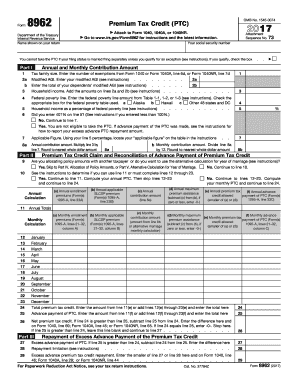

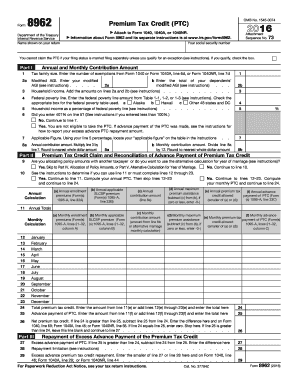

IRS Instructions 8962 2016 free printable template

Show details

For more information on how to report a change in State Marketplace website. Oct 12 2016 Health Coverage Tax Credit HCTC. The HCTC is a tax credit that pays a percentage of health insurance premiums for certain eligible taxpayers and their qualifying family members. The HCTC and the PTC are different tax credits that have different eligibility rules. If you think you may be eligible for the HCTC see Form 8885 and its instructions or visit www.irs.gov/ HCTC before completing Form 8962. Then...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 8962

Edit your IRS Instructions 8962 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 8962 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 8962 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 8962. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 8962 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 8962

How to fill out IRS Instructions 8962

01

Obtain IRS Form 8962 and instructions from the IRS website.

02

Collect necessary information, including your Form 1095-A, health coverage information, and income details.

03

Complete Part I of Form 8962 by entering the policy information from Form 1095-A, including the premiums paid and months covered.

04

Fill out Part II to calculate your premium tax credit by entering your household income and the federal poverty line information.

05

Complete Part III if you have any additional information regarding the premium tax credit, such as changes in coverage or tax years.

06

Review all entries for accuracy, ensuring that the total premium tax credit calculation matches your expectations.

07

Attach Form 8962 to your Form 1040 or 1040-SR tax return when filing.

Who needs IRS Instructions 8962?

01

Individuals who purchased health insurance through the Health Insurance Marketplace and are claiming the Premium Tax Credit.

02

Taxpayers who received a Form 1095-A, which reports details of their health coverage.

03

Those who had a change in their health coverage or financial circumstances that affects their premium tax credit.

04

Anyone filing taxes who needs to reconcile advance payments of the premium tax credit.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 6251 for 2016?

Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT). The AMT is a separate tax that is imposed in addition to your regular tax. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

What happens if you don't file your ITR Philippines?

If you fail to file and pay your tax due, the Tax Code will impose a 25% penalty on you. This penalty also applies if you fail to file your ITR with the wrong RDO. If you deliberately failed to file your tax returns and if you falsified your tax returns, you will be penalized a surcharge of 50%.

Who are required to file income tax return in the Philippines?

Citizens or foreigners residing in the Philippines and receiving income inside or outside the country must file an ITR. Companies usually file their employees' ITRs, while freelancers and business owners do it themselves. In 2021, there were about 26.8 million individual 26.8 million individual taxpayers.

How much is the penalty for late filing of ITR Philippines?

Penalties TAX CODE SECNATURE OF VIOLATIONCRIMINAL PENALTY IMPOSED255Failure to file and/or pay any internal revenue tax at the time or times required by law or regulationFine of not less than P10,000 and imprisonment of not less than one (1) year but not more than 10 years10 more rows

How do I file my income tax return in the Philippines?

Fill-up the BIR Form No. 1701 in triplicate copies. Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701, together with the required attachments.

Can I file my own tax return in Philippines?

In the Philippines, individuals and businesses must submit their tax returns by April 15 of each year. Remember, there are different ways to get this done. You can file electronically or manually, depending on the nature of your business.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS Instructions 8962 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like IRS Instructions 8962, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit IRS Instructions 8962 online?

The editing procedure is simple with pdfFiller. Open your IRS Instructions 8962 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the IRS Instructions 8962 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS Instructions 8962 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is IRS Instructions 8962?

IRS Instructions 8962 provide guidance on how to complete Form 8962, which is used to calculate the Premium Tax Credit for individuals who have purchased health insurance through the Health Insurance Marketplace.

Who is required to file IRS Instructions 8962?

Taxpayers who received premium tax credits for health insurance purchased through the Health Insurance Marketplace must file Form 8962 with their tax return.

How to fill out IRS Instructions 8962?

To fill out IRS Instructions 8962, follow the step-by-step guidelines provided in the instructions, including entering household information, determining the applicable percentage for the Premium Tax Credit, and reporting household income.

What is the purpose of IRS Instructions 8962?

The purpose of IRS Instructions 8962 is to help taxpayers correctly calculate and claim the Premium Tax Credit, which subsidizes the cost of health insurance obtained through the Health Insurance Marketplace.

What information must be reported on IRS Instructions 8962?

Information required on IRS Instructions 8962 includes the taxpayer's household size, annual income, the amount of premium tax credit received, and any additional tax amounts owed or adjustments.

Fill out your IRS Instructions 8962 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 8962 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.