Get the free irp schedule b - mva maryland

Show details

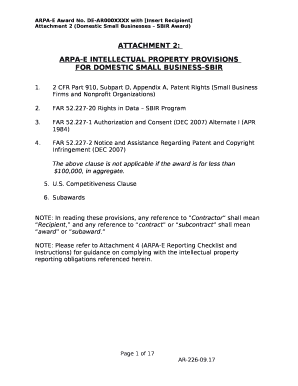

Motor Vehicle Administration 6601 Ritchie Highway, N.E. Glen Burnie, Maryland 21062 FIVE DIGITS ACCOUNT NUMBER IRP-B (12-13) THREE DIGITS TWO DIGITS FLEET NUMBER SUPP. NUMBER REGISTRATION YR. Kind

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irp schedule b

Edit your irp schedule b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irp schedule b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irp schedule b online

Follow the steps down below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irp schedule b. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irp schedule b

How to fill out irp schedule b:

01

Gather all necessary information and documentation related to your commercial motor vehicles (CMVs). This may include vehicle registration information, fleet details, and mileage records.

02

Start by reviewing the instructions provided for irp schedule b. Familiarize yourself with the format and requirements for reporting CMV information.

03

Begin filling out the schedule b form by entering your company's name, address, and other identifying details in the designated fields.

04

Provide the required information for each CMV, such as the vehicle identification number (VIN), license plate number, make and model, and gross vehicle weight rating (GVWR).

05

Indicate the jurisdiction where each CMV is registered and provide the corresponding registration information, including the registration number, date of expiration, and issuing jurisdiction.

06

Enter the actual mileage traveled by each CMV in the reporting period. This information may be obtained from your mileage records or electronic logging devices.

07

Calculate the total distance and total taxable distance for each CMV. The taxable distance is typically determined based on the jurisdictions in which the vehicle is registered and/or operated.

08

Summarize the information for all CMVs by calculating the total number of vehicles, total distance, total taxable distance, and total fees. These calculations may be provided automatically by the schedule b form or require manual calculations.

09

Review the completed irp schedule b for accuracy and ensure that all required fields have been filled out properly. Make any necessary corrections or additions before submitting.

Who needs irp schedule b:

01

Motor carriers that operate commercial motor vehicles (CMVs) in multiple jurisdictions typically need irp schedule b.

02

Interstate carriers, who transport goods or passengers across state lines, are often required to file irp schedule b.

03

Companies or individuals that own or lease CMVs weighing over 26,000 pounds or having three or more axles may also need to submit irp schedule b.

04

It is important to consult with the relevant jurisdiction's motor vehicle department or a professional in the transportation industry to determine if irp schedule b is required for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irp schedule b directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your irp schedule b as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the irp schedule b in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your irp schedule b and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out irp schedule b using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign irp schedule b. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is irp schedule b?

IRP Schedule B is a form used for reporting mileage and fees for interstate vehicles.

Who is required to file irp schedule b?

Motor carriers operating interstate vehicles are required to file IRP Schedule B.

How to fill out irp schedule b?

IRP Schedule B can be filled out by entering the required information such as vehicle information, mileage, and fees.

What is the purpose of irp schedule b?

The purpose of IRP Schedule B is to track and report mileage and fees for interstate vehicles.

What information must be reported on irp schedule b?

Information such as vehicle details, mileage by jurisdiction, and fees must be reported on IRP Schedule B.

Fill out your irp schedule b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irp Schedule B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.