IRS 1065 - Schedule K-1 2017 free printable template

Show details

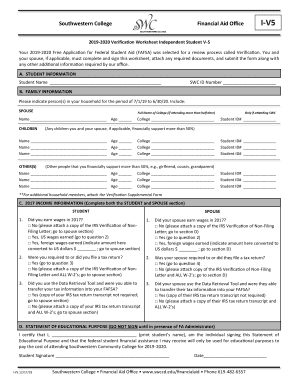

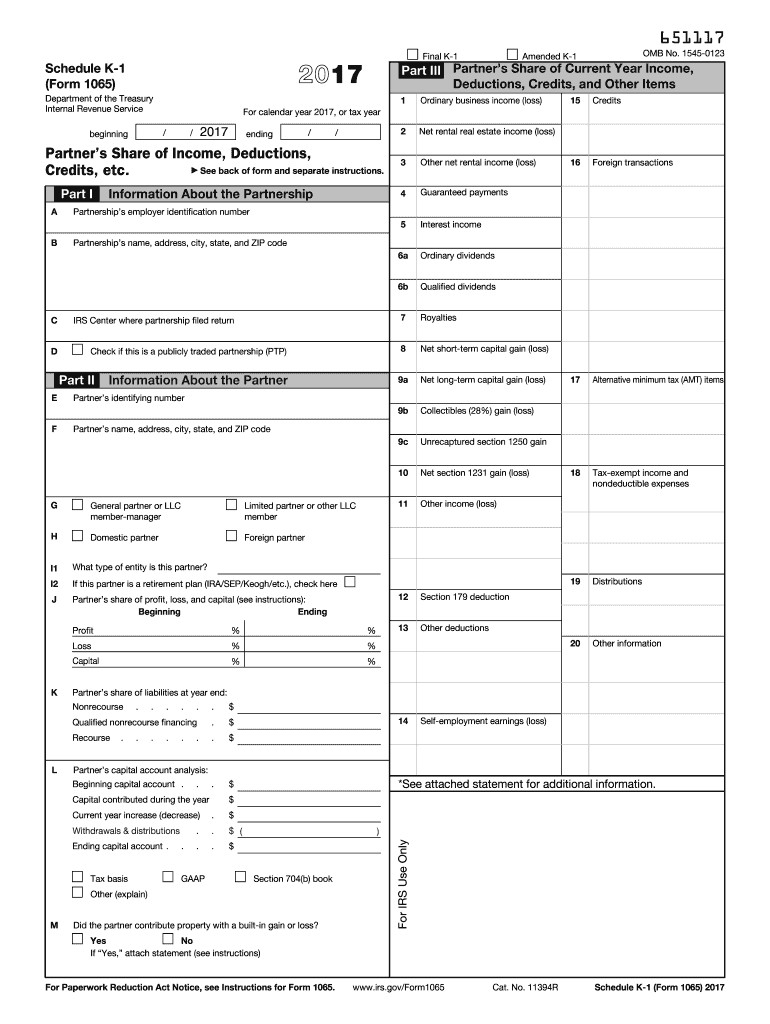

Www.irs.gov/Form1065 Cat. No. 11394R Page This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information see the separate Partner s Instructions for Schedule K-1 and the instructions for your income tax return. passive or nonpassive and enter on your return as follows. 651117 Final K-1 Schedule K-1 Form 1065 Department of the Treasury Internal Revenue Service Part...III Partner s Share of Current Year Income Deductions Credits and Other Items Other net rental income loss Guaranteed payments Interest income Ordinary dividends 6b B 6a A Net rental real estate income loss / ending Qualified dividends Alternative minimum tax AMT items Tax-exempt income and nondeductible expenses Distributions Other information Collectibles 28 gain loss Unrecaptured section 1250 gain Net section 1231 gain loss Other income loss Section 179 deduction Information About the Partner...Net long-term capital gain loss Check if this is a publicly traded partnership PTP Net short-term capital gain loss 9a IRS Center where partnership filed return Royalties F Foreign transactions Partnership s name address city state and ZIP code Part II E 9c D Credits 9b C Partner s Share of Income Deductions See back of form and separate instructions. 535 E Cancellation of debt 12. Section 179 deduction 13. Other deductions A Cash contributions 50 C Noncash contributions 50 E Capital gain...property to a 50 Instructions organization 30 G Contributions 100 H Investment interest expense Form 4952 line 1 I Deductions royalty income J Section 59 e 2 expenditures K Deductions portfolio 2 floor M Amounts paid for medical insurance Schedule A line 1 or Form 1040 line 29 N Educational assistance benefits O Dependent care benefits Form 2441 line 12 P Preproductive period expenses Q Commercial revitalization deduction See Form 8582 instructions from rental real estate activities R Pensions...and IRAs S Reforestation expense deduction T Domestic production activities information See Form 8903 instructions U Qualified production activities income Form 8903 line 7b V Employer s Form W-2 wages Form 8903 line 17 14. Tax basis GAAP Section 704 b book Other explain M Self-employment earnings loss Did the partner contribute property with a built-in gain or loss For IRS Use Only K Yes No If Yes attach statement see instructions For Paperwork Reduction Act Notice see Instructions for Form...1065. Self-employment earnings loss Note If you have a section 179 deduction or any partner-level deductions see the Partner s Instructions before completing Schedule SE. A Net earnings loss from Schedule SE Section A or B B Gross farming or fishing income C Gross non-farm income A Low-income housing credit section 42 j 5 from pre-2008 buildings other from pre-2008 buildings post-2007 buildings other from post-2007 E Qualified rehabilitation expenditures rental real estate F Other rental real...estate credits H Undistributed capital gains credit I Biofuel producer credit J Work opportunity credit K Disabled access credit L Empowerment zone employment credit M Credit for increasing research activities N Credit for employer social security and Medicare taxes O Backup withholding P Other credits A Name of country or U.S. possession B Gross income from all sources Form 1116 Part I C Gross income sourced at partner level Foreign gross income sourced at partnership level D Passive category E...General category F Other Deductions allocated and apportioned at partner level G Interest expense income L Total foreign taxes paid N Reduction in taxes available for credit Form 1116 line 12 Form 8873 O Foreign trading gross receipts P Extraterritorial income exclusion Q Other foreign transactions A Post-1986 depreciation adjustment B Adjusted gain or loss C Depletion other than oil gas D Oil gas geothermal gross income Form 6251 F Other AMT items A Tax-exempt interest income B Other tax-exempt...income A Cash and marketable securities C Other property A Investment income B Investment expenses Form 4136 C Fuel tax credit information other than rental real estate E Basis of energy property F Recapture of low-income housing Form 8611 line 8 credit section 42 j 5 credit other H Recapture of investment credit See Form 4255 I Recapture of other credits J Look-back interest completed long-term contracts See Form 8697 method L Dispositions of property with M Recapture of section 179 deduction...partners O Section 453 l 3 information P Section 453A c information Q Section 1260 b information R Interest allocable to production S CCF nonqualified withdrawals T Depletion information oil and gas U Reserved V Unrelated business taxable income W Precontribution gain loss X Section 108 i information Y Net investment income.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

To edit IRS 1065 - Schedule K-1, you can use pdfFiller's tools to make modifications easily. Open the form in pdfFiller, and use the editing features to update any necessary information. This may include correcting names, addresses, or other key details. Ensure that all changes comply with IRS regulations before finalizing the document.

How to fill out IRS 1065 - Schedule K-1

Filling out IRS 1065 - Schedule K-1 requires careful attention to detail. Start by gathering all necessary information about the entity and the partner. This includes the business name, tax identification number, and partner details. You will then input financial information, including income, deductions, and credits allocated to the partner. Verify all entries for accuracy before submission.

About IRS 1065 - Schedule K-1 2017 previous version

What is IRS 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065 - Schedule K-1 2017 previous version

What is IRS 1065 - Schedule K-1?

IRS 1065 - Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships. It serves as a informational return for each partner to report their share of the partnership's income on their individual tax returns. This form is essential for maintaining compliance with tax obligations as it ensures accurate income reporting.

What is the purpose of this form?

The primary purpose of IRS 1065 - Schedule K-1 is to provide each partner with a detailed account of their share of the partnership's financial activity. This includes the distribution of profits and losses, which partners must report on their individual tax returns. It helps clarify the tax responsibilities of each partner in the partnership structure.

Who needs the form?

IRS 1065 - Schedule K-1 must be issued to every partner in a partnership. This includes direct partners who receive a share of the income and any partners who may be investing in the business but do not participate in day-to-day operations. Additionally, anyone who is treated as a partner for tax purposes must receive a K-1.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1065 - Schedule K-1 if your partnership is a single-member LLC or if the partnership does not have any income, deductions, or credits to report for the year. Additionally, if a partner is a non-resident alien, specific rules may apply to their reporting requirements.

Components of the form

IRS 1065 - Schedule K-1 contains several crucial components, including the partner's share of income, deductions, credits, and specific allocations. Key fields include the partner’s name, address, tax identification number, and the total amount of income or loss allocated for the tax year. Detailed reporting allows partners to complete their individual tax returns with accuracy.

What are the penalties for not issuing the form?

Failure to issue IRS 1065 - Schedule K-1 can result in penalties for the partnership. The IRS may impose a fine for each K-1 that is not issued on time, which can add up significantly depending on the number of partners involved. Additionally, partners may face issues when filing their personal tax returns without this form.

What information do you need when you file the form?

To file IRS 1065 - Schedule K-1 accurately, you need the partnership's financial information, including income statements, records of deductions, and any credits attributable to each partner. It's important to have the correct tax identification numbers and personal information of each partner to ensure compliance with IRS requirements.

Is the form accompanied by other forms?

IRS 1065 - Schedule K-1 is typically submitted alongside Form 1065, the partnership income tax return. Additionally, if specific deductions or credits are claimed, relevant supporting documents must accompany the filings to substantiate the information reported in the K-1.

Where do I send the form?

IRS 1065 - Schedule K-1 should be filed with the IRS along with Form 1065. For partnerships with an office outside the United States, the forms may need to be submitted to specific locations based on the instructions provided by the IRS. Ensure that each partner receives their respective K-1 for inclusion with their personal tax returns.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Just started using. Seems pretty easy to navigate.

Just subscribed but my first form was excellently done. Intuitive and easy to negotiate the Dashboard. I really liked the alignment lines that assist to keep things neat when typing data into the field. Look forward to learning more about the capabilities. Thanks

See what our users say