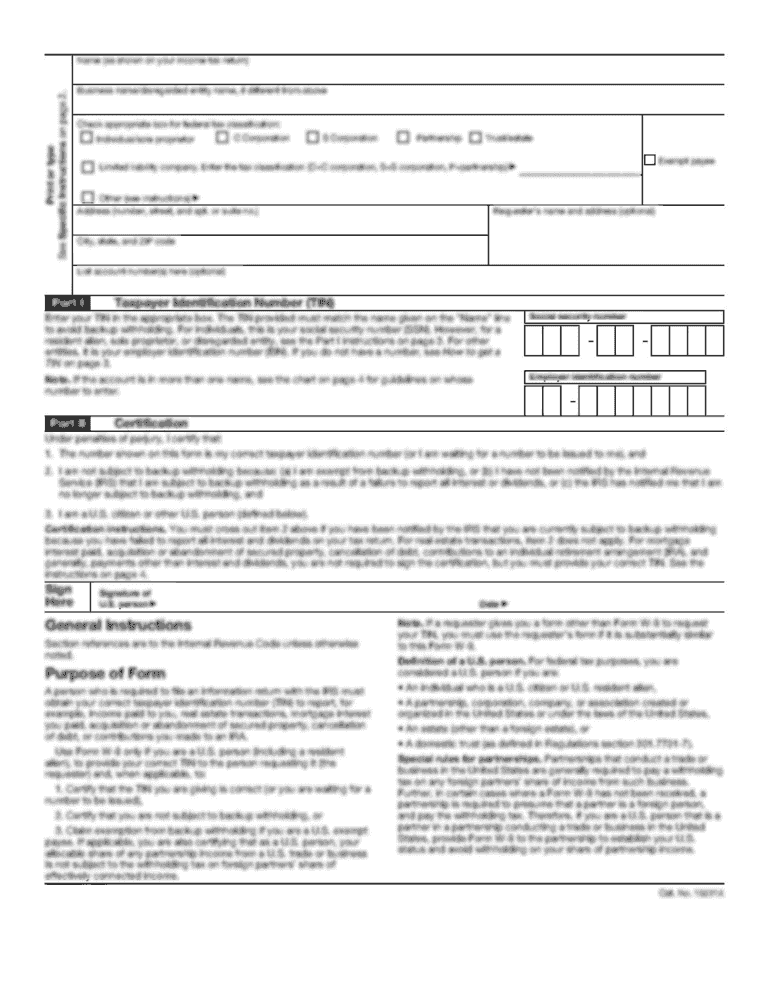

IRS Publication 936 2016 free printable template

Show details

Publication 936ContentsHome

Mortgage

Interest

DeductionFuture Developments. . . . . . . . . . . . 1Cat. No. 10426G

Department

of the

Treasury

Internal

Revenue

ServiceNow use in preparing2016 ReturnsReminder.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 936

Edit your IRS Publication 936 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 936 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Publication 936 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS Publication 936. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 936 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Publication 936

How to fill out IRS Publication 936

01

Obtain IRS Publication 936 from the IRS website or through your tax preparation software.

02

Read the introduction to understand the purpose of the publication and the types of people it applies to.

03

Gather necessary documents, including your mortgage interest statement and the amount of any refinanced mortgage received.

04

Complete the worksheet in Part I to determine if you qualify for the home mortgage interest deduction.

05

Follow the instructions in Part II to determine how much home mortgage interest you can deduct based on your mortgage balance.

06

Review any exceptions mentioned that may apply to your specific situation.

07

Transfer the calculated deduction onto your tax return as instructed.

Who needs IRS Publication 936?

01

Homeowners who have taken out a mortgage to purchase, build, or improve their home.

02

Taxpayers who are looking to deduct home mortgage interest on their tax returns.

03

Individuals who have refinanced their home mortgage and need to determine the interest deduction.

04

Anyone interested in understanding the limits on mortgage interest deductions as stated by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Are mortgage insurance premiums still deductible?

The mortgage insurance premium deduction is available through tax year 2020. Starting in 2021 the deduction will not be available unless extended by Congress.

When did mortgage insurance premium deduction expire?

The Consolidated Appropriations Act in 2021 extended the mortgage insurance deduction for the 2021 tax year, but that's the last year you can take this deduction. 7 It has expired for the 2022 tax year, which is the return you file in 2023.

Can I deduct mortgage insurance premiums in 2019?

Mortgage insurance premiums. You can claim the deduction on line 8d of Schedule A (Form 1040 or 1040-SR) for amounts that were paid or accrued in 2019.

How to calculate mortgage interest deduction over $750 000?

Divide the maximum debt limit by your remaining mortgage balance, then multiply that result by the interest paid to figure out your deduction. Let's consider an example: Your mortgage is $1 million, and since the deduction limit is $750,000, you'll divide $750,000 by $1 million to get 0.75.

Is the mortgage interest 100% tax deductible?

Is all mortgage interest deductible? Not all mortgage interest can be subtracted from your taxable income. Only the interest you pay on your primary residence or second home can be deducted if the loans were used to purchase, build or improve your property, or used for a business-related investment.

Are mortgage insurance premiums no longer deductible?

The mortgage insurance premium deduction was a temporary part of the tax code beginning in 2006. This deduction is expired, so you cannot use it on your 2022 tax return. In previous years, you could claim the deduction if you itemized your taxes and had an income below the maximum phase-out threshold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS Publication 936 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IRS Publication 936, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in IRS Publication 936?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IRS Publication 936 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit IRS Publication 936 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IRS Publication 936.

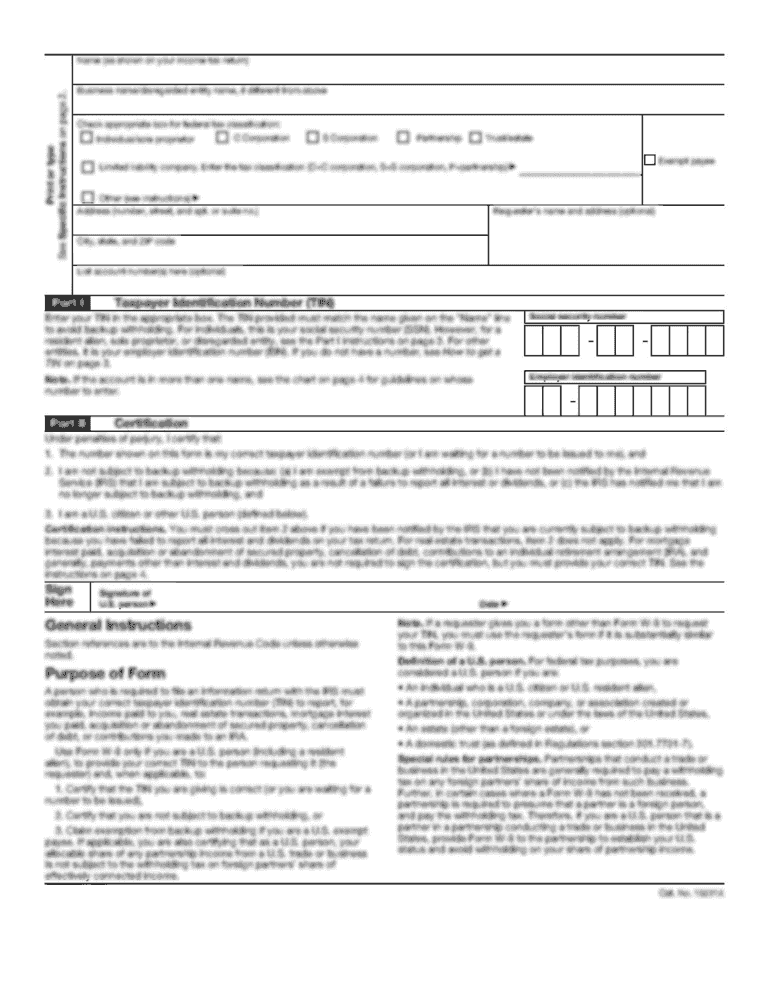

What is IRS Publication 936?

IRS Publication 936 provides guidance on the rules and calculations associated with the mortgage interest deduction, including information on how to determine the amount of home mortgage interest that qualifies for deduction.

Who is required to file IRS Publication 936?

Taxpayers who itemize their deductions and are claiming a deduction for home mortgage interest on their federal tax return are required to refer to IRS Publication 936.

How to fill out IRS Publication 936?

To fill out IRS Publication 936, taxpayers should gather their mortgage interest statements (Form 1098), determine the total interest paid, and follow the step-by-step instructions provided in the publication to calculate the deductible amount.

What is the purpose of IRS Publication 936?

The purpose of IRS Publication 936 is to educate taxpayers on how to properly claim the mortgage interest deduction, ensure compliance with tax regulations, and provide detailed examples and worksheets for accurate calculations.

What information must be reported on IRS Publication 936?

Information that must be reported includes the amount of mortgage interest paid during the tax year, details about the mortgage(s) including the principal balance, and any other relevant loan information necessary to determine eligibility for the deduction.

Fill out your IRS Publication 936 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 936 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.