OR 250-R09 2015-2026 free printable template

Show details

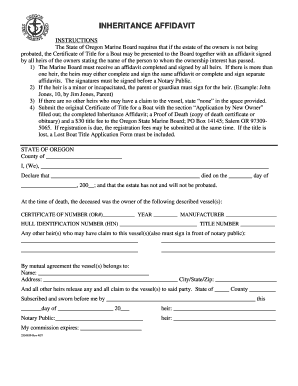

Example John Jones age 10 by Jim Jones Parent 3 If there are no other heirs who may have a claim to the vessel state none in the space provided. 4 Submit the original Certificate of Title for a Boat with the section Application by New Owner filled out the completed Inheritance Affidavit a Proof of Death copy of death certificate or obituary and a 50 title fee to the Oregon State Marine Board PO Box 14145 Salem OR 973095065. If registration is due the registration fees may be submitted at the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign download the form

Edit your oregon inheritance board form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dmv inheritance affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon inheritance affidavit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit inheritance affidavit oregon dmv form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR 250-R09 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR 250-R09

How to fill out OR 250-R09

01

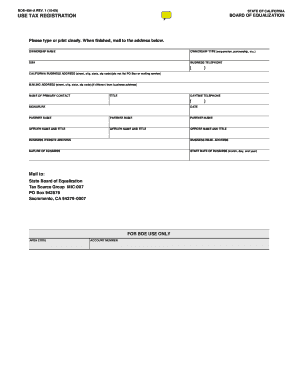

Obtain the OR 250-R09 form from the relevant tax authority's website or office.

02

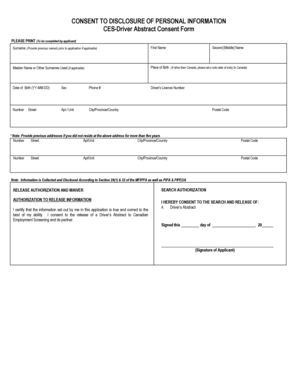

Fill out your personal information, including your name, address, and tax identification number.

03

Provide details about your income for the specified tax year, including wages, business earnings, and any other sources of income.

04

Complete sections related to deductions and credits that you are eligible for, ensuring that you have the necessary documentation.

05

Review all entries for accuracy and completeness before submission.

06

Sign and date the form to certify that the information provided is correct to the best of your knowledge.

07

Submit the completed form either electronically or by mail, following the specific instructions provided.

Who needs OR 250-R09?

01

Individuals who have earned income and need to report it for tax purposes.

02

Business owners and self-employed individuals who must declare their income and claim any applicable deductions.

03

Taxpayers seeking to apply for tax credits or refunds related to their income tax.

04

Anyone participating in tax-filing obligations mandated by the government for the relevant tax year.

Fill

form

: Try Risk Free

People Also Ask about

How much does probate cost in Oregon?

Simple probates may cost around $2,000, but an average is closer to $3,000 - $5,000 (and up).

How do I file a small estate in Oregon?

Step 1 – Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death. Step 2 – No Personal Representative. Step 3 – Complete Forms. Step 4 – File With Court. Step 5 – Send to Estate Recipients.

How much does it cost to file a small estate affidavit in Oregon?

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

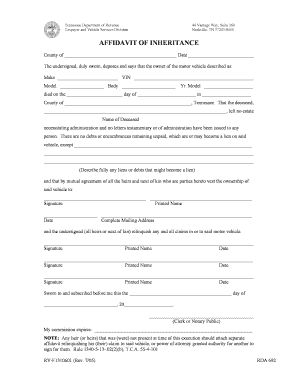

How to transfer a car title when owner is deceased in Oregon?

If all owners deceased If the estate of the person who died last is not being probated, DMV can accept an Inheritance Affidavit, or a Small Estate Certification, Form 6797. For the other owner(s) who did not die last, DMV requires proof of death.

Who can file a small estate affidavit in Oregon?

An affidavit of claiming successor can be filed by an heir or devisee of the decedent, or by a creditor of the estate. Forms are available here. When you file a Small Estate Affidavit, you are swearing that the information in the affidavit is true.

How long does a small estate affidavit take in Oregon?

Probate is the Court Administered transfer of the property of someone who has passed away. Typically, it takes 5-9 months to probate an estate. For small estates the process is typically quicker but still takes at least 4 months.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OR 250-R09 to be eSigned by others?

Once you are ready to share your OR 250-R09, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the OR 250-R09 in Gmail?

Create your eSignature using pdfFiller and then eSign your OR 250-R09 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete OR 250-R09 on an Android device?

Complete your OR 250-R09 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is OR 250-R09?

OR 250-R09 is a specific form used for reporting certain information related to tax obligations in the state of Oregon.

Who is required to file OR 250-R09?

Individuals or entities who have tax obligations in the state of Oregon and meet the criteria specified by the Oregon Department of Revenue are required to file OR 250-R09.

How to fill out OR 250-R09?

To fill out OR 250-R09, obtain the form from the Oregon Department of Revenue's website, complete all required fields including personal and financial information, and ensure to follow the instructions provided.

What is the purpose of OR 250-R09?

The purpose of OR 250-R09 is to report income, deductions, and other relevant financial information for tax purposes to ensure compliance with Oregon tax laws.

What information must be reported on OR 250-R09?

Information required on OR 250-R09 includes taxpayer identification details, earnings, deductions, credits claimed, and any other relevant financial data as stipulated by the Oregon Department of Revenue.

Fill out your OR 250-R09 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR 250-r09 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.