Get the free ecu w2

Show details

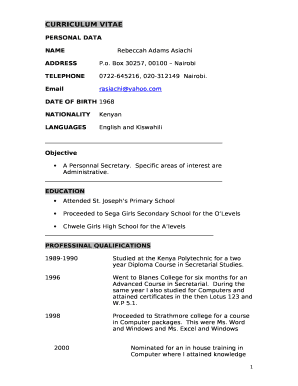

W-2 Form Reissue Request ALL INFORMATION MUST BE COMPLETED LEGIBLY BEFORE A W-2 CAN BE REISSUED. The Payroll Department will process 2014 W2s reissue requests weekly beginning on 9 February 2014.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ecu w2 form

Edit your ecu w2 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ecu w2 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ecu w2 form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ecu w2 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ecu w2 form

How to Fill Out ECU W2:

01

Start by gathering all necessary information: Before you begin filling out the ECU W2 form, make sure you have all the required information handy. This includes your personal details such as your full name, address, and Social Security number, as well as your employer's information and earnings for the year.

02

Review the instructions: Take a moment to carefully review the instructions provided with the ECU W2 form. These instructions will guide you through each section of the form and provide any specific requirements or additional information you may need to know.

03

Complete the employee information section: Begin by entering your personal information as requested on the form. This typically includes your full name, address, and Social Security number. Double-check that you have entered this information accurately before moving on to the next step.

04

Provide employer details: In the next section of the form, you will need to provide your employer's information. This includes their name, address, and Employer Identification Number (EIN). You can usually find this information on your paystub or any tax-related documents your employer has provided.

05

Report your earnings: The main purpose of the ECU W2 form is to report your earnings and any applicable taxes withheld by your employer. You will need to accurately report your wages, tips, and other compensation for the year in the appropriate boxes. Additionally, you should report any federal, state, or local income tax, Medicare, or Social Security taxes that were withheld from your paycheck.

06

Verify and double-check: Once you have completed all the necessary sections of the ECU W2 form, take a moment to review and verify that all the information you have provided is correct. Make sure there are no spelling errors, missing digits, or other mistakes that could potentially cause issues with your tax filing.

07

Keep a copy for your records: Before submitting your ECU W2 form to the appropriate tax agency, make a copy for your own records. This will serve as a reference in case you need it in the future or in case there are any discrepancies.

Who needs ECU W2?

01

Employees: Any individual who has been employed by East Carolina University (ECU) or any other employer who is required by law to file a W2 form, needs an ECU W2. This includes both full-time and part-time employees.

02

Contractors: Certain independent contractors who have been paid by ECU may also be required to receive a W2 form. This depends on the nature of their work and the classification of their employment status.

03

Students: Student employees who have received wages or compensation for work performed for ECU should also receive an ECU W2. This is applicable even if their wages are exempt from Social Security or Medicare taxes due to their student status.

04

Alumni and former employees: Even if you are no longer employed by ECU, you may still require an ECU W2 if you have received wages or compensation during the tax year for which the W2 form is issued. This is important for accurate reporting and filing of your taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ecu w2?

ECU W-2 refers to the wage and tax statement form issued by East Carolina University to employees for income earned in a calendar year.

Who is required to file ecu w2?

All employees of East Carolina University who received wages during the calendar year are required to file an ECU W-2 form.

How to fill out ecu w2?

Employees can fill out their ECU W-2 form by providing accurate information about their wages, taxes withheld, and other relevant details.

What is the purpose of ecu w2?

The purpose of the ECU W-2 form is to report the wages paid to an employee and the taxes withheld by East Carolina University during the calendar year.

What information must be reported on ecu w2?

The ECU W-2 form must report the employee's wages, federal and state tax withholdings, Social Security and Medicare withholdings, and other relevant information.

How can I send ecu w2 form to be eSigned by others?

ecu w2 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in ecu w2 form?

The editing procedure is simple with pdfFiller. Open your ecu w2 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the ecu w2 form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ecu w2 form.

Fill out your ecu w2 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ecu w2 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.