IRS Instructions 940 2017 free printable template

Get, Create, Make and Sign IRS Instructions 940

Editing IRS Instructions 940 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 940 Form Versions

How to fill out IRS Instructions 940

How to fill out IRS Instructions 940

Who needs IRS Instructions 940?

Instructions and Help about IRS Instructions 940

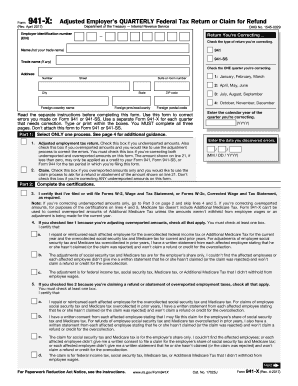

Welcome back to another video for harbor financial online com today I'm going to be talking about the 940 form instructions I'm going to show you guys if you need to fill out this form and how to powerful so the 940 it's used to report your annual federal unemployment tax known as funded the purpose of the few attacks is to provide funds for paying unemployment compensation to workers that have lost their jobs employers pay few detects and don't deduct this tax from their employees wages you have to file the 940 form if in a calendar year you paid wages of 1500 or more so if you're under this 1500 threshold you don't have to file the form 940 at our site Harbor financial and lime com you can use an online calculator to estimate what your taxes are going to be and this is a great free tool that we offer at our site that you may want to check out after the video now the rules for the 940 are different based on your situation and the number of employees you may have some of these special situations can include household employees in a private home employee at a local college fraternity or sorority cash wages paid to farmworkers Indian tribal governments tax-exempt organizations in employment employers of state and local government employees those are the special situations where that 940 rules are a little different even though form 940 covers a calendar year you may have to deposit your Feud attacks before you file your tax return so keep that in mind you're going to have to file this form I guess what I want to touch on here is you're going to have to deposit at least one quarterly payment if you're few to taxes more than 500 for the year, so you have to make at least a deposit in one quarter if you're a few to tax is more than 500 for the year make sure you pay your text when it's due and file the completed 940 with accuracy and make sure it's set in on time there are penalties and interest, so it's very important that this is sent in and postmarked on the right date funded puts a 6.2 tax on the employer for the first seven thousand of gross earnings of each worker per year, so it's a 6.2 tax percent tax once the 7,000 amounts is reached then the employer no longer pays any federal unemployment tax for that worker so once you get up to the 7,000 then you do not have to pay any more on that employer on that employee remember that the only thing the employer pays is the federal unemployment taxes, and it is not paid by the employee or taken out of their check the employer is paying this amount the employee does not pay any of it funded is separate from federal income tax Social Security and Medicare taxes, so this is a separate tax it really has nothing to do with those on our site Harbor financial online you can view the form 940 I'm going to take you to the 940 right now, and then I'll show you the site as well, so they bring that up for us this is the 940 you can do this form completely online electronic, so that's how I'm going to recommend...

People Also Ask about

What information do you need for a form 940?

What is the 940 FUTA rate?

How do I fill out a 940 form?

What was the FUTA credit reduction for 2017?

What is the FUTA rate for 2017?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 940 to be eSigned by others?

Can I edit IRS Instructions 940 on an iOS device?

How do I fill out IRS Instructions 940 on an Android device?

What is IRS Instructions 940?

Who is required to file IRS Instructions 940?

How to fill out IRS Instructions 940?

What is the purpose of IRS Instructions 940?

What information must be reported on IRS Instructions 940?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.