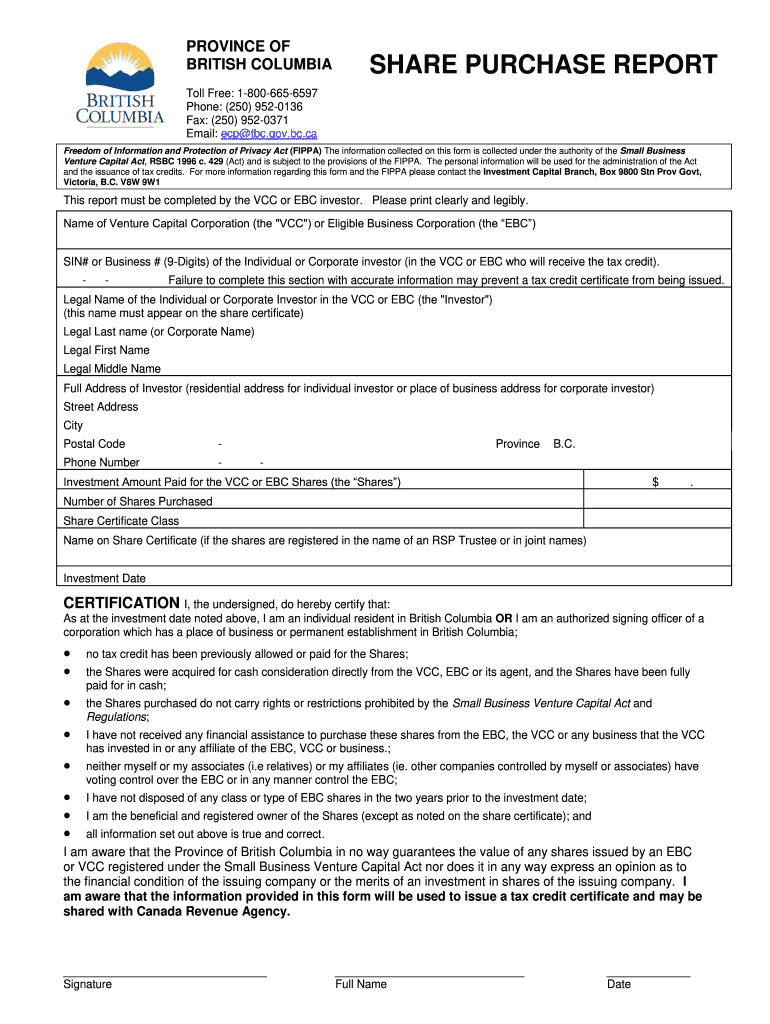

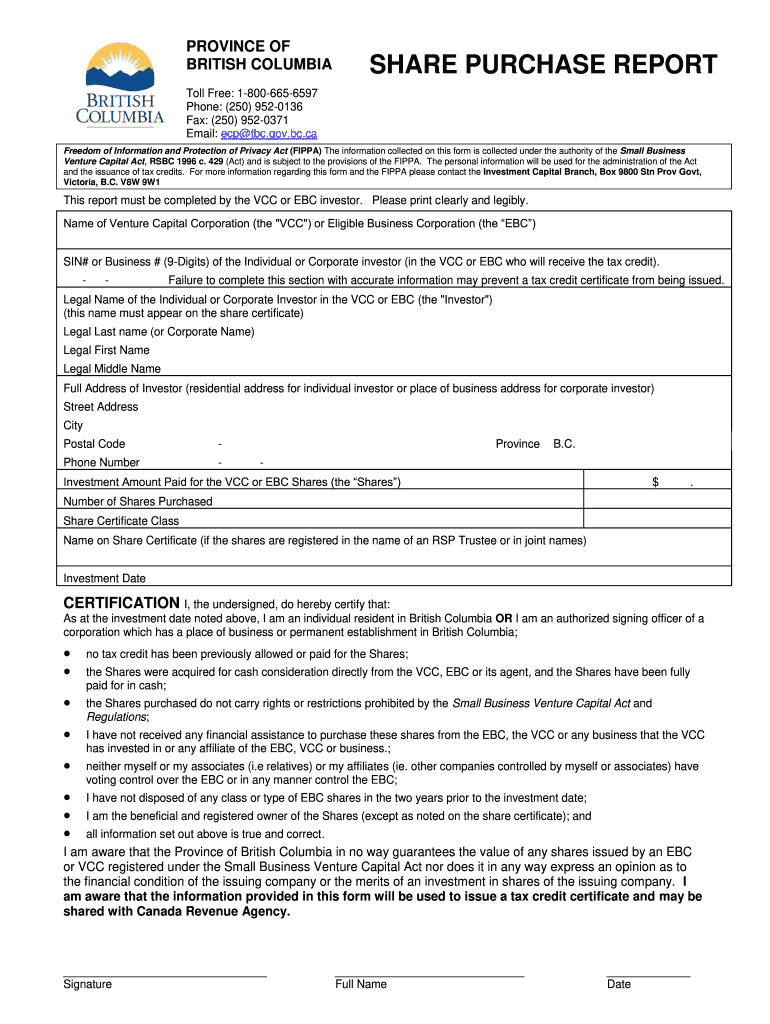

Canada Share Purchase Report free printable template

Get, Create, Make and Sign share purchase report form

How to edit share purchase report form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out share purchase report form

How to fill out Canada Share Purchase Report

Who needs Canada Share Purchase Report?

Video instructions and help with filling out and completing share purchase report

Instructions and Help about share purchase report form

Hi my name is Ken Wallace Roy and welcome to this video how to figure out if a stock is worth buying or in other words how to determine if a stock is undervalued everyone says to buy low and sell high now stock prices go up and down all the time and in this example you can see why it's important to buy low you'd want to buy the stock at around 14 as opposed to closer to 51 and in this video I'm going to show you exactly how to know when a stock is priced low and when it's priced high, but first we need to quickly go over three definitions so a share or a stock represents ownership of a company so if you were to buy even a single share in a company you would be part owner of that company and as an owner of the company you're entitled to share in the profits of the company and those profits are paid out as dividends so for example if a company is paying out a dividend of 100 per share, and you own a thousand shares you will receive 1000 every year for as long as you own those shares and as long as the company continues to pay a dividend of 1 per share and that money goes directly into your trading account you can spend it as you wish, or you can reinvest if it's all up to you the dividend yield is simply the dividend divided by the share price so in this example we'll take the same dividend of 1 per share and let's assume the share price today is 20 a share the dividend yield is going to be 5, so the 5 percent represents here is the return on your investment while you're holding on to those shares so let's say you have 5000 to invest so 5 of that is 250 dollars in dividends each year for as long as you own the shares and as long as the company continues to pay a divot another way to look at it is if you have the same 5000 to invest at 20 a share you're going to be able to buy 250 shares and again the dividend is 1 per share, and you end up with 250 dollars in dividends each year, so the 5 dividend yield is a very quick way to figure out okay what's the return on my investment while holding on to these shares now what happens if the share price starts to drop so let's say we go from 20 a share to 15 a share or let's say we go even further down to 10 a share or if the share price drops to 5, so you can see that as the share price continues to go down the dividend yield continues to go up so again let's go back to our example of 5000 to invest so if you were to buy these shares at 20 each return on investment would be 5 which is the 250 in dividends that we looked at before however if you waited till the shares dropped to 5 the same five thousand invested now would earn you 20 which would mean 1000 in dividends each year for as long as you own the shares in this company and as long as the company continues to pay dividends, so you can see that as the share price drops you're going to earn more in dividends, so it pays to buy low so let's just go over this very quickly so as we've seen as the share price goes down the dividend yield goes up and the...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in share purchase report form?

How do I fill out share purchase report form using my mobile device?

Can I edit share purchase report form on an Android device?

What is Canada Share Purchase Report?

Who is required to file Canada Share Purchase Report?

How to fill out Canada Share Purchase Report?

What is the purpose of Canada Share Purchase Report?

What information must be reported on Canada Share Purchase Report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.