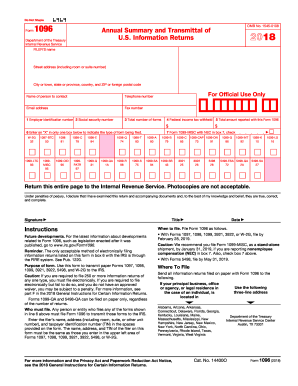

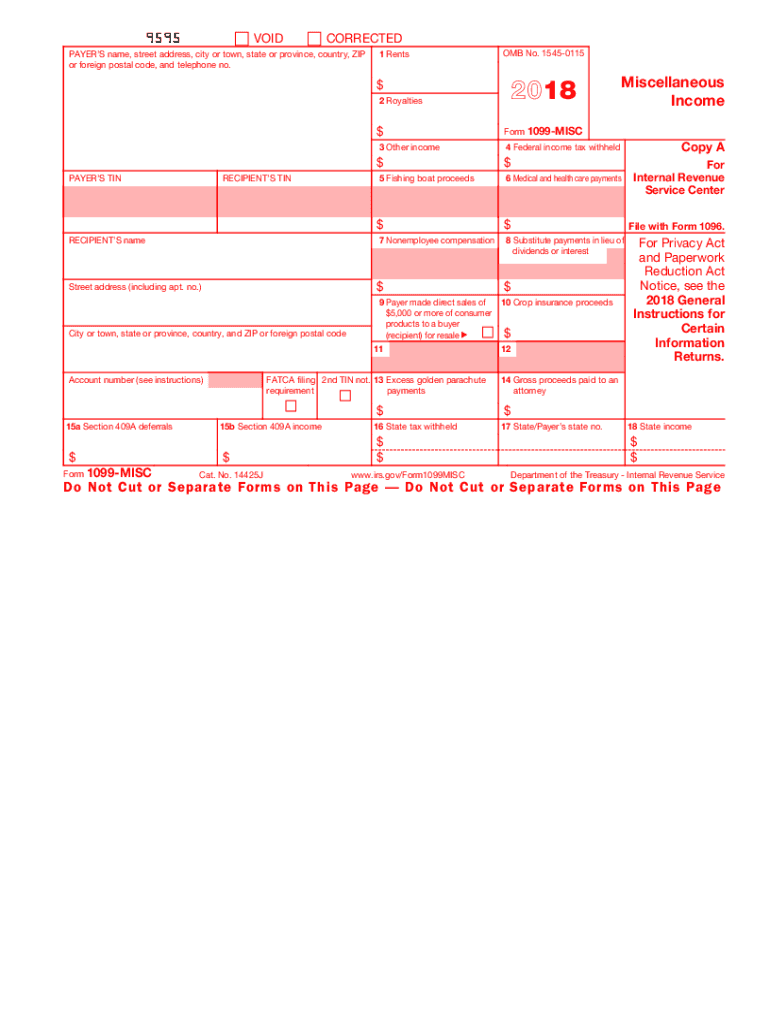

IRS 1099-MISC 2018 free printable template

Instructions and Help about IRS 1099-MISC

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

About IRS 1099-MISC 2018 previous version

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-MISC

What should I do if I discover an error on my submitted IRS 1099-MISC?

If you realize there’s an error on your submitted IRS 1099-MISC, you need to file a corrected form. This can typically be done by checking the ‘Corrected’ box on the new form. Make sure to submit it to the IRS as soon as you identify the mistake to minimize potential penalties.

How can I verify the status of my e-filed IRS 1099-MISC?

To verify the status of your e-filed IRS 1099-MISC, you can use the IRS e-file tracking system. This system allows you to check whether the IRS has received and processed your form. It’s important to hold on to the confirmation from your e-filing provider as proof of submission.

Are e-signatures acceptable for submitting an IRS 1099-MISC?

Yes, e-signatures are generally acceptable for submitting an IRS 1099-MISC. However, ensure that the e-signature method you choose complies with IRS standards to avoid any issues. Always confirm that your e-filing software supports e-signatures and that you’re following best practices for data security.

What do I do if my IRS 1099-MISC submission is rejected?

If your IRS 1099-MISC submission is rejected, review the rejection codes provided by your e-filing service. You'll need to correct the errors indicated and resubmit the form as soon as possible. Keep track of any necessary documentation to support the corrections made during the resubmission.

See what our users say