Get the free Parent Untaxed Income Form - archive csustan

Show details

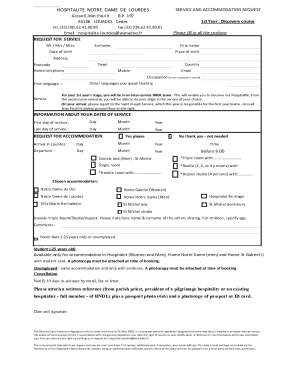

Financial Aid and Scholarship Office One University Circle, Turlock, CA 95382 Telephone (209) 667-3335 Fax (209) 664-7064 www.csustan.edu/financialaid Student Name: ID# 14/15 PUNT VERIFICATION OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign parent untaxed income form

Edit your parent untaxed income form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent untaxed income form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit parent untaxed income form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit parent untaxed income form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out parent untaxed income form

How to fill out parent untaxed income form:

01

Gather all necessary documents: Before starting, make sure you have all the required documents handy. This may include tax return transcripts, statements from untaxed income sources, and any other relevant financial information.

02

Accurately provide personal information: Fill in your parent's name, address, social security number, and other personal details as required on the form. Double-check that the information is correct before proceeding.

03

Report untaxed income sources: Identify and report all sources of untaxed income that your parent received during the specified period. This may include welfare benefits, child support, tax-exempt interest, and more. Be thorough and provide accurate amounts for each source.

04

Document deductions and exclusions: If your parent is eligible for any deductions or exclusions, ensure that they are properly reported on the form. This may include reporting tax-deferred pension contributions, foreign income exclusions, or other applicable deductions.

05

Calculate total untaxed income and add it to the form: Take the time to carefully calculate the total amount of untaxed income your parent received and enter it correctly on the form. Ensure that the figures are accurate and supported by the corresponding documents.

06

Review and sign the form: Before submitting the form, carefully review all the information provided. Check for any mistakes or omissions. Both your parent and yourself may need to sign the form, depending on the requirements.

07

Submit the form: Once you are confident that the form is complete and accurate, submit it to the appropriate entity or organization as instructed. Keep copies of the form and supporting documents for your records.

Who needs parent untaxed income form?

The parent untaxed income form is typically required for students applying for financial aid or scholarships. It allows the financial aid office or scholarship committee to assess the parent's untaxed income in order to determine the student's eligibility for financial assistance. It is crucial for students and their parents to complete this form accurately and submit it before the indicated deadline to avoid any delays in the financial aid or scholarship application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my parent untaxed income form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign parent untaxed income form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send parent untaxed income form to be eSigned by others?

Once your parent untaxed income form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit parent untaxed income form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your parent untaxed income form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is parent untaxed income form?

The parent untaxed income form is a document used to report any income or benefits received by a parent that are not subject to taxation.

Who is required to file parent untaxed income form?

Parents who have untaxed income or benefits must file the parent untaxed income form.

How to fill out parent untaxed income form?

To fill out the parent untaxed income form, parents must accurately report any untaxed income or benefits they have received.

What is the purpose of parent untaxed income form?

The purpose of the parent untaxed income form is to provide information about any untaxed income or benefits received by parents that may impact financial aid eligibility.

What information must be reported on parent untaxed income form?

Parents must report any untaxed income, such as untaxed portions of pension distributions or foreign income, on the parent untaxed income form.

Fill out your parent untaxed income form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Parent Untaxed Income Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.