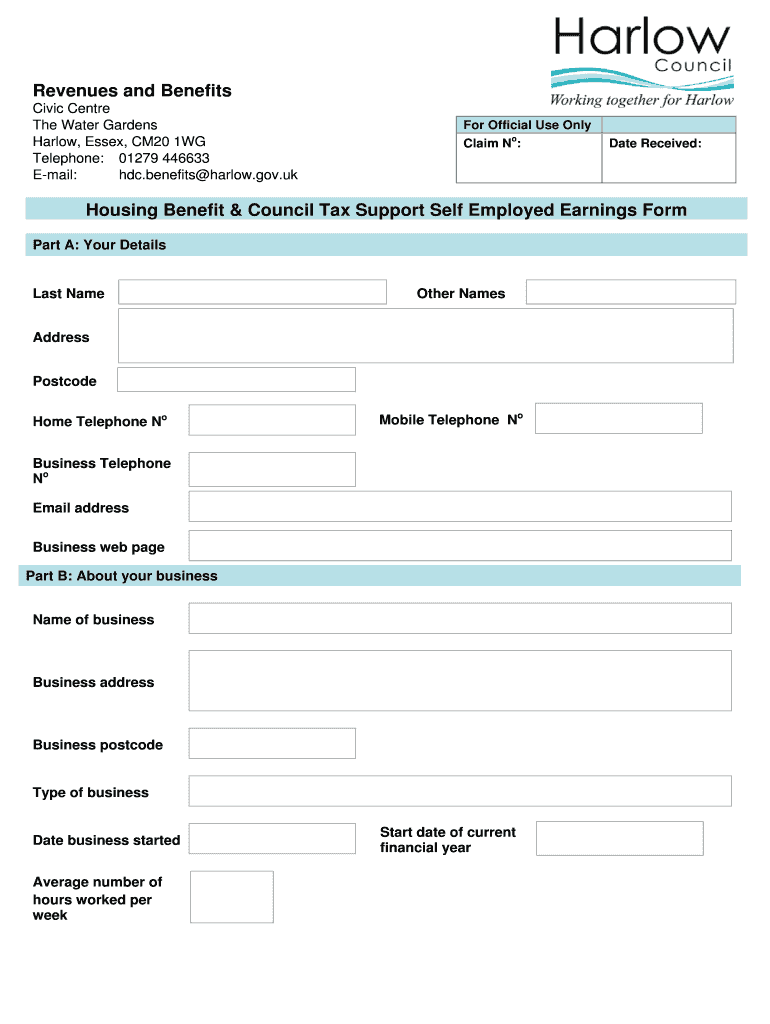

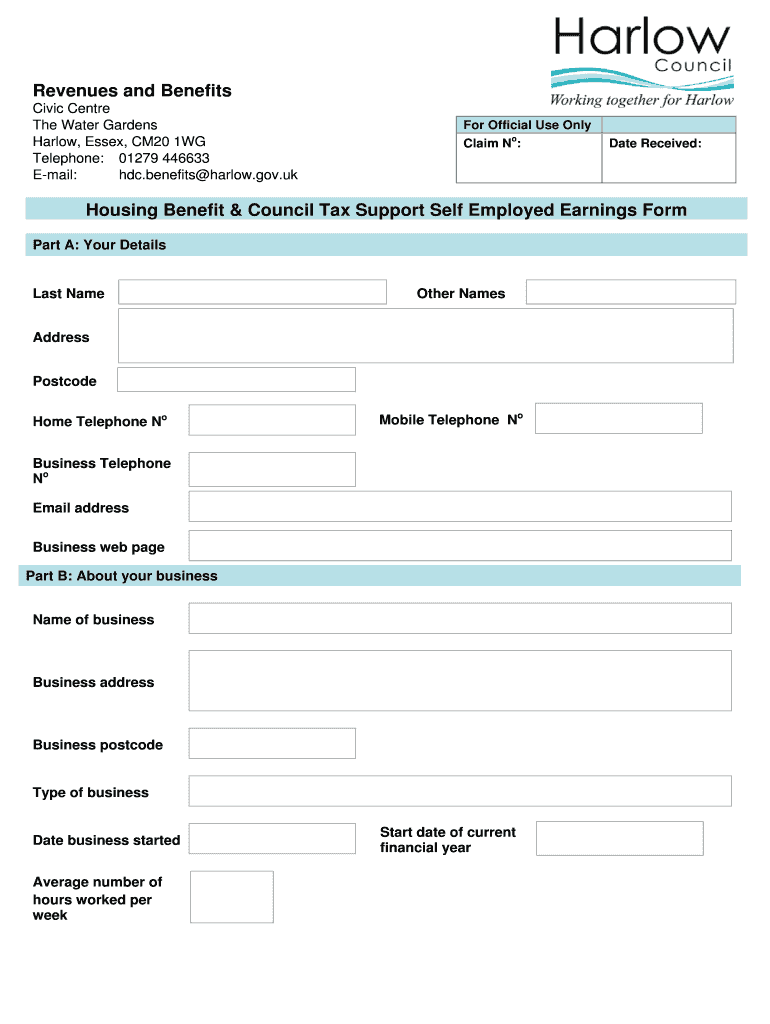

Get the free Self Employed Earnings Form.pdf - Harlow Council

Show details

Revenues and Benefits Civic Center The Water Gardens Harlow, Essex, CM20 1WG Telephone: 01279 446633 E-mail: HD.benefits Harlow.gov.UK For Official Use Only Claim No: Date Received: Housing Benefit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self employed earnings formpdf

Edit your self employed earnings formpdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employed earnings formpdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employed earnings formpdf online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self employed earnings formpdf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employed earnings formpdf

How to fill out self employed earnings form pdf:

01

Begin by downloading the self employed earnings form pdf from the appropriate source, such as the official government website or a trusted financial institution.

02

Open the pdf file using a compatible software or application, ensuring that you have the necessary tools to fill out the form electronically.

03

Start by entering your personal information in the designated sections of the form, such as your full name, address, contact details, and social security number.

04

Proceed to the section that requires you to provide details about your self employment income. This may include information about your business name, type of self employment, and the relevant dates.

05

In the income section, accurately report your self employment earnings for the specified timeframe. Include all sources of income, such as client payments, sales revenue, or any other income generated through your self employment.

06

Make sure to indicate whether you have deducted any business expenses or tax deductions from your total income. This may require filling out additional sections or attaching supporting documents as required by the form instructions.

07

If the form requires information about your business expenses, provide a detailed breakdown of these expenses. Include receipts or other documents as necessary to substantiate your claims.

08

Continue to fill out the remaining sections of the form, providing all requested information related to your self employment earnings, tax liability, and any other relevant details.

09

Carefully review the completed form to ensure accuracy and completeness. Check for any errors or missing information, and make any necessary corrections before submitting the form.

10

Save your completed self employed earnings form pdf and consider printing a physical copy for your records.

11

Submit the completed form as instructed by the relevant authorities, such as by mail, online submission, or in-person at a designated office.

Who needs self employed earnings form pdf?

01

Self-employed individuals who earn income through their own business or freelance work.

02

Entrepreneurs who operate as sole proprietors or as independent contractors.

03

Individuals who are not classified as employees and do not receive a W-2 form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my self employed earnings formpdf directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign self employed earnings formpdf and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send self employed earnings formpdf to be eSigned by others?

Once your self employed earnings formpdf is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit self employed earnings formpdf online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your self employed earnings formpdf to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is self employed earnings formpdf?

Self employed earnings form PDF is a document used by self-employed individuals to report their income and expenses to the tax authorities.

Who is required to file self employed earnings formpdf?

Self-employed individuals, such as freelancers, independent contractors, and business owners, are required to file self employed earnings form PDF.

How to fill out self employed earnings formpdf?

To fill out self employed earnings form PDF, you will need to provide details of your income, expenses, and any relevant deductions. This can usually be done using a tax software or by hand.

What is the purpose of self employed earnings formpdf?

The purpose of self employed earnings form PDF is to accurately report self-employed income to the tax authorities in order to calculate the correct amount of taxes owed.

What information must be reported on self employed earnings formpdf?

Self employed earnings form PDF requires reporting of income from self-employment, expenses related to the self-employed work, and any deductions that may apply.

Fill out your self employed earnings formpdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employed Earnings Formpdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.