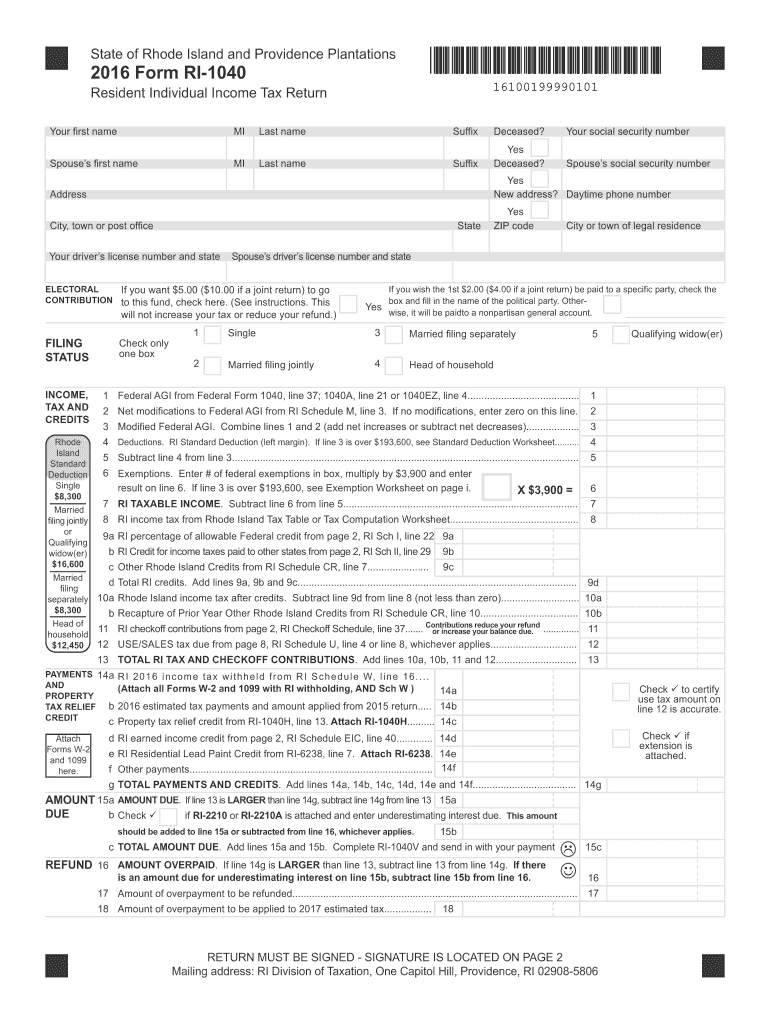

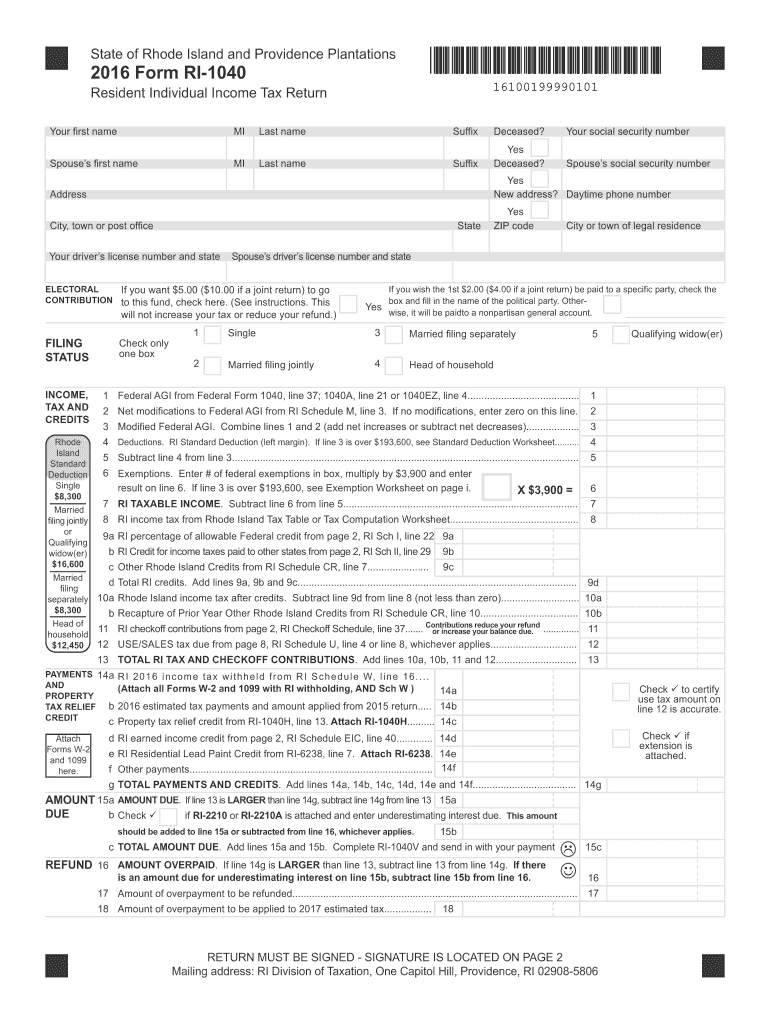

RI DoT RI-1040 2016 free printable template

Get, Create, Make and Sign ri 1040 2015 2016

How to edit ri 1040 2015 2016 online

Uncompromising security for your PDF editing and eSignature needs

RI DoT RI-1040 Form Versions

How to fill out ri 1040 2015 2016

How to fill out RI DoT RI-1040

Who needs RI DoT RI-1040?

Instructions and Help about ri 1040 2015 2016

Law.com legal forms guide for mar 1 1040 resident individual income tax return Rhode Island residents use a form R 1 1040 to document and file their state income tax owed the form is found on the website of the Rhode Island division of taxation step 1 and to your name and social security number as well as that of your spouse if filing jointly and to your address and a daytime telephone number step 2 if you wish to make an electoral contribution indicate this with a check mark step 3 indicate where the check mark whether you are filing as a single individual married filing jointly or separately as head of household or as a qualifying widow or widower step 4 enter your federal adjusted gross income online one modification should be computed on a separate schedule m and entered online to some of these two lines is entered on line three steps 5 enter your standard deduction as tied to your filing status and indicated in the chart on the left on line four subtract this from line three and enter the difference on line five federal exemptions should be multiplied by 35 hundred dollars and the resulting product entered on line 6 then subtracted from line five to determine your taxable income online seven step 6 consult a Rhode Island tax table or tax computation worksheet to determine your income tax on line 82 complete line 9 you must complete schedules one and two on the next page as well as the separately provided Schedule C are the total tax credits on line 9 d are subtracted from line eight to determine your income tax owed after credits on line 10 step 7 complete the check off schedule on the second page to complete line 11 step 8 follow instructions to complete lines 12 through 15 to determine your amount owed if you are owed a refund complete line 16 through 18 sign and date the bottom of the second page to watch more videos please make sure to visit laws calm

People Also Ask about

What is the standard deduction for RI?

What is RI state tax withholding?

How much is payroll tax in Rhode Island?

How much taxes do they take out in Rhode Island?

What percentage of taxes is taken out in RI?

What percent of my paycheck is taken out in taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ri 1040 2015 2016 directly from Gmail?

How can I get ri 1040 2015 2016?

Can I sign the ri 1040 2015 2016 electronically in Chrome?

What is RI DoT RI-1040?

Who is required to file RI DoT RI-1040?

How to fill out RI DoT RI-1040?

What is the purpose of RI DoT RI-1040?

What information must be reported on RI DoT RI-1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.