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete authorization to run credit on an Android device?

Complete your authorization to run credit and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your authorization to run credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization To Run Credit is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.