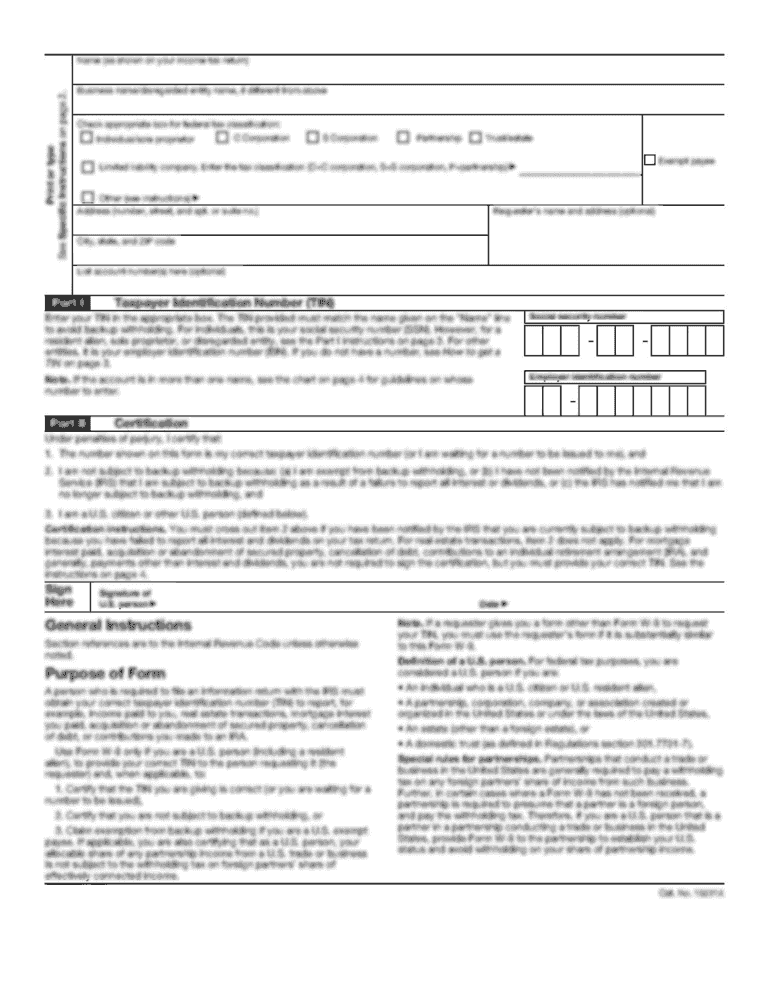

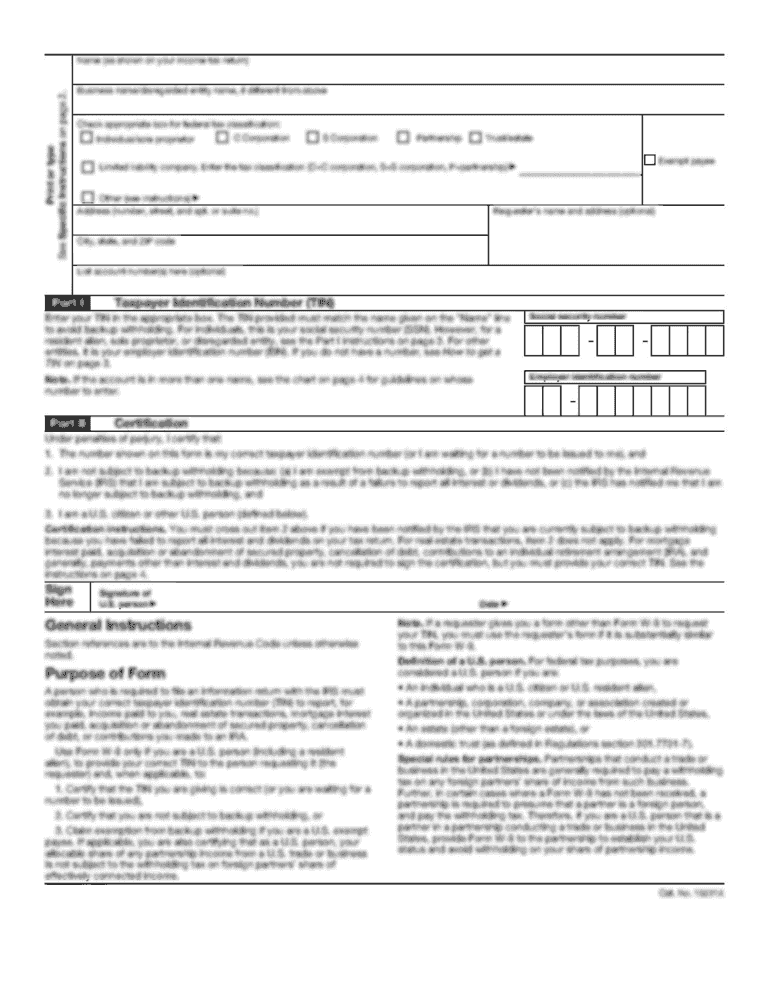

Get the free Distributions From a Vanguard IRA

Show details

Print Entire Kit Print Forms Only What's inside: IRA Distribution Form Bank Transfer Service Form IRA Distribution Kit To authorize distributions from your Vanguard IRA If you meet the eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign distributions from a vanguard

Edit your distributions from a vanguard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your distributions from a vanguard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit distributions from a vanguard online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit distributions from a vanguard. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out distributions from a vanguard

How to fill out distributions from a vanguard?

01

Visit the Vanguard website or log in to your Vanguard account.

02

Click on the "My Accounts" tab and select the account from which you want to make a distribution.

03

Choose the distribution type, such as regular cash distribution or reinvestment.

04

Enter the amount you would like to distribute or specify the percentage of the account balance you wish to distribute.

05

Select the frequency of distributions, whether it is a one-time distribution or recurring.

06

Specify the destination for the distribution, such as a bank account or another investment account.

07

Review the information and submit the distribution request.

Who needs distributions from a vanguard?

01

Individual investors who want to receive regular income from their Vanguard investments.

02

Retirees who depend on their investment accounts for income during their retirement years.

03

Investors who want to reinvest their earnings back into their Vanguard portfolio to potentially grow their investments further.

Fill

form

: Try Risk Free

People Also Ask about

How do I make an IRA distribution from Vanguard?

On the Sell Vanguard funds page, select the IRA you want to take the distribution from under the Where's the money coming from? section. You'll need to decide how you want to sell your funds. You can sell in dollars, in shares, or as a percentage.

What are the terms of withdrawal for Vanguard?

Withdrawals & loans You can't take withdrawals until a specified event, such as reaching age 59½, terminating the plan, separating from service, or experiencing another event as identified by the plan. You may be allowed to take a hardship withdrawal, which may be subject to a 10% penalty if you're under age 59½.

Can I withdraw money from my Vanguard brokerage account?

You have the option to transfer funds from your Vanguard account to your bank by wire transfer or by electronic bank transfer (EBT). Find more information about the difference between the two options.

How do I withdraw from my Vanguard IRA?

How do I make a withdrawal? Log into your account. Select 'Payments' from the 'My Portfolio' menu. Select 'Money out' Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash' Follow the on-screen instructions.

How do I withdraw money from my Vanguard IRA?

How do I make a withdrawal? Log into your account. Select 'Payments' from the 'My Portfolio' menu. Select 'Money out' Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash' Follow the on-screen instructions.

Is there a fee to withdraw from Vanguard IRA?

Withdrawals of contributions are always tax-free and penalty-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify distributions from a vanguard without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including distributions from a vanguard, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute distributions from a vanguard online?

With pdfFiller, you may easily complete and sign distributions from a vanguard online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out distributions from a vanguard using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign distributions from a vanguard and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is distributions from a vanguard?

Distributions from a Vanguard refer to the payments made to shareholders from the earnings or profits of the funds they hold, typically including dividends and capital gains.

Who is required to file distributions from a vanguard?

Typically, investors receiving distributions from a Vanguard fund are required to report these on their tax returns. Additionally, Vanguard itself must report distributions made to its investors to the IRS.

How to fill out distributions from a vanguard?

To report distributions from Vanguard, you typically need to gather your Form 1099-DIV or 1099-B received from Vanguard and enter the relevant information into your tax return, specifying dividends and capital gains as required.

What is the purpose of distributions from a vanguard?

The purpose of distributions from a Vanguard is to provide investors with a share of the fund's earnings, which can be reinvested or taken as cash income.

What information must be reported on distributions from a vanguard?

The information that must be reported includes the total amount of dividend income, any capital gains distributions, and the relevant tax identification numbers for both the investor and Vanguard.

Fill out your distributions from a vanguard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distributions From A Vanguard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.