Get the free ca frb 3801 and nonresidents form - ftb ca

Show details

2013 Instructions for Form FT 3801 Passive Activity Loss Limitations These instructions are based on the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ca frb 3801 and

Edit your ca frb 3801 and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca frb 3801 and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca frb 3801 and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca frb 3801 and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca frb 3801 and

How to fill out CA FRB 3801 and:

01

Start by obtaining the CA FRB 3801 form from the California Federal Reserve Bank or their website.

02

Carefully read the instructions provided on the form to understand its purpose and the information required.

03

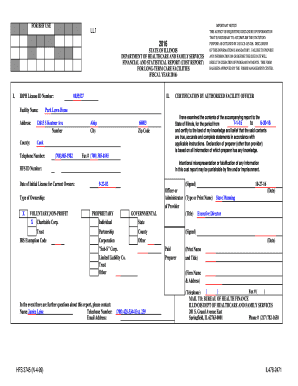

Begin filling out the form by entering your personal information such as your name, address, and contact details in the designated fields.

04

Proceed to provide the necessary financial information requested, such as your income, expenses, and assets. Ensure accuracy and include all relevant details.

05

If applicable, indicate any dependents or spouse/partner information as requested.

06

Review the completed form to ensure accuracy and completeness. Double-check for any errors or missing information.

07

Sign and date the form as required. Ensure that all required signatures are obtained.

08

Make a copy of the filled-out form for your records before submitting it to the designated authority or organization.

Who needs CA FRB 3801 and:

01

Business owners: CA FRB 3801 form may be required for business owners who need to report their financial information for regulatory or taxation purposes.

02

Lenders: Financial institutions or lenders may request individuals or businesses to fill out CA FRB 3801 to assess their creditworthiness or eligibility for loans.

03

Government agencies: Certain government agencies may require individuals or businesses to submit CA FRB 3801 to gather financial information for statistical or policy purposes.

04

Auditors or accountants: Professionals involved in auditing or accounting may use CA FRB 3801 to gather financial data for analysis and reporting purposes.

Note: The specific entities or individuals who need CA FRB 3801 may vary depending on the jurisdiction and context. It is important to consult the relevant authorities or professionals to determine if and when this form needs to be filled out.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ca frb 3801 and?

Ca frb 3801 is a form used for reporting foreign bank and financial accounts.

Who is required to file ca frb 3801 and?

Any U.S. person who has a financial interest in or signature authority over foreign bank accounts with an aggregate value exceeding $10,000 at any time during the calendar year is required to file ca frb 3801.

How to fill out ca frb 3801 and?

Ca frb 3801 can be filled out online through the Financial Crimes Enforcement Network (FinCEN) website.

What is the purpose of ca frb 3801 and?

The purpose of ca frb 3801 is to combat money laundering, tax evasion, and other financial crimes by monitoring foreign bank accounts held by U.S. persons.

What information must be reported on ca frb 3801 and?

Ca frb 3801 requires the reporting of the account holder's name, address, account number, and the maximum value of the account during the reporting period.

Can I create an electronic signature for the ca frb 3801 and in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ca frb 3801 and in seconds.

How do I edit ca frb 3801 and straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ca frb 3801 and, you need to install and log in to the app.

How do I fill out ca frb 3801 and using my mobile device?

Use the pdfFiller mobile app to fill out and sign ca frb 3801 and. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your ca frb 3801 and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.