Get the free Mortgage Mediation Program Form - ca4 uscourts

Show details

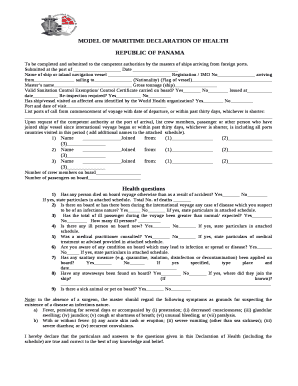

UNITED STATES COURT OF APPEALS FOR THE FOURTH CIRCUIT 1100 East Main Street, Suite 501 Richmond, Virginia 23219-3517 (804) 916-2700 www.ca4.uscourts.gov ORAL ARGUMENT CD REQUEST FORM For Cases Argued

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage mediation program form

Edit your mortgage mediation program form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage mediation program form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage mediation program form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage mediation program form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage mediation program form

How to fill out mortgage mediation program form:

01

Carefully read through the instructions: Before starting to fill out the form, it is important to thoroughly read the instructions provided. These instructions will give you a clear understanding of what information is required and how it should be provided.

02

Gather all necessary documents: Make sure to gather all the necessary documents before starting to fill out the form. This may include documents such as financial statements, pay stubs, tax returns, and any other relevant paperwork that may be required to complete the form accurately.

03

Provide accurate and detailed information: It is vital to provide accurate and detailed information on the form. Be sure to double-check all the information you provide to avoid any errors or discrepancies that could impact the mediation process. Inaccurate information could potentially lead to delays or even the rejection of your application.

04

Answer all questions: Carefully go through each question on the form and ensure that you answer them all. Leaving any questions unanswered may result in your application being deemed incomplete. If you are unsure about how to answer a particular question, seek guidance or clarification from a professional or the program administrators.

05

Seek professional assistance if needed: If you find the form complex or difficult to understand, it may be helpful to seek professional assistance. This could be in the form of a mortgage mediator, an attorney, or a housing counselor who can guide you through the process and ensure that you are providing the necessary information accurately.

Who needs mortgage mediation program form:

01

Homeowners facing foreclosure: The mortgage mediation program form is typically required for homeowners who are facing foreclosure. This program aims to help homeowners negotiate with their lenders to find a mutually beneficial solution to avoid foreclosure.

02

Individuals seeking mediation assistance: The form is also necessary for individuals who are seeking mediation assistance to resolve mortgage-related disputes. Whether it is issues related to loan modifications, repayment plans, or any other mortgage-related concerns, the mediation program form is required to initiate the process.

03

Those in need of financial relief: Individuals who are experiencing financial difficulties and are looking for options to alleviate their mortgage burden may also need to fill out the mortgage mediation program form. This form will help assess their financial situation and determine if they qualify for any financial assistance or alternative solutions.

04

Homeowners wanting to explore alternatives: The mortgage mediation program form may be necessary for homeowners who are looking to explore alternatives to foreclosure, such as short sales or deed in lieu of foreclosure. This form will help facilitate the communication and negotiation between the homeowner and their lender.

05

Individuals seeking guidance and support: Even if homeowners are unsure about their eligibility or the specifics of the mediation program, they can still fill out the form to seek guidance and support. Program administrators or housing counselors can review their situation and provide advice on the appropriate steps to take.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage mediation program form?

The mortgage mediation program form is a document used to request mediation between a homeowner and their mortgage lender to potentially avoid foreclosure.

Who is required to file mortgage mediation program form?

Homeowners who are facing potential foreclosure are typically required to file the mortgage mediation program form.

How to fill out mortgage mediation program form?

To fill out the mortgage mediation program form, homeowners need to provide their personal information, details about the mortgage loan, and reasons for needing mediation.

What is the purpose of mortgage mediation program form?

The purpose of the mortgage mediation program form is to facilitate communication between homeowners and lenders to explore options for avoiding foreclosure.

What information must be reported on mortgage mediation program form?

The mortgage mediation program form typically requires information such as contact details, mortgage account information, financial hardship reasons, and proposed solutions.

How can I edit mortgage mediation program form from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mortgage mediation program form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my mortgage mediation program form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your mortgage mediation program form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit mortgage mediation program form on an Android device?

You can make any changes to PDF files, like mortgage mediation program form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your mortgage mediation program form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Mediation Program Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.