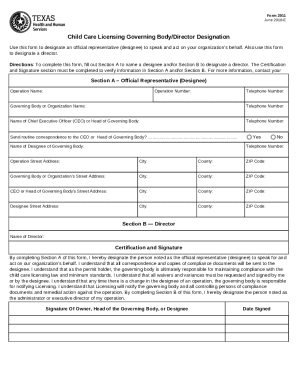

TX Form 2911 2012 free printable template

Show details

Texas Dept of Family and Protective ServicesForm 2911 October 2012GOVERNING BODY/DIRECTOR DESIGNATION Texas law gives you the right to know what information is collected about you by means of a form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Form 2911

Edit your TX Form 2911 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Form 2911 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Form 2911 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Form 2911. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form 2911 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Form 2911

How to fill out TX Form 2911

01

Gather all necessary information about the transaction you are reporting.

02

Start by filling out Part I, which includes your personal or business information.

03

In Part II, provide details about the transaction, including the date and amount.

04

Fill out Part III to indicate the nature of the transaction and any applicable exemptions.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form at the bottom.

Who needs TX Form 2911?

01

Individuals or businesses that are engaged in certain transactions requiring reporting to the Texas comptroller.

02

Taxpayers who have made purchases subject to Texas use tax.

03

Organizations that are filing for a tax exemption related to specific transactions.

Fill

form

: Try Risk Free

People Also Ask about

Do you need a license to babysit in Texas?

Except for home daycare providers who are babysitting for multiple children on a regular basis that might qualify as a Licensed Family Home, a Licensed Childcare Home,w or a Registered Childcare Home*, Texas babysitters are largely free from legal regulation and are not required to be licensed.

Can you babysit without a license Texas?

Except for home daycare providers who are babysitting for multiple children on a regular basis that might qualify as a Licensed Family Home, a Licensed Childcare Home,w or a Registered Childcare Home*, Texas babysitters are largely free from legal regulation and are not required to be licensed.

How long does it take to get daycare license in Texas?

DFPS Child Care Licensing will issue or deny the permit no later than 60 days after they accept your application.

How do I get a child care license in Texas?

Become a Child Care Home Provider Step 1 - Attend a Child Care Home Pre-Application Class. Step 2 - Become Familiar with Required Materials and Helpful Resources. Step 3 – Create an online Child Care Licensing account. Step 4 – Submit an Online Application and Fees.

What are the child care licensing requirements in Texas?

You must obtain at least 30 clock hours of training each year relevant to the age of the children for whom you provide care. The 30 clock hours of annual training are exclusive of any requirements for the licensing Pre-application Course, first-aid and CPR training, and transportation safety training.

How many babies can a caregiver have in Texas?

LICENSING REQUIREMENTS Ratios for Daycare Centers in Texas StateAge RangeChild: Staff RatioMaximum Group Size0 – 11 months4:11012 – 17 months5:11318 – 23 months9:1187 more rows

Do you have to be licensed to run an in home daycare in Texas?

Licensing Requirements Licensing regulates child-care offered in center-based and home-based operations. Child care includes the care, supervision, training, or education of an unrelated child or children (13 or younger) for less than 24 hours per day in a place other than the child's own home.

How much is child care license in Texas?

Fee Amounts Type of FeeLicensed Child Care Operations (except CPAs)Type of Fee ApplicationLicensed Child Care Operations (except CPAs) $35Type of Fee Initial LicenseLicensed Child Care Operations (except CPAs) $35Type of Fee Initial License RenewalLicensed Child Care Operations (except CPAs) $354 more rows

How many kids can you babysit without a license Texas?

In general, Texas requires you to register or license your childcare home if you care for more than four children at a time. If you provide regular child care for one to three children, you may have to list your home with the state.

How many kids can I babysit at home in Texas?

Provides care and supervision for up to six unrelated children 13 or younger during school hours, and can also provide care and supervision for six additional school-age children after school hours (no more than 12 children can be in care at any time, including children related to the caregiver).

Do daycares have to be licensed in Texas?

Chapter 42 of the Texas Human Resources Code requires persons who operate a child care facility to be licensed by Child Care Licensing.

How many kids can you babysit in Texas without a license?

In general, Texas requires you to register or license your childcare home if you care for more than four children at a time. If you provide regular child care for one to three children, you may have to list your home with the state.

Who is exempt from child care licensing Texas?

Texas Human Resources Code §42.041(b)(17) exempts a child care facility that operates for less than three consecutive weeks and less than 40 days in a period of 12 months.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my TX Form 2911 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your TX Form 2911 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit TX Form 2911 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TX Form 2911 right away.

How do I complete TX Form 2911 on an Android device?

Use the pdfFiller mobile app to complete your TX Form 2911 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is TX Form 2911?

TX Form 2911 is a tax form used in Texas for reporting certain transactions and tax liabilities, typically related to sales and use tax.

Who is required to file TX Form 2911?

Businesses and individuals who engage in taxable sales of goods or services and are required to report and remit sales and use tax in Texas must file TX Form 2911.

How to fill out TX Form 2911?

To fill out TX Form 2911, taxpayers should provide accurate information regarding their sales, purchases, and tax collected, ensuring all required fields are completed before submitting to the Texas Comptroller.

What is the purpose of TX Form 2911?

The purpose of TX Form 2911 is to facilitate the reporting and collection of sales and use tax by businesses to ensure compliance with Texas tax laws.

What information must be reported on TX Form 2911?

Information that must be reported on TX Form 2911 includes total sales, tax collected, exempt sales, and any other relevant financial information related to sales and use tax transactions.

Fill out your TX Form 2911 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Form 2911 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.