Get the free FHA CHECK LIST FOR CONDO SPOT APPROVAL

Show details

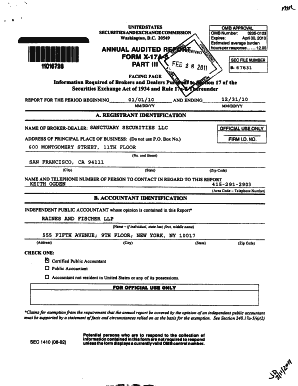

FHA CHECK LIST FOR CONDO SPOT APPROVAL 1. The legal documents of the homeowners' association do not contain a right of first refusal or restrictive covenant. 2. The unit is part of a condominium regime

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha check list for

Edit your fha check list for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha check list for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha check list for online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fha check list for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha check list for

How to fill out FHA check list for:

01

Gather all necessary documents: Start by collecting all the required documents for filling out the FHA check list. This may include pay stubs, bank statements, tax returns, employment history, and other financial documents.

02

Review the checklist items: Carefully read through the FHA check list to understand what information is required for each item. This will help ensure that you provide accurate and complete information.

03

Complete the application forms: Fill out the required application forms accurately and legibly. Double-check all the information you provide to avoid any mistakes or errors.

04

Provide financial documentation: Attach all the relevant financial documents as per the FHA check list. This may include proof of income, bank statements, and tax returns. Make sure to provide clear and complete copies.

05

Verify employment and income: Ensure that you provide accurate and up-to-date information regarding your employment history and income. This may include contacting your employer to verify your employment status.

06

Review and sign the checklist: Go through the completed FHA check list to make sure everything is filled accurately and completely. Sign the checklist where required, acknowledging that all the provided information is true and correct to the best of your knowledge.

Who needs FHA check list for:

01

First-time homebuyers: Individuals who are purchasing their first home and are using an FHA loan may need to fill out the FHA check list to qualify for the loan.

02

Homeowners seeking refinancing: Homeowners who want to refinance their mortgage using an FHA loan may be required to complete the FHA check list.

03

Homebuyers with low credit scores: FHA loans are often available to individuals with lower credit scores compared to traditional loans. Therefore, those with lower credit scores may need to fill out the FHA check list to qualify for the loan.

04

Borrowers with limited down payment: FHA loans often allow borrowers to have a lower down payment compared to conventional loans. Individuals who do not have a substantial down payment may need to fill out the FHA check list to apply for the loan.

05

Individuals applying for FHA rehabilitation loans: FHA offers rehabilitation loans for individuals who want to purchase or refinance a property that needs significant repairs or improvements. Applicants for these loans may need to complete the FHA check list.

In summary, anyone looking to purchase a home using an FHA loan, refinance their existing mortgage with an FHA loan, or apply for an FHA rehabilitation loan may need to fill out the FHA check list. It is important to carefully follow the instructions and provide all the required information and documentation accurately to ensure a smooth loan application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fha check list for directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fha check list for and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find fha check list for?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the fha check list for in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in fha check list for without leaving Chrome?

fha check list for can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is fha check list for?

The FHA checklist is used to ensure that all necessary documents and information are gathered and reviewed before submitting an FHA loan application.

Who is required to file fha check list for?

Borrowers who are applying for an FHA loan are required to fill out the FHA checklist.

How to fill out fha check list for?

The FHA checklist can be filled out by providing accurate and complete information as requested in each section.

What is the purpose of fha check list for?

The purpose of the FHA checklist is to streamline the loan approval process and ensure that all necessary documentation is in place.

What information must be reported on fha check list for?

The FHA checklist typically requires information such as personal financial information, employment history, and details about the property being purchased.

Fill out your fha check list for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Check List For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.