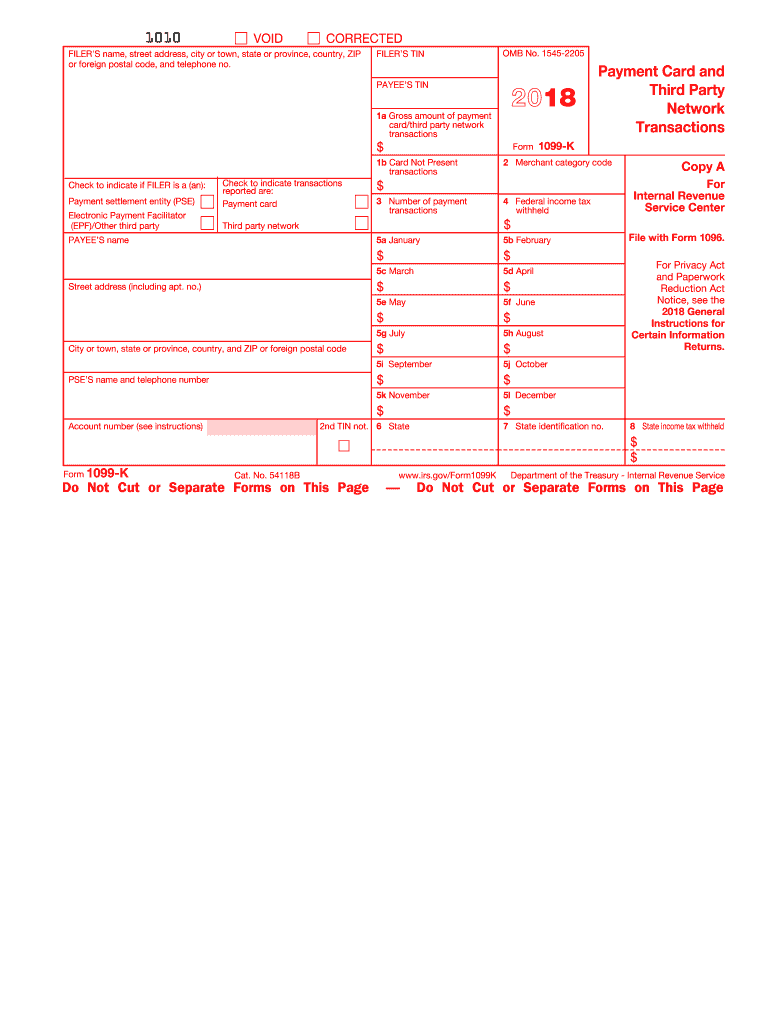

IRS 1099-K 2018 free printable template

Show details

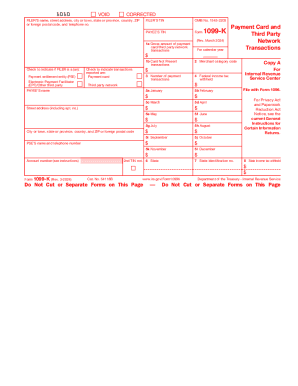

FILER S TIN OMB No. 1545-2205 PAYEE S TIN 1a Gross amount of payment card/third party network transactions Form 1b Card Not Present Payment settlement entity PSE Check to indicate transactions reported are Payment card Electronic Payment Facilitator EPF /Other third party Third party network 1099-K 2 Merchant category code 3 Number of payment 4 Federal income tax withheld 5a January 5b February PAYEE S name 5c March 5d April 5e May Street address including apt. no. 5f June 5g July 5h August 5i...September City or town state or province country and ZIP or foreign postal code Copy A Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns. To be filed with the recipient s state income tax return when required. Copy 2 Copy C For FILER Settlement Entity or Electronic Payment Facilitator/Other Third Party To complete Form 1099-K use Returns and the 2018 Instructions for Form 1099-K. To order...these instructions and additional forms go Caution Because paper forms are scanned during processing you cannot file Forms 1096 1097 1098 1099 3921 3922 or 5498 that you print from the IRS website. For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns. 5j October 5k November PSE S name and telephone number 5l December 2nd TIN not. 6 State Account number see instructions Payment Card and Third Party Network 7 State identification no. 8 State income...tax withheld Form 1099-K Cat. No. 54118B Do Not Cut or Separate Forms on This Page www.irs.gov/Form1099K Department of the Treasury - Internal Revenue Service 6 State Copy 1 For State Tax Department CORRECTED if checked This is important tax information and is being furnished to the IRS. If you are required to file a return a negligence penalty or other sanction may be imposed on you if taxable income results from this IRS determines that it has not been reported. Copy B For Payee Keep for your...records You have received this form because you have either a accepted payment cards for payments or b received payments through a third party network that exceeded 20 000 in gross total reportable exceeded 200 for the calendar year. See Form W-9 Request for Taxpayer amount on your income tax return as tax withheld. Boxes 5a 5l. Shows the gross amount of payment card/third party network transactions made to you for each month of the calendar year. Boxes 6 8. Shows state and local income tax...withheld from the payments. Future developments. For the latest information about developments related to Form 1099-K and its instructions such as legislation enacted after they were published go to www.irs.gov/Form1099K. To be filed with the recipient s state income tax return when required. Copy 2 Copy C For FILER Settlement Entity or Electronic Payment Facilitator/Other Third Party To complete Form 1099-K use Returns and the 2018 Instructions for Form 1099-K. Attention Copy A of this form is...provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

How to fill out IRS 1099-K

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

Editing the IRS 1099-K form requires accuracy and attention to detail. You can use pdfFiller's tools to make necessary changes to the form before submission. Ensure that you review all entries meticulously, as any discrepancies can lead to issues with the IRS.

How to fill out IRS 1099-K

Filling out the IRS 1099-K form involves several key steps. Begin by gathering the required information such as your name, address, and identification number, along with the payer's details. For assistance in completing the form, pdfFiller provides features that allow you to enter your data easily and correctly.

About IRS 1099-K 2018 previous version

What is IRS 1099-K?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-K 2018 previous version

What is IRS 1099-K?

IRS 1099-K is a tax form used to report payment transactions. Specifically, it is issued by payment settlement entities to report the gross amount of payment card and third-party network transactions to the Internal Revenue Service. This form is vital for both the taxpayers and the IRS to ensure accurate income reporting.

What is the purpose of this form?

The purpose of the IRS 1099-K is to provide a clear record of transactions made through electronic payment methods. This form helps the IRS cross-reference income reported by individuals and businesses with the payments they have received. Proper filing of the 1099-K aids in tax compliance and prevents underreporting of income.

Who needs the form?

Individuals and businesses that receive payments through credit cards or third-party networks, such as PayPal or Venmo, are required to receive a 1099-K if they meet specific thresholds. For tax year 2022, the threshold was set at $600 in total payments. Review your payment history from these sources to determine if you will receive a 1099-K.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1099-K if your gross payments are below the reporting threshold or if you are not engaged in a trade or business. Additionally, certain payments that are classified as personal transactions do not require filing of this form. Always consult with a tax professional to determine your obligations.

Components of the form

The IRS 1099-K contains several sections, including the payer's name, address, and Taxpayer Identification Number (TIN), as well as similar details from the recipient. The form also lists the total payment amounts for each month in the reporting year. Understanding these components is essential for completing the form accurately.

Due date

The due date for the IRS 1099-K form is typically January 31st of the year following the tax year being reported. If the due date falls on a weekend or holiday, it may be due on the next business day. Timely filing helps avoid penalties and ensures compliance with IRS regulations.

What payments and purchases are reported?

Payments reported on the IRS 1099-K include transactions made via credit and debit cards, as well as payments received through payment networks. The form captures the total gross amount received from all these transactions. Understanding what constitutes reportable income is crucial for accurate tax reporting.

How many copies of the form should I complete?

You must complete multiple copies of the IRS 1099-K when filing. Typically, three copies are necessary: one for the IRS, one for the state tax authority (if applicable), and one for the recipient of the payments. Verify your state’s requirements to ensure compliance with local regulations.

What are the penalties for not issuing the form?

Failing to issue or file the IRS 1099-K can lead to significant penalties. The IRS imposes fines that can vary based on how late the form is filed, with potential charges for each form that is incorrectly filed. It's essential to ensure that all requirements are met to avoid these financial consequences.

What information do you need when you file the form?

When filing the IRS 1099-K, you will generally need the following information: payer's and recipient's names, addresses, TINs, and the total amount of payments made. Organizing this data prior to starting the form helps streamline the filing process, minimizing potential errors.

Is the form accompanied by other forms?

IRS 1099-K may need to be accompanied by other tax forms, depending on the circumstances. For example, if you report payments to a business, you might also need to submit a Form 1096, which is an annual summary form. Check IRS guidelines to determine which forms are necessary for your situation.

Where do I send the form?

The destination for sending the IRS 1099-K form varies based on the state in which the recipient is located. Generally, forms are sent to the appropriate IRS processing center, which can be determined by consulting the IRS website. Ensure that you send the form to the correct address to avoid delays in processing.

See what our users say