USDA RD 442-21 1995-2025 free printable template

Get, Create, Make and Sign form 442 21

Editing form 442 21 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 442 21 forms fillable

How to fill out USDA RD 442-21

Who needs USDA RD 442-21?

Video instructions and help with filling out and completing usda 442 21 fillable

Instructions and Help about form 442 21 fillable

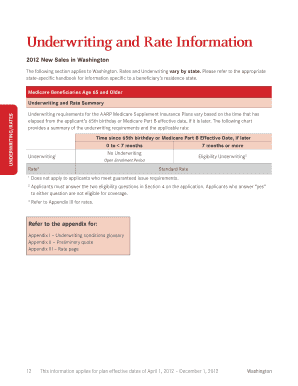

Hi I'm Annie Fitzsimmons I'm your Washington Realtors Legal Hotline lawyer today we are starting a subseries of our big series entitled real estate fundamentals you should know our subseries is all about the financing contingency form 22-a today's video is going to look at paragraph 1 a form 22 a with paragraph 1 the buyer identifies the type of loan and the amount of down payment that will trigger their good faith requirement to obtain financing and if they're unable to obtain the financing identified in the form 22 a then they'll recover their earnest money they'll have they'll have a legal excuse for failing to close a transaction assuming they fulfill all the other requirements of the financing contingency so let's talk just about the buyers' requirement to identify the type of loan they're getting in their amount of down payment buyer has a variety of check boxes that they can choose from buyers should of course do a good job working with their lender before they ever make an offer, so they know which type of loan they're going to be getting or at least not more than you know a couple types of loans if for example they're not sure between an FHA or a conventional it might depend on the property itself then they could check both boxes, but it would be ridiculous for any listing broker to advise a seller to accept an offer if for example every box was checked because that would indicate a buyer who had no idea how they were going to finance the purchase of the property but let's just assume that a buyer marks the conventional box and then says that they are going to put 10 down and seller accepts that offer the language below that still part of the first paragraph says that buyer must make loan application within five days following mutual acceptance sometimes buyers will go in and make some form of loan application may be seeking underwriting approval prior to purchase prior to mutual acceptance that's not the same as actually making loan application because a true loan application can't be submitted until we have the address of the property, so the loan application required by paragraph 1 to form 22 a must be made after mutual acceptance has to be made within five days buyer goes and makes their loan application if when buyer is meeting with the lender says you know what you mark the box for conventional, but honestly you're going to have a greater chance of success getting an FHA loan I recommend that you apply for an FHA loan instead of the conventional then buyer brokers that buyer is going to have to with sellers permission revise the financing contingency before they do that or maybe the buyer makes a loan application for both a conventional loan and an FHA loan even though the only box marked is conventional if that happens buyer is going to have to see that conventional loan application all the way through to a declination unless they have revised the form 22 a to identify that buyer will in fact be relying on the FHA loan instead...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my usda 442 21 form in Gmail?

Can I create an eSignature for the 442 21 forms blank in Gmail?

How do I fill out usda 442 21 on an Android device?

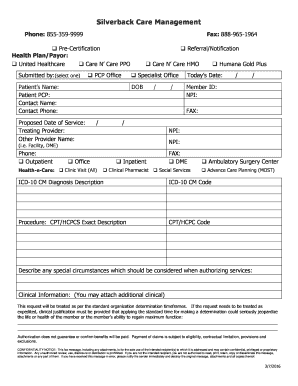

What is USDA RD 442-21?

Who is required to file USDA RD 442-21?

How to fill out USDA RD 442-21?

What is the purpose of USDA RD 442-21?

What information must be reported on USDA RD 442-21?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.