NY DTF IT-201-D 2017-2025 free printable template

Show details

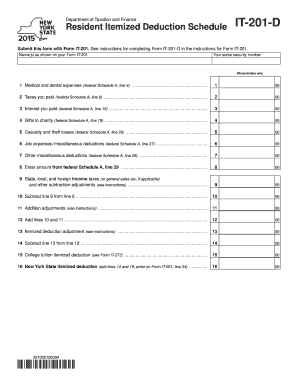

Department of Taxation and Finance Resident Itemized Deduction Schedule IT-201-D Submit this form with Form IT-201. See instructions for completing Form IT-201-D in the instructions for Form IT-201. Name s as shown on your Form IT-201 Your social security number Whole dollars only 1 Medical and dental expenses federal Schedule A line 4. 2 Taxes you paid federal Schedule A line 9. 3 Interest you paid federal Schedule A line 15. 4 Gifts to charity federal Schedule A line 19. 5 Casualty and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 201 resident deduction form

Edit your it 201 deduction printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nys resident deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new york it 201 deduction online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit d resident form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-201-D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out schedule 201 form

How to fill out NY DTF IT-201-D

01

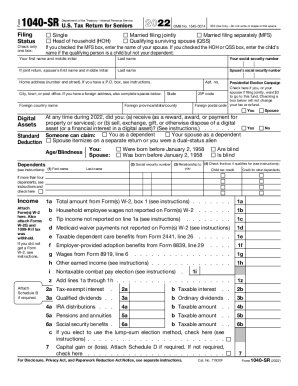

Gather all necessary tax documents, including W-2s and 1099s.

02

Obtain a copy of the NY DTF IT-201-D form from the New York State Department of Taxation and Finance website.

03

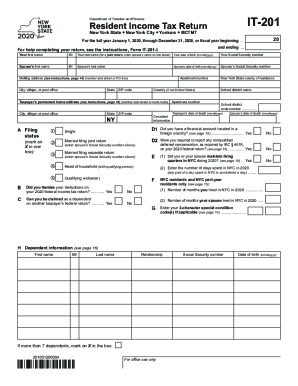

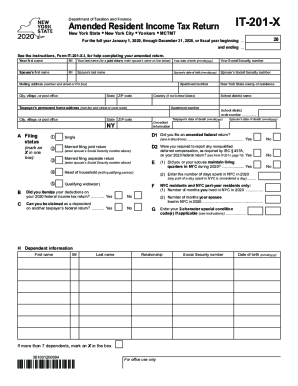

Start by filling out your personal information at the top of the form, including your name, address, and Social Security number.

04

Fill in your filing status based on your circumstances (single, married, etc.).

05

Report your total New York adjusted gross income, making sure to include all sources of income.

06

Claim deductions for any eligible expenses, ensuring you follow the specific guidelines provided for each deduction.

07

Calculate your New York State tax liability using the provided tax tables or formulas.

08

If applicable, fill out any additional schedules or forms that pertain to your situation.

09

Review your completed form for accuracy and completeness.

10

Submit the form either electronically or by mail to the appropriate address by the deadline.

Who needs NY DTF IT-201-D?

01

Individuals who are residents of New York State and need to file their annual income tax return.

02

Taxpayers who have non-resident or part-year resident income that requires filing a New York tax return.

03

Anyone looking to claim a refund due to overpayment of taxes in the previous year.

Video instructions and help with filling out and completing ny it 201

Instructions and Help about form 201d

Fill

deductions deductible form

: Try Risk Free

People Also Ask about taxation itemized 201

How do I claim 1 on my w4?

Should I claim 1 or 0 on my W-4 Form? You can no longer claim allowances like 1 or 0 on your W-4 since the IRS redesigned the form. However, you can claim an exemption from withholding if you owed no income tax last year and don't expect to owe anything in the current year.

Should I claim 1 or 2?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do you figure out your deductions?

Subtract the dependent tax credit total from the computed annual tax. Divide the amount of tax by the number of pay periods per year to arrive at the amount of Federal tax withholding to be deducted per pay period.

Does claiming 1 or 0 give you more money?

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

Is it okay to claim 0?

What is this? If you claimed zero allowances on your pre-2023 W-4, the maximum amount of taxes was withheld from each of your paychecks. As a result, you'd likely get a big tax refund from the IRS at the end of the season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in it 201 d form 2017?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your deducted deductions deductible to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in deducted premiums without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your medical tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the schedule tax electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your nys 201 d form and you'll be done in minutes.

What is NY DTF IT-201-D?

NY DTF IT-201-D is a form used by taxpayers in New York State to claim a refund of any overpayment of personal income taxes, specifically for the state's tax return.

Who is required to file NY DTF IT-201-D?

Taxpayers who have overpaid their New York State personal income tax and wish to receive a refund must file NY DTF IT-201-D.

How to fill out NY DTF IT-201-D?

To fill out NY DTF IT-201-D, begin by entering your personal information, including your name, address, and Social Security number. Then, indicate the tax year, report the amounts that were overpaid, and provide any necessary documentation to support your claim.

What is the purpose of NY DTF IT-201-D?

The purpose of NY DTF IT-201-D is to provide a mechanism for taxpayers to request the refund of any overpaid income taxes to the New York State Department of Taxation and Finance.

What information must be reported on NY DTF IT-201-D?

The information that must be reported on NY DTF IT-201-D includes the taxpayer's identifying information, the tax year for which the refund is requested, and details about any overpayment of taxes, including amounts and calculations that justify the refund request.

Fill out your NY DTF IT-201-D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deductible Deduct is not the form you're looking for?Search for another form here.

Keywords relevant to 201 d form

Related to amounts insurance

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.