TX Form AN 2014-2025 free printable template

Show details

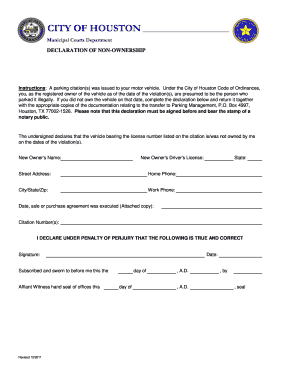

Harris County Appraisal District P. O. Box 920975 Houston, Texas 772920975 (713) 9577800 Form AN (12/14)Affidavit as Proof of Ownership Tax Year:Account Number:This affidavit must be executed before

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas department of motor vehicles title transfer form

Edit your texas trailer title transfer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdf vehicle transfer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Form AN online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Form AN. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form AN Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Form AN

How to fill out TX Form AN

01

Obtain TX Form AN from the official website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of income you are reporting in the designated section of the form.

04

Provide details of your income sources, including amounts and any relevant dates.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the form by mail or online, following the instructions provided.

Who needs TX Form AN?

01

Individuals who are reporting specific types of income related to Texas tax obligations.

02

Taxpayers who need to document earnings for their annual tax return.

03

Self-employed individuals needing to report business income in Texas.

Fill

form

: Try Risk Free

People Also Ask about

Can I do a title transfer online in Texas?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

How do I file a title application in Texas?

Please contact the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000 for details. This form must be completed and submitted to a county tax assessor-collector's office accompanied by any required application fee, supporting documents, registration fee, if applicable, and any motor vehicle tax due.

Can you transfer a car title in Texas online?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

What paperwork do I need to transfer a title in Texas?

The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle. The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317).

How to fill out a Texas title transfer form?

1:20 4:13 Texas Title Transfer SELLER Instructions - YouTube YouTube Start of suggested clip End of suggested clip Then you'll print the buyers name and complete address then fill in the odometer reading in theMoreThen you'll print the buyers name and complete address then fill in the odometer reading in the space provided enter your mileage exactly as it appears on your odometer.

How do I transfer ownership of a car in Texas?

If you have bought a vehicle from a Texas dealer and you are a Texas resident, the dealership will transfer the title at the tax office on your behalf. However, if you have purchased a vehicle from an individual, the documents must be submitted to the tax office in person or by mail.

What forms do I need to transfer a title in Texas?

Form 130-U (Application for Texas Title and/or Registration), signed and dated by the seller(s) and buyer(s). If seller is unable to sign the Form 130-U, a Bill of Sale from the out of state seller can be provided instead. The Form 130-U can be found under the Forms tab on the TxDMV website.

Can you change ownership of a vehicle online?

Many people now choose to record a vehicle change of ownership using the DVLA website. It's a quick and simple way to change the logbook online. The DVLA will send you an email confirmation and then a follow-up letter in the post to indicate that the changes have been made.

Do both parties have to be present to transfer a car title in Texas?

The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

Does a car title transfer need to be notarized in Texas?

Texas titles must be notarized. Only sign the title in the presence of a notary public.

Can I transfer my title online in Texas?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

How do I transfer a car title from two owners to one in Texas?

What Do I Need for a Texas Vehicle Title Transfer? A signed and completed Application for Texas Vehicle Title (Form 130-U) from the vehicle's seller. A release of lien and/or power of attorney (if applicable) Payment for the required TX fees and taxes.

Do both parties have to be present to transfer a title in Texas?

The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

How do I transfer a title in Texas?

If you have bought a vehicle from a Texas dealer and you are a Texas resident, the dealership will transfer the title at the tax office on your behalf. However, if you have purchased a vehicle from an individual, the documents must be submitted to the tax office in person or by mail.

What is Texas Form 130-U?

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

What happens if a buyer does not transfer a vehicle on its name in Texas?

Texas Sellers liability for the vehicle in the event the buyer does not transfer the title. You only have 30 days to file the Vehicle Transfer Notification to receive this state- guaranteed removal of liability.

Can you do a Texas title transfer online?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

Do you need an appointment to transfer a title in Texas?

Customers with appointments will receive priority, so appointments are encouraged. All other customers will receive service on a first come, first serve basis depending on their service request. Dealers, title service companies and their "runners" are not eligible to book appointments.

How do I transfer ownership of a car in Texas?

Car Buying and Selling: The TX Transfer Process Get the Certificate of Title. File the Application for Texas Title (Form 130-U) Declare applicable taxes and fees: Paid sales tax. Complete the vehicle inspection. (Seller) Odometer reading. Show your personal documents: Pay the vehicle transfer taxes and fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX Form AN on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TX Form AN right away.

How can I fill out TX Form AN on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your TX Form AN. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete TX Form AN on an Android device?

Use the pdfFiller Android app to finish your TX Form AN and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is TX Form AN?

TX Form AN is a state tax form used by taxpayers in Texas to report certain types of income or transactions for tax purposes.

Who is required to file TX Form AN?

Individuals and businesses in Texas who have specific types of income or financial transactions that meet the filing criteria set by the Texas Comptroller are required to file TX Form AN.

How to fill out TX Form AN?

To fill out TX Form AN, you need to provide your personal or business information, report the required income or transactions, and include any necessary supporting documentation as outlined in the form instructions.

What is the purpose of TX Form AN?

The purpose of TX Form AN is to ensure that the state of Texas receives accurate information on certain income and transactions, which helps in the assessment and collection of state taxes.

What information must be reported on TX Form AN?

The information that must be reported on TX Form AN includes taxpayer identification details, types of income or transactions, amounts, and any applicable deductions or credits.

Fill out your TX Form AN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Form AN is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.