MI DoT 3372 2000 free printable template

Show details

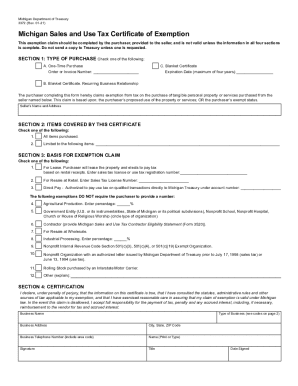

Michigan Department of Treasury, SAW 3372 (5-00) MICHIGAN SALES AND USE TAX CERTIFICATE OF EXEMPTION This certificate is invalid unless all four sections are completed by the purchaser. Section 1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 3372

Edit your MI DoT 3372 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 3372 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 3372 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI DoT 3372. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 3372 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 3372

How to fill out 3372

01

Gather all necessary personal information, including your full name, address, and Social Security number.

02

Obtain the appropriate version of Form 3372 from the official source.

03

Complete the identification section at the top of the form.

04

Provide details regarding the specific purpose for filling out Form 3372.

05

Fill in any required financial information if applicable.

06

Review all sections to ensure accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form according to the guidelines provided, whether by mail or electronically.

Who needs 3372?

01

Individuals applying for a specific government benefit or assistance program that requires Form 3372.

02

People seeking to update their personal information with a government agency.

03

Anyone who has been instructed by a government official or program to complete Form 3372.

Fill

form

: Try Risk Free

People Also Ask about

What is the exemption on a tax form?

Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax. Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does.

What is the IRS form for sales tax exemption?

You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZPDF to determine if you are eligible to file this form.

What is a Texas sales tax exemption certificate?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

What is the income threshold for Texas franchise tax?

Reports and Payments For franchise tax reports originally due…The no tax due threshold is…on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,000on or after Jan. 1, 2016, and before Jan. 1, 2018$1,110,0005 more rows

How do I become a tax exempt business in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Who is not subject to Texas franchise tax?

Entities Not Subject to Franchise Tax sole proprietorships (except for single member LLCs); general partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships);

How do I fill out a federal tax exemption?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How many exemptions should I claim?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Is it better to claim 0 or exempt?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MI DoT 3372 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including MI DoT 3372, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit MI DoT 3372 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MI DoT 3372 right away.

Can I edit MI DoT 3372 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MI DoT 3372 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is 3372?

Form 3372 is a tax form used by businesses and individuals to report certain financial information to the IRS.

Who is required to file 3372?

Businesses and individuals who meet specific income thresholds or who engage in certain types of transactions may be required to file Form 3372.

How to fill out 3372?

To fill out Form 3372, gather the necessary financial documents, complete the required sections accurately, and ensure all information is in compliance with IRS regulations.

What is the purpose of 3372?

The purpose of Form 3372 is to provide the IRS with a comprehensive account of the taxpayer's financial activities for accurate reporting and taxation.

What information must be reported on 3372?

Form 3372 requires reporting of income, expenses, deductions, and other relevant financial data as prescribed by the IRS.

Fill out your MI DoT 3372 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 3372 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.