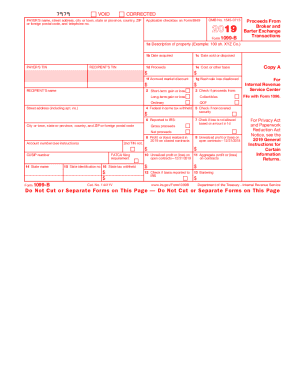

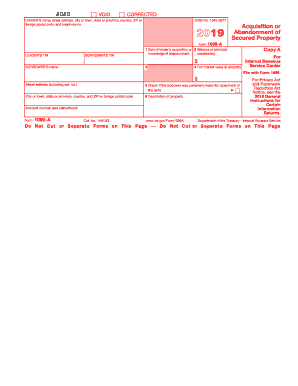

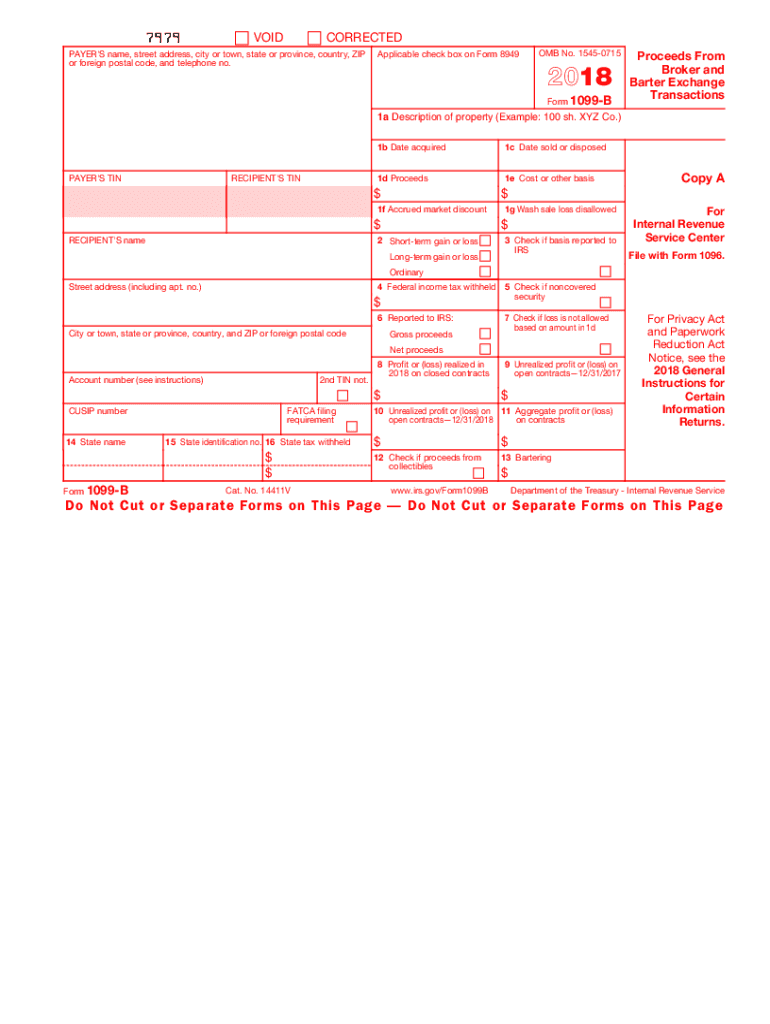

IRS 1099-B 2018 free printable template

Instructions and Help about IRS 1099-B

How to edit IRS 1099-B

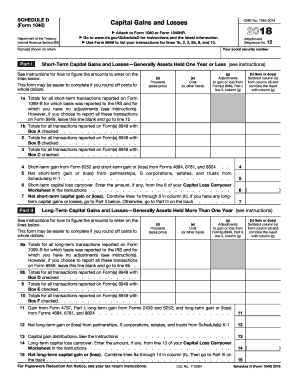

How to fill out IRS 1099-B

About IRS 1099-B 2018 previous version

What is IRS 1099-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-B

What should I do if I realize I made a mistake on my IRS 1099-B after submitting it?

If you discover an error after filing your IRS 1099-B, you need to submit a corrected form. This is typically done by filing a new 1099-B with the correct information and marking it as 'corrected.' Additionally, ensure that you notify recipients of the update, as they may need the corrected information for their tax filings.

How can I verify that my IRS 1099-B has been received and processed by the IRS?

To confirm receipt of your IRS 1099-B, you can use the IRS's online tool or wait for your records from the IRS. If you e-filed, you should receive an acknowledgment indicating whether the submission was accepted or rejected. Common e-file rejection codes can help you troubleshoot any issues that may arise during the submission process.

What are some common errors that filers make with the IRS 1099-B, and how can they be avoided?

Filers often make mistakes like incorrect taxpayer identification numbers or failing to report all transactions. To avoid these errors, double-check that all information matches official records and review filing guidelines thoroughly. Additionally, using reliable software for e-filing can help minimize errors by guiding you through each step of the process.

Are there any special considerations for nonresidents when filing the IRS 1099-B?

Nonresidents must be aware of specific requirements when filing the IRS 1099-B, particularly regarding withholding taxes and the need for a taxpayer identification number. It's essential for nonresidents to consult tax guidelines related to their specific situation to ensure compliance and handle any withholding implications correctly.

What should I understand about the privacy and data security of information on my IRS 1099-B?

When handling your IRS 1099-B, it's critical to maintain strict data security practices. Ensure that you store the form securely and avoid sharing it without proper protections in place. The IRS also recommends using encryption for electronic submissions and being cautious about where you enter sensitive information to prevent identity theft.

See what our users say