CA CDTFA-82 (Formerly BOE-82) 2017 free printable template

Show details

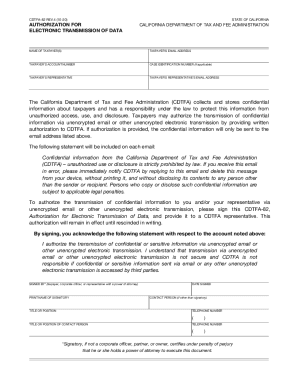

CDTFA82 REV. 3 (817)AUTHORIZATION FOR

ELECTRONIC TRANSMISSION OF DEVASTATE OF CALIFORNIACALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATIONNAME OF TAXPAYER(S) OR DEEPER(S)TAXPAYERS/TEENAGERS EMAIL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-82 Formerly BOE-82

Edit your CA CDTFA-82 Formerly BOE-82 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-82 Formerly BOE-82 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-82 Formerly BOE-82 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-82 Formerly BOE-82. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-82 (Formerly BOE-82) Form Versions

Version

Form Popularity

Fillable & printabley

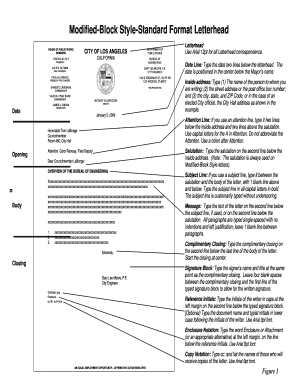

How to fill out CA CDTFA-82 Formerly BOE-82

How to fill out CA CDTFA-82 (Formerly BOE-82)

01

Download the CA CDTFA-82 form from the California Department of Tax and Fee Administration website.

02

Read the instructions thoroughly to understand the filing process.

03

Fill out your personal information in the designated fields, including your name, address, and contact information.

04

Provide the required account information, such as your seller's permit number or other relevant identification numbers.

05

Clearly state the reason for your exemption request in the appropriate section.

06

Include any additional documentation required to substantiate your claim.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form to the appropriate address as outlined in the instructions.

Who needs CA CDTFA-82 (Formerly BOE-82)?

01

Individuals or businesses seeking a sales tax exemption in California.

02

Retailers who purchase items for resale and need to substantiate their exempt status.

03

Non-profit organizations claiming exemption from sales tax for eligible purchases.

04

Businesses making tax-exempt purchases in compliance with California regulations.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you dont pay Cdtfa?

Penalty and Interest There is a 10 precent penalty for not filing your return and/or paying your full tax or fee payment on time. However, your total penalty will not exceed 10 percent of the amount of tax for the reporting period. An additional 10 percent penalty may apply, if you do not pay the tax by the due date.

What is Cdtfa 82?

To authorize the transmission of confidential information to you and/or your representative via unencrypted email or other unencrypted electronic transmission, please sign this CDTFA-82, Authorization for Electronic Transmission of Data, and provide it to a CDTFA representative.

What is a California sales tax certificate?

When purchasing items for resale, registered sellers may avoid the sales tax by giving their supplier adequate documentation in the form of a resale certificate. A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale.

How do I know if I owe use tax California?

You May Owe Use Tax. You may owe “use tax” if you made a purchase from an out-of-state retailer and were not charged California tax on the purchase. If you have not saved your receipts, you may calculate and pay estimated use tax on your 2021 California Income Tax return, based upon your income.

What is the penalty for paying sales tax late in California?

Failure to pay taxes - 10% under RTC 6565 and 6591. Failure to pay prepayment amounts - 6% under 6476 and 6477. Amnesty interest penalty - 50% under RTC 7074(a) and Double amnesty penalty 7073.

Why am I getting a letter from CDTFA?

Customs Pre-Notification Letter (CDTFA-400-USC) We received information from U.S. Customs and Border Protection (CBP) indicating that you imported items into California for storage, use, or other consumption in this state during the previous calendar year which may require you to pay use tax.

Do I have to pay California use tax?

You owe use tax on any item purchased for use in a trade or business and you are not registered, or required to be registered with the CDTFA to report sales or use tax. You owe use tax on purchases of individual items with a purchase price of $1,000 or more each.

What happens if you don't pay sales tax in California?

The penalty for failure to file a return is 10 percent of the tax amount that is due for each bill. An additional 25 percent penalty applies if the failure to file was due to fraud or intent to evade the tax, and you may be subject to criminal prosecution.

How do I change my address on my CA seller's permit?

My business information or address has changed. What do I do? Seller's permit or prepaid MTS account holders should fill out the Notice of Business Change form (CDTFA-345) and follow the instructions.

Do I need to file CDTFA?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

How do I avoid a California state tax penalty?

If you filed your incomes taxes or paid your income taxes after the due date, you received a penalty. To avoid penalties in the future, file or pay by the due date.

What does the CDTFA do?

The California Department of Tax and Fee Administration (CDTFA) administers California's sales and use, fuel, tobacco, alcohol, and cannabis taxes, as well as a variety of other taxes and fees that fund specific state programs.

How do I close my sales tax account in California?

In order to close your sales tax permit in California, you will need to contact California's customer service center at 1-800-400-7115 to begin the process of cancelling your sales tax permit.

How do I file a sales tax return in California?

Login to the California Department of Tax and Fee Administration website in a separate tab. Under the Accounts tab, click Sales and Use Tax. Answer questions – The new system has questions that will vary by business. Enter your Gross Sales – Use the “Gross Sales” amount from your California state TaxJar report.

How long can you go without paying taxes in California?

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable. The stakes are particularly high in criminal tax prosecution cases.

What is cdtfa 392?

To represent the taxpayer for changes to their mailing address for any and all Payroll Tax Law, Benefit Reporting, both Payroll Tax Law and Benefit Reporting. Unless limited, this Power of Attorney will remain in effect until the final resolution of all tax or fee matters specified herein.

How long do you have to pay California state taxes?

You must file and pay by April 18, 2022. Send us your payment if you are not ready to file your return.

What happens if you dont pay CDTFA?

Penalty and Interest There is a 10 precent penalty for not filing your return and/or paying your full tax or fee payment on time. However, your total penalty will not exceed 10 percent of the amount of tax for the reporting period. An additional 10 percent penalty may apply, if you do not pay the tax by the due date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA CDTFA-82 Formerly BOE-82 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CA CDTFA-82 Formerly BOE-82 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the CA CDTFA-82 Formerly BOE-82 in Gmail?

Create your eSignature using pdfFiller and then eSign your CA CDTFA-82 Formerly BOE-82 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit CA CDTFA-82 Formerly BOE-82 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CA CDTFA-82 Formerly BOE-82. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is CA CDTFA-82 (Formerly BOE-82)?

CA CDTFA-82, formerly known as BOE-82, is a form used by the California Department of Tax and Fee Administration for reporting and claiming a refund of sales and use tax.

Who is required to file CA CDTFA-82 (Formerly BOE-82)?

Individuals or businesses that have overpaid sales and use tax, or those claiming a refund due to exempt transactions, are required to file CA CDTFA-82.

How to fill out CA CDTFA-82 (Formerly BOE-82)?

To fill out CA CDTFA-82, one must provide identifying information such as the business name, account number, and contact details, along with detailed information regarding the tax amounts being claimed for a refund.

What is the purpose of CA CDTFA-82 (Formerly BOE-82)?

The purpose of CA CDTFA-82 is to facilitate the process of requesting a refund for sales and use tax overpayments or to document exempt transactions for tax reporting purposes.

What information must be reported on CA CDTFA-82 (Formerly BOE-82)?

CA CDTFA-82 requires the reporting of specific details including the period of overpayment, the total amount of sales tax paid, the refund amount requested, and relevant transaction details that support the refund claim.

Fill out your CA CDTFA-82 Formerly BOE-82 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-82 Formerly BOE-82 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.