Get the free Gasoline And Oil Invoices template

Show details

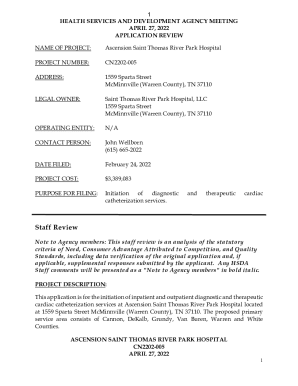

CHAPTER 8400 INDEXINTRODUCTION

8400

General

8400.1

DISBURSEMENTS BY CONTROLLERS WARRANTS

PAYROLLS

8421

PURCHASE AND EXPENSE CLAIMS

8422

Invoices And Vouchers

8422.1

Freight And Transportation Invoices

8422.101

Gasoline

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gasoline and oil invoices

Edit your gasoline and oil invoices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gasoline and oil invoices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gasoline and oil invoices online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gasoline and oil invoices. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gasoline and oil invoices

How to fill out gasoline and oil invoices

01

Make sure you have the necessary information, such as the name and address of the fuel supplier, the date of purchase, and the quantity of fuel purchased.

02

Start by filling out the top section of the invoice with your own business information, including your name or company name, address, and contact details.

03

Next, enter the details of the fuel supplier, including their name, address, and contact information. This is usually located on the top right section of the invoice.

04

In the main body of the invoice, list each fuel purchase line by line. Include the date of purchase, the quantity of fuel, the type of fuel (e.g., gasoline or oil), and the price per unit.

05

Calculate the total cost of each fuel purchase by multiplying the quantity by the price per unit and enter it in the 'Total' column.

06

If applicable, add any additional charges or taxes to the total cost and include them separately.

07

At the bottom of the invoice, calculate the grand total by adding up all the individual fuel purchase totals and any additional charges.

08

Include any payment terms or instructions, such as the due date for payment and acceptable payment methods.

09

Review the completed invoice to ensure accuracy and make any necessary corrections before sending or filing it.

Who needs gasoline and oil invoices?

01

Individuals who use gasoline or oil for personal vehicles or equipment may need gasoline and oil invoices for reimbursement purposes or for keeping track of expenses.

02

Businesses that operate vehicles, machinery, or equipment that require gasoline or oil may also need these invoices for accounting and tax purposes.

03

Fuel suppliers and distributors may need gasoline and oil invoices to maintain proper records of sales and transactions with their customers.

04

Government agencies or regulatory bodies may require gasoline and oil invoices as part of compliance and auditing processes.

05

Accountants or bookkeepers who handle financial records for individuals or businesses may request gasoline and oil invoices to ensure accurate expense tracking.

06

Insurance companies may ask for gasoline and oil invoices as supporting documentation in case of claims related to fuel-related incidents.

07

Transportation companies or logistics providers may need gasoline and oil invoices to manage their fuel expenses and analyze costs.

08

Fleet managers or owners of vehicle fleets may use gasoline and oil invoices to monitor fuel consumption, evaluate efficiency, and control expenses.

09

Auditors or financial advisors may rely on gasoline and oil invoices to review and validate expenses during financial audits or assessments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gasoline and oil invoices?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific gasoline and oil invoices and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete gasoline and oil invoices online?

Filling out and eSigning gasoline and oil invoices is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the gasoline and oil invoices in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your gasoline and oil invoices and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is gasoline and oil invoices?

Gasoline and oil invoices are documents that detail the purchase of gasoline and oil products.

Who is required to file gasoline and oil invoices?

Businesses and individuals who purchase and use gasoline and oil products are required to file gasoline and oil invoices.

How to fill out gasoline and oil invoices?

Gasoline and oil invoices should include details such as the date of purchase, quantity of products purchased, price per unit, total cost, and supplier information.

What is the purpose of gasoline and oil invoices?

The purpose of gasoline and oil invoices is to track the purchase and usage of gasoline and oil products for accounting and tax purposes.

What information must be reported on gasoline and oil invoices?

Gasoline and oil invoices must include details such as the date of purchase, quantity of products purchased, price per unit, total cost, and supplier information.

Fill out your gasoline and oil invoices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gasoline And Oil Invoices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.