Get the free CONVENTIONAL LOAN PACKAGE

Show details

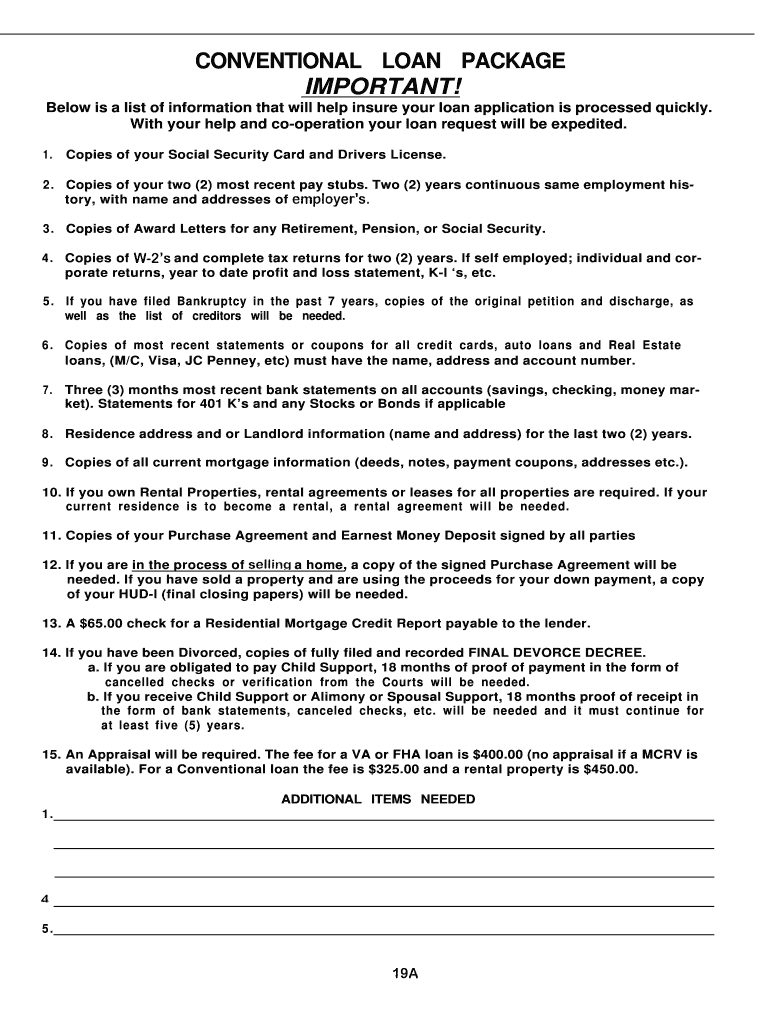

CONVENTIONAL LOAN PACKAGE

IMPORTANT!

Below is a list of information that will help insure your loan application is processed quickly.

With your help and cooperation your loan request will be expedited.

1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conventional loan package

Edit your conventional loan package form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conventional loan package form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing conventional loan package online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit conventional loan package. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conventional loan package

How to fill out a conventional loan package:

01

Obtain the loan application form: Start by acquiring the conventional loan application form from a lending institution or mortgage lender. This form will serve as the foundation for your loan package.

02

Gather necessary documentation: Collect all the required documents that are typically needed for a conventional loan application. This may include proof of income, such as pay stubs, tax returns, and bank statements, as well as identification documents, proof of employment, and information about any assets or debts.

03

Complete the loan application form: Carefully fill out the loan application form with accurate and up-to-date information. This includes personal information, employment details, financial information, and any other requested details. Be sure to double-check the form for any errors or missing information before submitting it.

04

Compile supporting documents: Organize and attach all the necessary supporting documents to your loan package. This may include copies of your ID, bank statements, tax returns, employment verification, and any additional documents required by the lender.

05

Provide additional information if needed: If there are any additional forms or information requested by the lender, make sure to include them in your loan package. This could include a credit authorization form, purchase agreement (if applicable), or any other documentation that may be necessary for the loan evaluation process.

06

Review and proofread: Before submitting the loan package, carefully review all the documents and forms. Make sure all information is accurate, documents are legible, and there are no errors or omissions. It's crucial to present a complete and well-organized loan package to increase the chances of approval.

07

Submit the loan package: Once you have reviewed and compiled all the required documentation, submit the loan package to your chosen lender or lending institution. Follow their specific submission instructions, whether it be in-person, online, or through mail. Keep copies of all the documents for your records.

Who needs a conventional loan package:

01

Homebuyers: Individuals or families looking to purchase a home often require a conventional loan package to apply for a mortgage. This package provides the necessary information and documentation for a lender to evaluate and approve the loan.

02

Real estate investors: Investors who wish to secure financing for investment properties, such as rental properties or fix-and-flip projects, often need to put together a conventional loan package. This package helps lenders assess the viability and potential profitability of the investment.

03

Refinancers: Homeowners who want to refinance their existing mortgage also need a conventional loan package to apply for a new loan. This package enables lenders to review the homeowner's financial situation and determine if they qualify for a lower interest rate or different loan terms.

In summary, filling out a conventional loan package involves acquiring the loan application form, gathering necessary documents, completing the application form accurately, compiling supporting documents, reviewing and proofreading the package, and finally submitting it to the lender. This package is essential for homebuyers, real estate investors, and homeowners who wish to refinance their mortgage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my conventional loan package directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your conventional loan package and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find conventional loan package?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the conventional loan package in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit conventional loan package on an Android device?

You can make any changes to PDF files, like conventional loan package, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is conventional loan package?

A conventional loan package typically includes documents such as credit reports, income verification, asset verification, and property appraisal.

Who is required to file conventional loan package?

Borrowers who are applying for a conventional loan are required to submit a loan package.

How to fill out conventional loan package?

To fill out a conventional loan package, borrowers need to provide accurate and up-to-date information such as income, assets, debts, and personal information.

What is the purpose of conventional loan package?

The purpose of a conventional loan package is to provide lenders with necessary information to assess the borrower's creditworthiness and ability to repay the loan.

What information must be reported on conventional loan package?

Information such as credit history, income, assets, debts, and property details must be reported on a conventional loan package.

Fill out your conventional loan package online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conventional Loan Package is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.