Get the free Securities Accounts Cleared Through Southwest Securities Inc

Show details

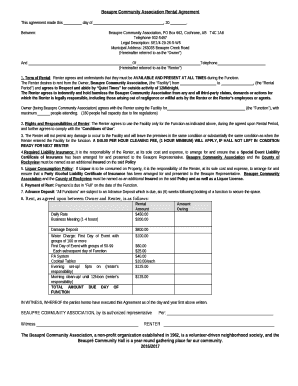

Polar Investment Counsel Inc.

Brokers & Investment Advisors; Member: FINRA, NFL, MSB, SIPC

Securities Accounts Cleared Through: Southwest Securities Inc. Member NYSE, FINRA. SIPC

Futures Accounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign securities accounts cleared through

Edit your securities accounts cleared through form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your securities accounts cleared through form via URL. You can also download, print, or export forms to your preferred cloud storage service.

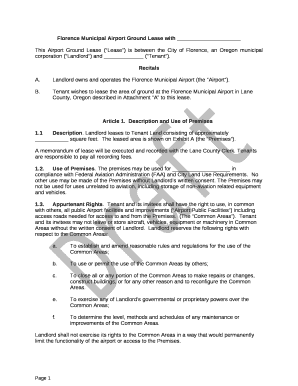

Editing securities accounts cleared through online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit securities accounts cleared through. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

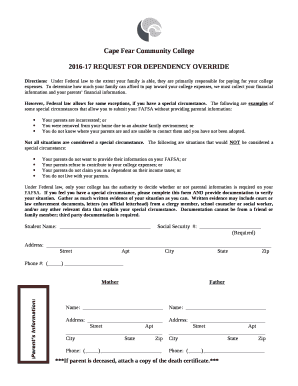

How to fill out securities accounts cleared through

How to fill out securities accounts cleared through:

01

Gather the necessary documents: Before filling out a securities account cleared through, make sure you have all the required documents. This may include identification proof, bank statements, and any relevant investment records.

02

Choose a clearinghouse: Determine which clearinghouse you want to use for clearing your securities accounts. Research different options available and select the one that best fits your needs and preferences.

03

Complete the application form: Obtain the application form from the chosen clearinghouse. Fill in all the requested information accurately and thoroughly. This may include personal details, investment objectives, and financial information.

04

Attach supporting documents: As instructed in the application form, attach any required supporting documents. Ensure that you provide all the necessary proof of identity, address, and investment records to satisfy the clearinghouse's verification process.

05

Review and double-check: Before submitting the application, carefully review all the information you have provided. Double-check for any errors or missing details that may affect the processing of your securities accounts cleared through.

06

Submit the application: Once you have reviewed the application form and attached all the required supporting documents, submit the completed application to the clearinghouse. Follow the instructions provided to ensure it reaches the correct department or individual.

Now, let's move on to the next part of the question:

Who needs securities accounts cleared through?

01

Institutional investors: Institutional investors, such as pension funds, insurance companies, and mutual funds, often need securities accounts cleared through. Clearing allows them to efficiently manage and settle their securities transactions while minimizing counterparty risk.

02

Brokers and dealers: Brokers and dealers involved in trading securities on behalf of their clients require securities accounts cleared through. This enables them to streamline their operations and provide efficient trade execution and settlement services to their customers.

03

Individual investors: Individual investors who engage in trading or investing in securities may also benefit from using securities accounts cleared through. Clearing provides them with a centralized platform for managing their investments, ensuring proper settlement, and reducing the risk associated with direct transactions.

In summary, filling out securities accounts cleared through involves following a step-by-step process, gathering necessary documents, choosing a clearinghouse, completing the application form, attaching supporting documents, reviewing the information, and submitting the application. This service is valuable to institutional investors, brokers and dealers, as well as individual investors who seek efficient management and settlement of their securities transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is securities accounts cleared through?

Securities accounts are cleared through a clearing system that acts as an intermediary between buyers and sellers.

Who is required to file securities accounts cleared through?

All individuals and entities who hold securities accounts are required to file securities accounts cleared through.

How to fill out securities accounts cleared through?

Securities accounts cleared through can be filled out by providing information about the securities held in the account, the value of the securities, and any transactions that occurred.

What is the purpose of securities accounts cleared through?

The purpose of securities accounts cleared through is to provide transparency and oversight of securities holdings and transactions.

What information must be reported on securities accounts cleared through?

Information such as the name of the account holder, the type of securities held, the value of securities, and any transactions must be reported on securities accounts cleared through.

How can I manage my securities accounts cleared through directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your securities accounts cleared through as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify securities accounts cleared through without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your securities accounts cleared through into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit securities accounts cleared through on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign securities accounts cleared through. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your securities accounts cleared through online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Securities Accounts Cleared Through is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.