Get the free Arizona Form 140PY Part-Year Resident Personal Income Tax Return

Show details

? Arizona Form 140PY Part-Year Resident Personal Income Tax Return ONE STAPLE. NO TAPE. OR FISCAL YEAR BEGINNING m Check box 82F if filing 82F Your First Name and Middle Initial m d d Y Y Y Y AND

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 140py part-year

How to edit arizona form 140py part-year

How to fill out arizona form 140py part-year

Instructions and Help about arizona form 140py part-year

How to edit arizona form 140py part-year

To edit Arizona Form 140PY, utilize a tool like pdfFiller that allows users to make annotations, fill in required fields, and adjust the content as necessary for accurate submission. Begin by uploading the form into the platform, then proceed to enter or modify the information as needed. Ensure all edits are saved properly before proceeding to the next steps of filing.

How to fill out arizona form 140py part-year

Filling out Arizona Form 140PY requires specific steps to ensure accuracy and compliance. First, gather your income statements and any relevant financial documents from the tax year in question. Next, follow these steps:

01

Enter your personal information such as name, address, and Social Security Number.

02

Report your total income, detailing any income earned while a resident of Arizona.

03

Complete the tax calculation sections, taking care to apply any applicable credits or deductions.

04

Review the form for accuracy and completeness before submission.

Latest updates to arizona form 140py part-year

Latest updates to arizona form 140py part-year

Keep an eye on the Arizona Department of Revenue's website for any recent updates regarding Form 140PY. Changes in tax law or filing procedures could impact your filing needs, so verifying the latest version of the form and any accompanying instructions is crucial for compliance.

All You Need to Know About arizona form 140py part-year

What is arizona form 140py part-year?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 140py part-year

What is arizona form 140py part-year?

Arizona Form 140PY is a tax return specifically designed for individuals who are part-year residents of Arizona. This form enables part-year residents to accurately report their income earned in the state as well as claim appropriate deductions and credits for the period they resided in Arizona.

What is the purpose of this form?

The primary purpose of Arizona Form 140PY is to facilitate a clear and accurate reporting of income for individuals who only lived in Arizona for part of the tax year. It allows these taxpayers to determine their tax responsibilities based on the income they earned during their residency in the state.

Who needs the form?

Individuals who moved into or out of Arizona during the tax year must file this form if they earned income while they were Arizona residents. This includes people who relocated for employment, education, or other personal reasons. Understanding whether you're classified as a full-time or part-time resident is essential for determining your filing obligations.

When am I exempt from filling out this form?

You are exempt from completing Arizona Form 140PY if you did not earn any income during your time as a part-year resident, or if your total income falls below the minimum filing threshold for the year as established by the Arizona Department of Revenue. Always check current guidelines to confirm your eligibility for exemption.

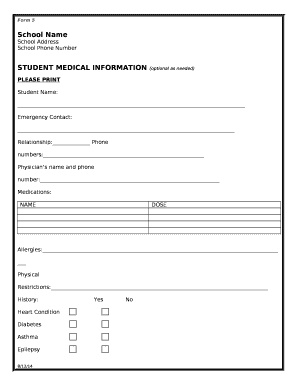

Components of the form

Arizona Form 140PY consists of several key components, including sections for personal information, income reporting, tax calculation, and credits or deductions. Each section aims to capture specific details related to your situation as a part-year resident, ensuring accurate tax assessments. Incomplete or inaccurate information could lead to delays or penalties.

What are the penalties for not issuing the form?

Failure to file Arizona Form 140PY, when required, can result in penalties and interest on any unpaid tax due. The Arizona Department of Revenue may impose a fine based on the amount of tax owed, alongside additional interest for each month the tax remains unpaid. It is essential to file on time to avoid these repercussions.

What information do you need when you file the form?

When filing Arizona Form 140PY, you will need personal identification information, income details for the entire year and specifically for the months you resided in Arizona, as well as documentation of any deductions or credits you plan to claim. Having all relevant documentation prepared beforehand streamlines the filing process and reduces errors.

Is the form accompanied by other forms?

Arizona Form 140PY may need to be accompanied by additional forms, such as schedules detailing specific types of income or credit claims. Review the instructions for Form 140PY carefully to ascertain which additional forms are applicable based on your individual tax situation.

Where do I send the form?

Completed Arizona Form 140PY should be mailed to the Arizona Department of Revenue. The exact mailing address can be found in the instructions accompanying the form, which may vary based on whether you are enclosing a payment or not. Ensure that you send the form to the appropriate address to avoid processing delays.

See what our users say