WI PR-230 2017 free printable template

Show details

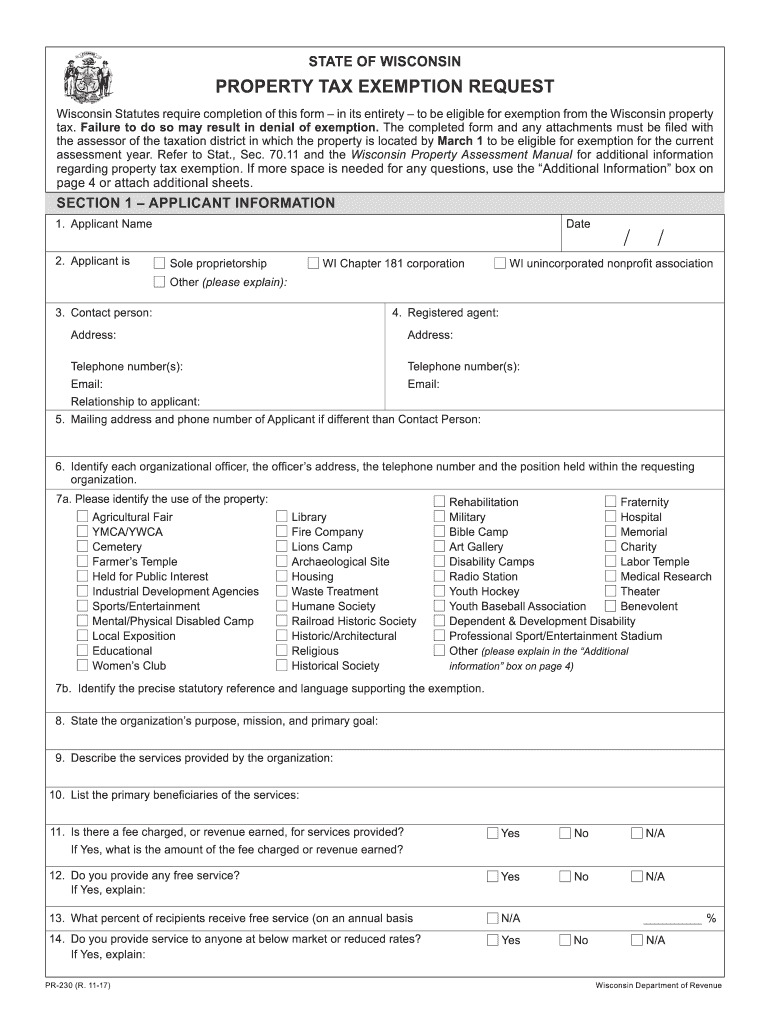

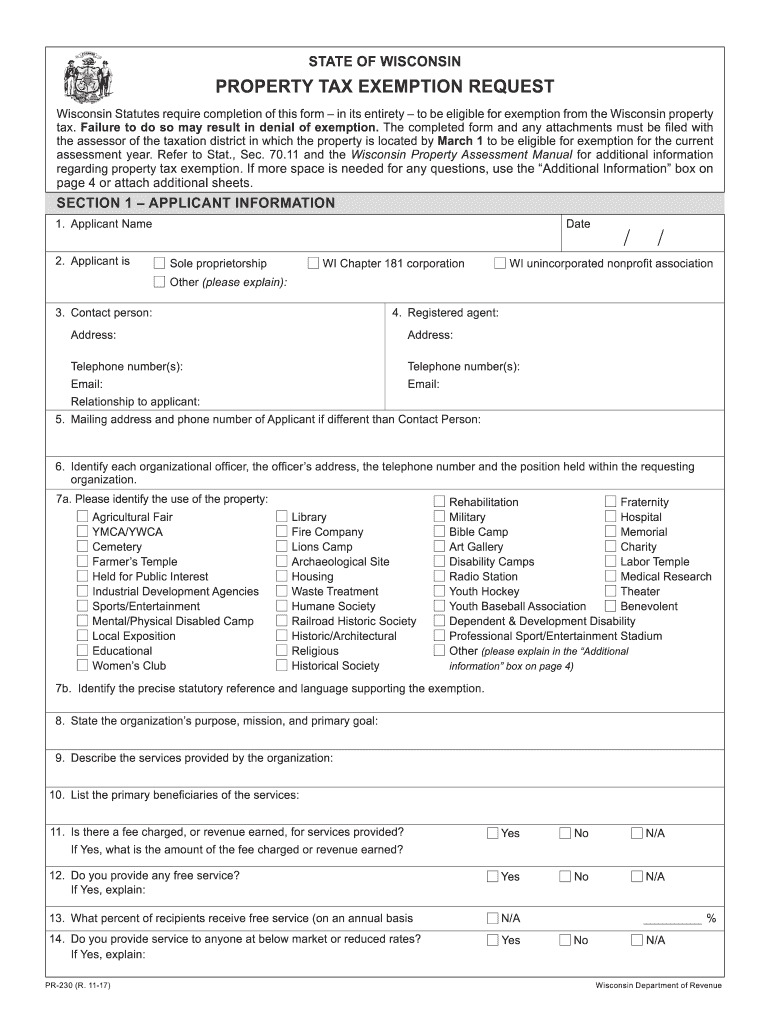

STATE OF WISCONSINPROPERTY TAX EXEMPTION REQUEST Wisconsin Statutes require completion of this form in its entirety to be eligible for exemption from the Wisconsin property tax. Failure to do so may

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI PR-230

Edit your WI PR-230 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI PR-230 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI PR-230 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI PR-230. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI PR-230 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI PR-230

How to fill out WI PR-230

01

Start by downloading the WI PR-230 form from the official Wisconsin Department of Revenue website.

02

Fill in the taxpayer's name and address in the designated fields.

03

Provide the Social Security Number or Federal Employer Identification Number as required.

04

Enter the tax year for which the form is being submitted.

05

Follow the instructions to complete the relevant sections, including any necessary schedules or additional forms.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate Wisconsin Department of Revenue office, either by mail or electronically if applicable.

Who needs WI PR-230?

01

Any individual or business that needs to report specific information related to property tax credits or related matters in Wisconsin.

02

Taxpayers seeking to claim a credit or exemption on their property taxes.

03

Those who have received property tax relief and need to report that information.

Fill

form

: Try Risk Free

People Also Ask about

How do I file for property tax exemption in Wisconsin?

To apply for an exemption, you must complete a Wisconsin Department of Revenue application form, which may be obtained from the local assessor. The form must be filed for any property that was taxed in the previous year but, because of a change in the use, occupancy, or ownership, may now qualify for exemption.

What qualifies as a farm for tax purposes in Wisconsin?

Wisconsin defines agricultural land as “land which is devoted primarily to agriculture use” as per Sec. Tax 18, Wis. Adm. Code.

How do I qualify for farm tax exemption in Wisconsin?

Production of the following items qualifies as an agricultural operation: Livestock: Hogs, cattle, sheep, and horses. Dairy. Poultry: A combined total of 20 or more chickens, geese, turkeys or ducks. Fruit: A combined total of 20 or more fruit trees, grapevines, and nut trees.

What is the agricultural property tax exemption in Wisconsin?

The farmland tax relief credit is also a refundable credit that is provided through the state income tax system. The credit reimbursement rate for net property taxes levied on agricultural land only is established annually by the Department of Revenue (DOR). The maximum allowable credit is $1,500.

At what age do you stop paying property taxes in Wisconsin?

At least one owner of the property must be at least 65 years of age.

Who qualifies for property tax exemption California?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI PR-230 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing WI PR-230, you need to install and log in to the app.

How do I fill out the WI PR-230 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign WI PR-230. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out WI PR-230 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your WI PR-230 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is WI PR-230?

WI PR-230 is a form used in Wisconsin to report and remit sales and use taxes collected by businesses.

Who is required to file WI PR-230?

Any business or individual in Wisconsin who collects sales and use taxes from customers is required to file WI PR-230.

How to fill out WI PR-230?

To fill out WI PR-230, businesses need to provide their identification information, report total sales, calculate the tax collected, and provide payment for the amount due.

What is the purpose of WI PR-230?

The purpose of WI PR-230 is to ensure that businesses accurately report the sales and use taxes they have collected and remit those taxes to the state.

What information must be reported on WI PR-230?

WI PR-230 requires businesses to report total sales, amount of tax collected, any adjustments or exemptions, and their identification information.

Fill out your WI PR-230 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI PR-230 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.