UK Barclays HPBBCAL4 2016-2026 free printable template

Show details

Customer Copy Fixed Loan Agreement regulated by the Consumer Credit Act 1974Barclays Bank PLC (the “Bank or we/us) branch address offers company of company address (the “Borrower or you) a Barclay

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign barclays business plc form

Edit your loan repayments agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 421882908 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing barclays loan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK Barclays HPBBCAL4. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

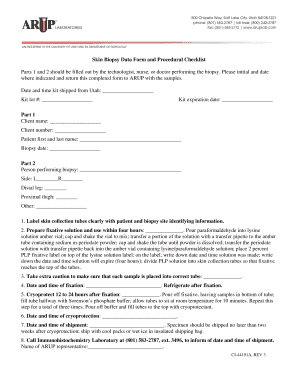

How to fill out UK Barclays HPBBCAL4

How to fill out UK Barclays HPBBCAL4

01

Gather all necessary personal information, such as your name, address, and contact details.

02

Collect financial information, including your income, expenses, and any existing debts.

03

Access the UK Barclays HPBBCAL4 form from the official Barclays website or your account portal.

04

Start filling out the form by entering your personal information in the designated fields.

05

Complete the financial section by accurately detailing your income, expenses, and any relevant financial obligations.

06

Review your entries for accuracy and completeness before submission.

07

Once everything is filled out correctly, submit the form electronically or print it for mailing, depending on your preference.

Who needs UK Barclays HPBBCAL4?

01

Individuals applying for financing or credit through Barclays.

02

Clients looking to assess their budget for loan eligibility or approval.

03

Anyone needing to provide detailed financial information for a Barclays-related product or service.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a loan agreement for a friend?

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

Is a loan agreement legally binding?

A loan contract, also known as a loan agreement, is a legally binding document between a lender and a borrower that sets the terms and conditions for loaning money.

What is a loan between friends called?

A friendly loan is a personal loan that you receive from a friend or family member. These loans are often informal, but taking the time to write down a loan agreement can help both you and the friend or family member set expectations.

How do I write a simple loan agreement?

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do I make a loan agreement between friends?

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

Does a loan agreement need to be notarized?

Although some loans don't require a notary, it's smart to get a notarized note. A notary is an independent third party who can verify both parties' identities and their willingness to sign a contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UK Barclays HPBBCAL4 online?

Filling out and eSigning UK Barclays HPBBCAL4 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the UK Barclays HPBBCAL4 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your UK Barclays HPBBCAL4 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out UK Barclays HPBBCAL4 on an Android device?

Use the pdfFiller app for Android to finish your UK Barclays HPBBCAL4. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is UK Barclays HPBBCAL4?

UK Barclays HPBBCAL4 is a specific financial report or document required by Barclays Bank UK, likely related to regulatory compliance or auditing purposes.

Who is required to file UK Barclays HPBBCAL4?

Entities that have transactions or accounts under Barclays Bank UK that fall under the reporting requirements are obligated to file UK Barclays HPBBCAL4.

How to fill out UK Barclays HPBBCAL4?

To fill out UK Barclays HPBBCAL4, one must gather the necessary financial data, follow the guidelines provided by Barclays, and ensure all required fields are completed accurately before submission.

What is the purpose of UK Barclays HPBBCAL4?

The purpose of UK Barclays HPBBCAL4 is to ensure compliance with financial regulations, monitor risks, and provide transparency in reporting for the institution and its clients.

What information must be reported on UK Barclays HPBBCAL4?

UK Barclays HPBBCAL4 must report detailed financial data, including transaction records, account balances, and any relevant compliance-related information as stipulated by Barclays' guidelines.

Fill out your UK Barclays HPBBCAL4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Barclays hpbbcal4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.