Get the free Planning for Retirement SS Options Brief formatted - Collin.docx. An agency-by-agenc...

Show details

(212512009) Tareq Mascot — Re: CCB o n n a g-Report. — Naval District.e for Washington-. — Indian Head. — From: To: CC: Date: Subject: -- -- - Ed Dexter Doug1as. M CIV NAVAL Washington Hamm

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planning for retirement ss

Edit your planning for retirement ss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planning for retirement ss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

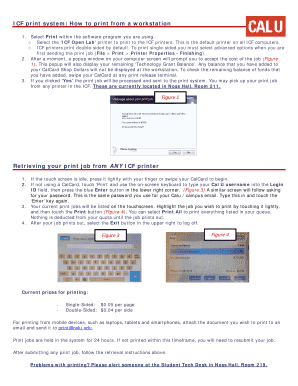

How to edit planning for retirement ss online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit planning for retirement ss. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planning for retirement ss

01

Start by gathering all necessary financial information, such as your current income, expenses, and savings. This will give you an idea of your current financial standing and help you plan for retirement accordingly.

02

Determine your retirement goals and objectives. Think about when you want to retire, the lifestyle you desire during retirement, and any specific financial milestones you want to achieve.

03

Calculate your projected retirement expenses. Consider factors such as housing, healthcare, travel, and any other expenses you anticipate having during retirement. This will help you estimate how much money you need to save.

04

Assess your current Social Security benefits. Visit the official Social Security Administration website and create an account to access your Social Security statement. This statement will provide an estimate of your future benefits based on your earnings history.

05

Consider additional retirement savings options. While Social Security will likely play a role in your retirement income, it may not be sufficient to cover all expenses. Research and explore other retirement savings vehicles, such as employer-sponsored retirement plans or individual retirement accounts (IRAs), to supplement your Social Security benefits.

06

Develop a retirement savings plan. Consider utilizing retirement calculators or consulting with a financial advisor to determine how much you need to save each month to meet your retirement goals.

07

Implement your retirement savings plan. Take action by contributing regularly to your retirement accounts and making adjustments as needed based on your evolving financial situation.

08

Monitor and review your plan periodically. As life circumstances change, it is important to reassess your retirement plan and make any necessary adjustments to stay on track.

09

Everyone who wants to ensure financial security and a comfortable retirement should consider planning for retirement SS. Whether you are a young professional just starting your career or someone nearing retirement age, having a well-thought-out retirement plan can provide peace of mind and help you achieve your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit planning for retirement ss straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing planning for retirement ss, you need to install and log in to the app.

Can I edit planning for retirement ss on an Android device?

You can make any changes to PDF files, like planning for retirement ss, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out planning for retirement ss on an Android device?

Use the pdfFiller mobile app and complete your planning for retirement ss and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is planning for retirement ss?

Planning for retirement ss refers to the process of preparing financially for retirement by saving and investing for the future.

Who is required to file planning for retirement ss?

Anyone who is working and earning income is encouraged to start planning for retirement ss to ensure financial stability during retirement.

How to fill out planning for retirement ss?

You can fill out planning for retirement ss by creating a retirement savings plan, setting retirement goals, and regularly reviewing and adjusting your retirement savings strategy.

What is the purpose of planning for retirement ss?

The purpose of planning for retirement ss is to ensure financial security and stability during retirement by saving and investing wisely.

What information must be reported on planning for retirement ss?

Common information that must be reported on planning for retirement ss includes income sources, expenses, savings contributions, retirement age goal, and retirement income needs.

Fill out your planning for retirement ss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planning For Retirement Ss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.