Get the free Charles Schwab CRS Individual

Show details

Charles Schwab CRS Individual Recertification Instructions to Account Holder www.schwab.com.hk +85221010500 www.schwab.com.sg +6565363922 www.schwab.co.uk 0080008265001 (inside the UK) or +14156678400

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charles schwab crs individual

Edit your charles schwab crs individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charles schwab crs individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charles schwab crs individual online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charles schwab crs individual. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

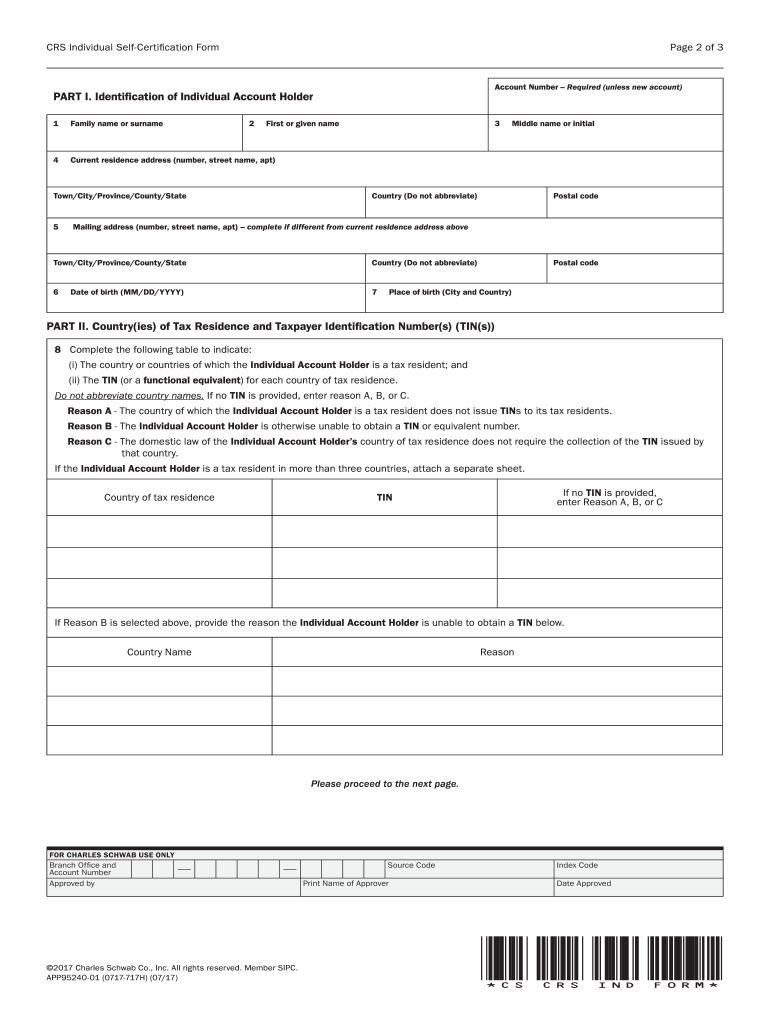

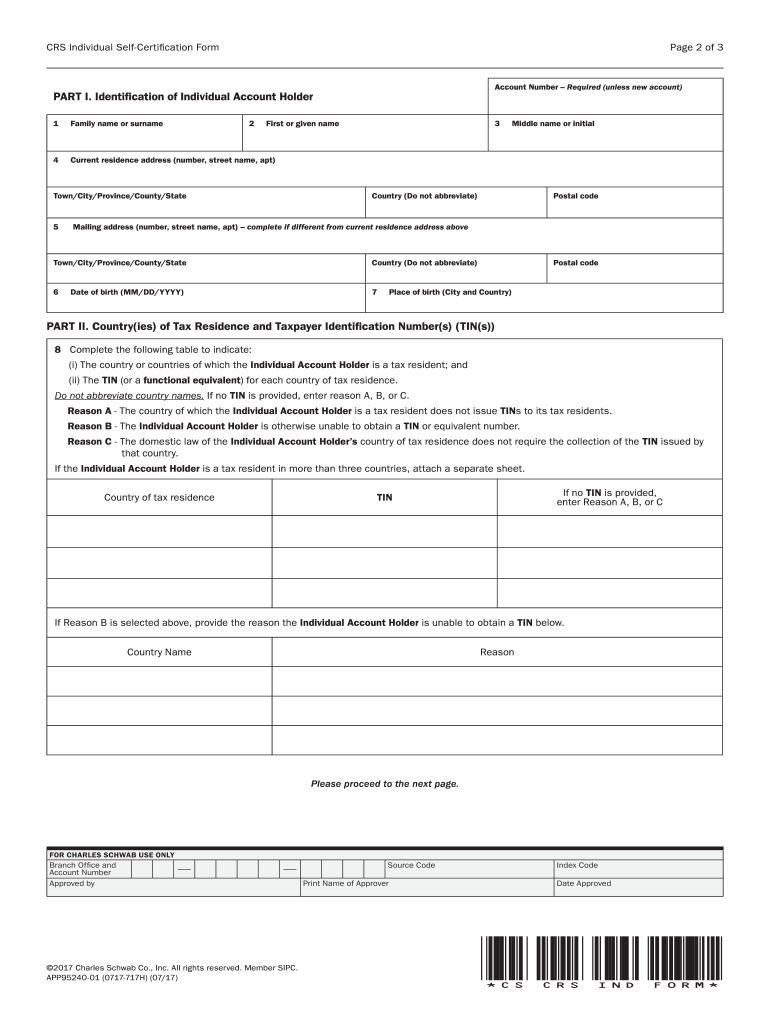

How to fill out charles schwab crs individual

How to fill out charles schwab crs individual

01

Obtain the CRS Individual form from the Charles Schwab website or branch.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide your tax identification number and other required identification documents.

04

Answer the questions related to your tax residency accurately.

05

Review the completed form for any errors or missing information.

06

Sign and date the form.

07

Submit the form either online or by visiting a Charles Schwab branch.

Who needs charles schwab crs individual?

01

Individuals who want to open an investment account with Charles Schwab and are subject to the requirements of the CRS (Common Reporting Standard).

02

People who have tax obligations in multiple countries and need to report their financial accounts to comply with international tax regulations.

03

Investors who want to ensure their account information is shared with relevant tax authorities in accordance with CRS guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Does Schwab report to the IRS?

We'll send out the 1099 Composite and Year-End Summary in two mailings, depending on your investment types. And don't worry about providing 1099 copies to the IRS: We do that as part of our reporting.

How do I get my tax form from Charles Schwab?

Narrator: To begin, click on Accounts, then select Statements. Mouse clicks Accounts and selects Statements. Narrator: Navigating to this page during tax season will automatically display the 1099 Dashboard. Here, you'll be able to easily view your tax forms for the current tax year.

What is a CRS form?

SEC regulations require clients to have access to an easy-to-read disclosure form regarding the nature of their relationship with the firm, called the Customer Relationship Summary, or Form CRS. Form CRS includes: The types of client relationships and services the firm offers.

What is a Schwab individual account?

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. Whether you're setting aside money for the future or saving up for a big purchase, you can use your funds whenever and however you want.

How to open an individual brokerage account with Charles Schwab?

How do I open a brokerage account? The easiest way to open Schwab brokerage account is online. You can also get help opening an account by calling us at 866-232-9890 or visiting one of 300 local branches. The online account application process only takes about 10 minutes.

What tax form do I get from brokerage account?

The federal tax laws require brokerage firms, mutual funds, and other entities to report on Form 1099 all investment income, usually interest or dividends, they have paid to investors during the previous tax year. Form 1099 is a tax form required by the Internal Revenue Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify charles schwab crs individual without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your charles schwab crs individual into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the charles schwab crs individual form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign charles schwab crs individual. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit charles schwab crs individual on an iOS device?

Use the pdfFiller mobile app to create, edit, and share charles schwab crs individual from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is charles schwab crs individual?

Charles Schwab CRS Individual refers to the Common Reporting Standard (CRS) individual account information that must be reported by financial institutions to tax authorities.

Who is required to file charles schwab crs individual?

Financial institutions such as Charles Schwab are required to file CRS individual account information.

How to fill out charles schwab crs individual?

To fill out Charles Schwab CRS individual information, financial institutions must gather and report relevant account information of their clients in accordance with CRS regulations.

What is the purpose of charles schwab crs individual?

The purpose of Charles Schwab CRS individual reporting is to increase tax transparency and combat tax evasion by exchanging financial account information with other tax jurisdictions.

What information must be reported on charles schwab crs individual?

Information such as account holder's name, address, tax identification number, account balance, and income must be reported on Charles Schwab CRS individual.

Fill out your charles schwab crs individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charles Schwab Crs Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.