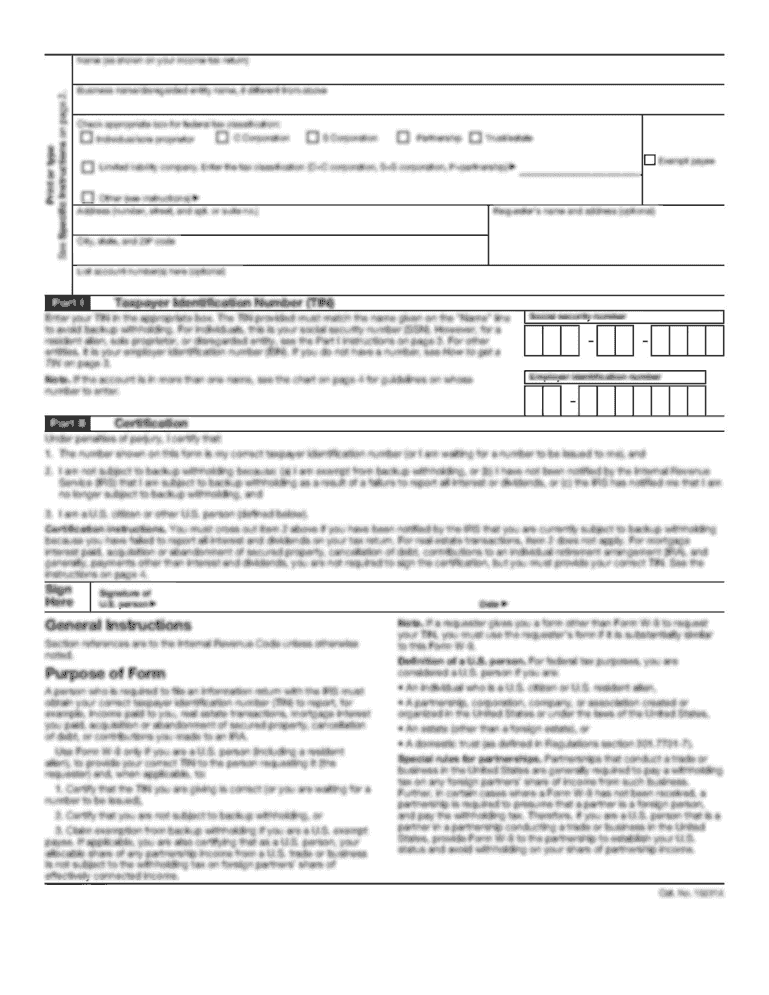

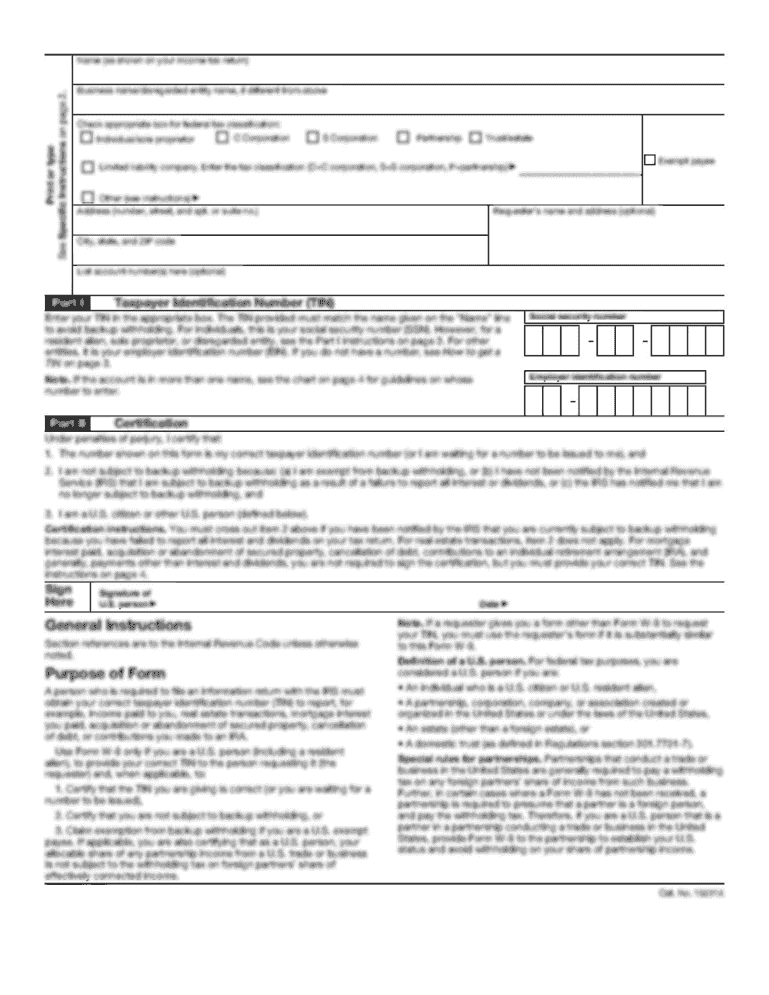

Get the free f Philanthropy

Show details

HEROES f Philanthropy2016 ANNUAL Reportage theme of our report this year is HEROES of Philanthropy. While we single out a few examples on the following pages, in reality you all are our heroes. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign f philanthropy

Edit your f philanthropy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f philanthropy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit f philanthropy online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit f philanthropy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out f philanthropy

How to fill out f philanthropy

01

Start by researching different philanthropic activities and organizations to find one that aligns with your values and interests.

02

Determine your financial capabilities and how much you are willing to donate or contribute towards philanthropy.

03

Contact the chosen organization or charity to understand their specific requirements for filling out philanthropy forms.

04

Obtain and carefully read the philanthropy form provided by the organization.

05

Fill out the form accurately, providing all the necessary information, such as personal details, donation amount, purpose of donation, etc.

06

Double-check the form for any errors or missing information before submitting it.

07

If required, attach any additional documents or supporting evidence along with the form.

08

Submit the filled out philanthropy form to the organization either electronically or through traditional mail.

09

Keep a copy of the submitted form for your records and follow up with the organization to ensure they received it.

10

Consider consulting with a financial advisor or tax professional to understand any potential tax benefits or implications of your philanthropic contributions.

Who needs f philanthropy?

01

Anyone who wants to make a positive impact in the community or society can benefit from philanthropy.

02

Individuals or families with financial resources or assets they are willing to donate.

03

Charitable organizations or nonprofits that rely on donations to support their programs and initiatives.

04

Social causes, such as education, healthcare, poverty alleviation, environmental conservation, and humanitarian aid, often benefit from philanthropy.

05

Entrepreneurs or business owners who want to give back to the community and engage in corporate social responsibility.

06

Philanthropy can also be a way for individuals to leave a lasting legacy by supporting causes they are passionate about.

07

Communities facing social or economic challenges often require philanthropic support to improve their conditions.

08

Philanthropy can be undertaken by individuals of all ages and backgrounds, from young students to retired professionals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit f philanthropy from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your f philanthropy into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send f philanthropy for eSignature?

Once you are ready to share your f philanthropy, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out f philanthropy on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your f philanthropy. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is f philanthropy?

F philanthropy is a form of charitable giving that involves donating time, resources, or funds to support social causes or nonprofit organizations.

Who is required to file f philanthropy?

Individuals, organizations, or foundations that make significant donations to charitable causes may be required to file f philanthropy.

How to fill out f philanthropy?

To fill out f philanthropy, individuals or organizations need to provide details about their charitable donations, including the amount donated and the recipient organization.

What is the purpose of f philanthropy?

The purpose of f philanthropy is to track and report charitable contributions to ensure transparency and accountability in philanthropic activities.

What information must be reported on f philanthropy?

Information such as the name of the recipient organization, the amount donated, and the purpose of the donation must be reported on f philanthropy.

Fill out your f philanthropy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

F Philanthropy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.