Get the free INCOME TAX DATAITEMIZER

Show details

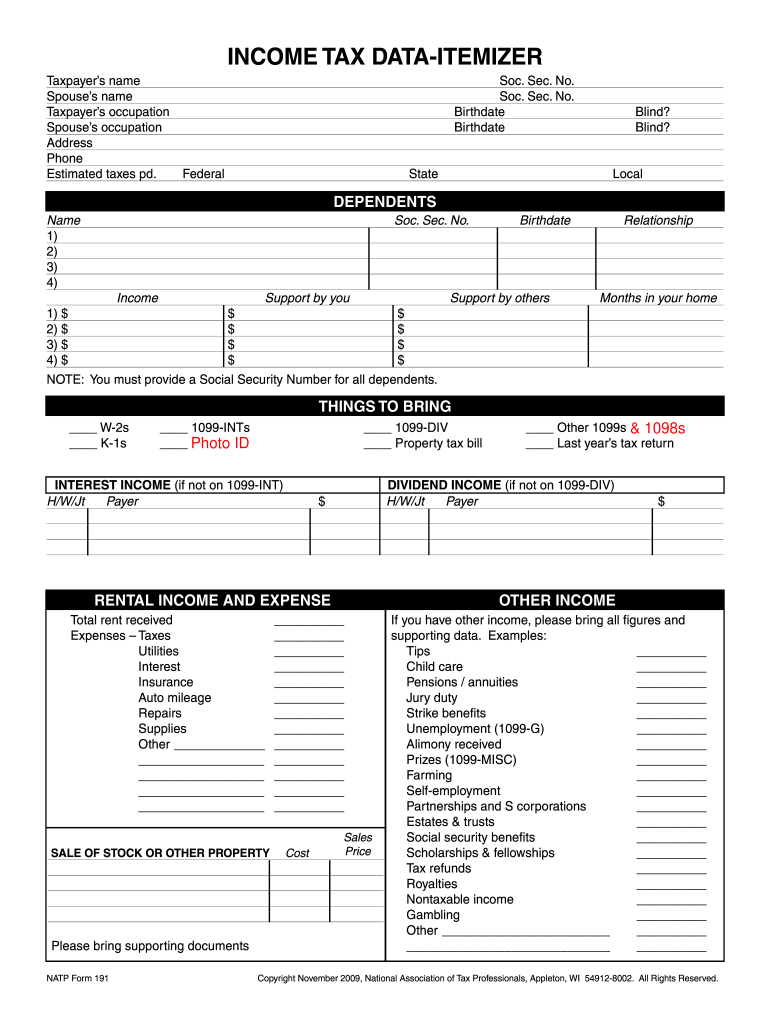

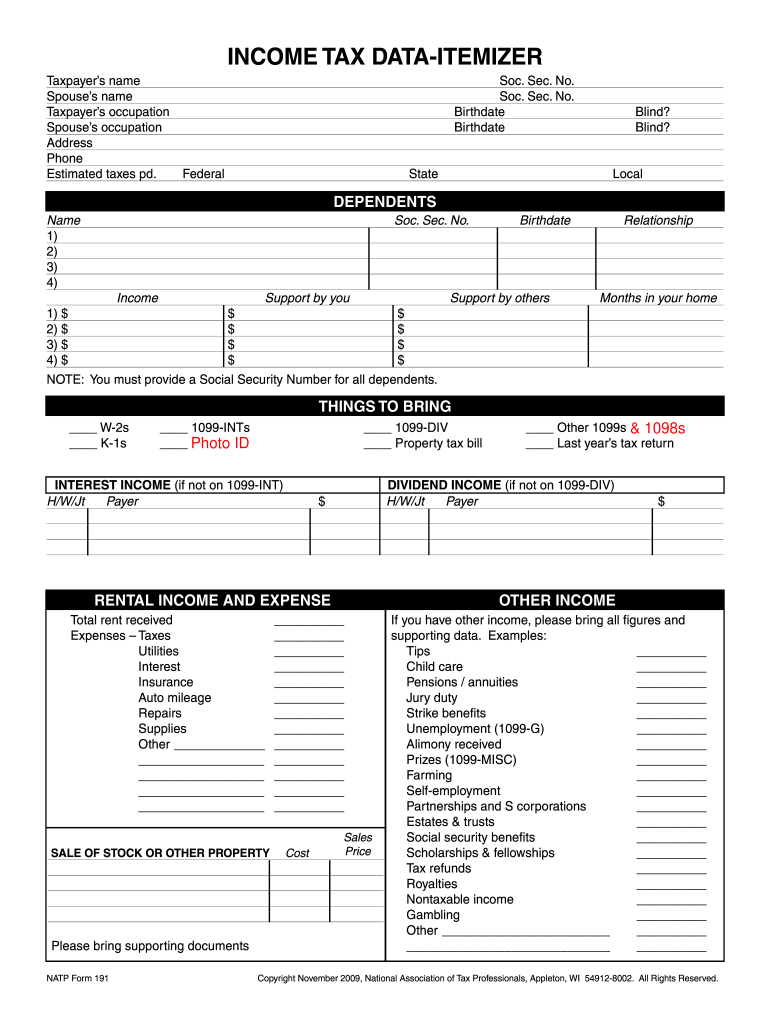

INCOME TAX DATAITEMIZER Taxpayers name Spouses name Taxpayers occupation Spouses occupation Address Phone Estimated taxes pd. Soc. Sec. No. Soc. Sec. No. Birthdate Federal State Blind? Blind? Local

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax dataitemizer

Edit your income tax dataitemizer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax dataitemizer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income tax dataitemizer online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income tax dataitemizer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax dataitemizer

How to fill out income tax dataitemizer:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other relevant income statements.

02

Prepare a list of deductions and credits that you may be eligible for, such as mortgage interest, education expenses, or charitable donations.

03

Use the dataitemizer software or online platform to input your personal information, including your name, social security number, and filing status.

04

Follow the prompts to enter your income information from the documents you gathered in step 1. Make sure to accurately input all the numbers to avoid errors.

05

Proceed to fill out the deductions and credits section, inputting the relevant information for each item on your list from step 2.

06

Double-check all the information you have entered to ensure accuracy and completeness.

07

Review your filled-out income tax dataitemizer form to ensure you haven't missed any important details or made any mistakes.

08

Once you are satisfied with the accuracy of your dataitemizer, you can submit it to the appropriate tax authority, either electronically or by mail.

Who needs income tax dataitemizer:

01

Individuals who have various sources of income, such as employment, freelancing, or investments, may need to use income tax dataitemizer to ensure all their income is accurately reported.

02

People who have numerous deductions and credits that they want to claim may find it helpful to use income tax dataitemizer to organize and maximize their tax benefits.

03

Individuals with complex financial situations, such as self-employed individuals or those with rental properties, may require income tax dataitemizer to properly report their income and expenses.

Remember, it is always advisable to consult with a tax professional or seek guidance from the relevant tax authority to ensure accurate and compliant filing of your income taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the itemized deduction from gross income?

What are itemized deductions? Itemized deductions are subtractions from a taxpayer's Adjusted Gross Income (AGI) that reduce the amount of income that is taxed. Most taxpayers have a choice of taking a standard deduction or itemizing deductions. Taxpayers should use the type of deduction that results in the lowest tax.

What is itemizing sales tax?

What is the sales tax deduction? On your tax return, you can deduct the state and local general sales tax you paid during the year, or you can deduct the state and local income tax you paid during the year.

What if standard deduction is more than income?

If your deductions exceed income earned and you had tax withheld from your paycheck, you might be entitled to a refund. You may also be able to claim a net operating loss (NOLs). A Net Operating Loss is when your deductions for the year are greater than your income in that same year.

How to calculate income tax?

Now, one pays tax on his/her net taxable income. For the first Rs. 2.5 lakh of your taxable income you pay zero tax. For the next Rs. 2.5 lakhs you pay 5% i.e. Rs 12,500. For the next 5 lakhs you pay 20% i.e. Rs 1,00,000. For your taxable income part which exceeds Rs. 10 lakhs you pay 30% on the entire amount.

How do you itemize sales tax?

How to take advantage of the sales tax deduction. Compare what you paid in sales tax for the year to what you paid in state, local and foreign income tax for the year. Then deduct the larger of the two amounts. Reid Riker, a certified public accountant in Reno, Nevada, says these things can speed up the decision.

Can you itemize sales tax?

The Internal Revenue Service (IRS) permits you to write off either your state and local income tax or sales taxes when itemizing your deductions. People who live in a state that does not impose income taxes often benefit most from this deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in income tax dataitemizer without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing income tax dataitemizer and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the income tax dataitemizer in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your income tax dataitemizer in seconds.

Can I create an electronic signature for signing my income tax dataitemizer in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your income tax dataitemizer directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is income tax dataitemizer?

Income tax data itemizer is a tool used to itemize and report income, deductions, credits, and other financial information to calculate the amount of tax owed or refund due.

Who is required to file income tax dataitemizer?

Individuals who have income that requires reporting, such as wages, self-employment income, interest, dividends, and other sources of income, may be required to file income tax data itemizer.

How to fill out income tax dataitemizer?

Income tax data itemizer can be filled out manually or using tax preparation software. It requires entering accurate financial information, deductions, and credits to calculate the tax liability.

What is the purpose of income tax dataitemizer?

The purpose of income tax data itemizer is to accurately report income and expenses to determine the amount of tax owed or refund due to the taxpayer.

What information must be reported on income tax dataitemizer?

Income tax data itemizer requires reporting various information including income sources, deductions, credits, and other financial details that impact the tax liability.

Fill out your income tax dataitemizer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Dataitemizer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.