Get the free Tax & Wealth Advisor

Show details

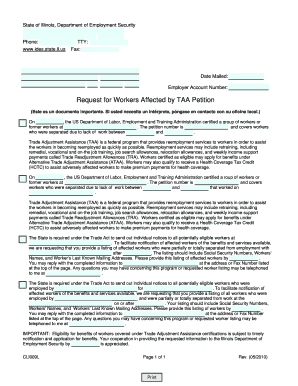

Tax corporation tax Hark Gala CPA Tax & Wealth Advisor 8860 Columbia 100 Parkway Suite 306 Columbia, MD 21045 3019123450 CPA etaxonline.com http://www.etaxonline.comCaring for Your Aging Parents November

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax amp wealth advisor

Edit your tax amp wealth advisor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax amp wealth advisor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax amp wealth advisor online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax amp wealth advisor. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax amp wealth advisor

How to fill out tax amp wealth advisor

01

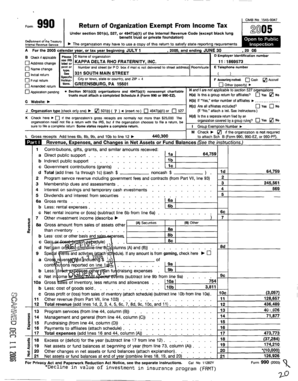

Gather all relevant financial documents and records such as income statements, expense receipts, investment statements, and any relevant tax forms.

02

Compile a list of all sources of income, including wages, self-employment income, dividends, and interest earned.

03

Identify all eligible deductions and credits, such as mortgage interest, medical expenses, education expenses, and charitable contributions.

04

Complete the necessary forms, such as Form 1040 for individuals or Form 1065 for partnerships.

05

Double-check all calculations and ensure accuracy of information provided.

06

Review the completed tax return for any potential errors or omissions.

07

Submit the filled-out tax forms to the appropriate tax authorities, either by mail or through online filing.

08

Keep copies of all tax documents and records for future reference and auditing purposes.

Who needs tax amp wealth advisor?

01

Individuals with complex financial situations, multiple sources of income, or varying types of investments.

02

Business owners and entrepreneurs who may have additional tax considerations due to their business activities.

03

High-net-worth individuals who need strategic tax planning and wealth management to maximize their financial resources.

04

Families and individuals who want to ensure compliance with tax laws and minimize their tax liabilities.

05

People facing major life events such as marriage, divorce, retirement, or inheritance, which can have significant tax implications.

06

Individuals who lack the time, knowledge, or confidence to navigate through tax laws and regulations.

07

Anyone seeking professional advice and guidance to optimize their financial situation and achieve long-term financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax amp wealth advisor from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your tax amp wealth advisor into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find tax amp wealth advisor?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax amp wealth advisor and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out tax amp wealth advisor on an Android device?

Complete your tax amp wealth advisor and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is tax amp wealth advisor?

Tax and wealth advisor is a professional who provides advice on tax planning and wealth management.

Who is required to file tax amp wealth advisor?

Individuals and businesses who want to optimize their tax strategies and manage their wealth effectively may benefit from the services of a tax and wealth advisor.

How to fill out tax amp wealth advisor?

To fill out a tax and wealth advisor form, you will need to provide detailed information about your income, expenses, assets, and investments.

What is the purpose of tax amp wealth advisor?

The purpose of a tax and wealth advisor is to help individuals and businesses minimize their tax liabilities and maximize their wealth growth.

What information must be reported on tax amp wealth advisor?

Information such as income, expenses, assets, investments, and any relevant tax deductions must be reported on a tax and wealth advisor form.

Fill out your tax amp wealth advisor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Amp Wealth Advisor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.