IRS 886-L 2014-2025 free printable template

Show details

Form886L(Rev. December 2014)Department of the TreasuryInternal Revenue ServiceSupporting DocumentsName of Taxpayer Identification Number Release provide a photocopy of the document or documents requested

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign internal revenue service documents

Edit your internal revenue service documents form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service documents form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internal revenue service documents online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit internal revenue service documents. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue service documents

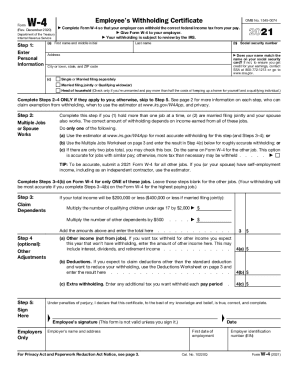

How to fill out IRS 886-L

01

Obtain Form IRS 886-L from the IRS website or your local IRS office.

02

Provide your name, address, and taxpayer identification number at the top of the form.

03

Indicate the type of relief you are requesting by checking the appropriate box.

04

Fill out the sections detailing the reason for the relief, including any relevant explanations or circumstances.

05

Attach any required documents or evidence that support your claim.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate IRS office as indicated in the instructions.

Who needs IRS 886-L?

01

Taxpayers who have received a notice from the IRS regarding tax relief for a specific issue.

02

Individuals seeking relief from penalties under certain IRS programs.

03

Taxpayers who qualify for a specific tax relief program that requires the use of Form 886-L.

Fill

form

: Try Risk Free

People Also Ask about

What form does the IRS require?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What documents does the IRS need?

Supporting documents include sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. These documents contain the information you need to record in your books. It is important to keep these documents because they support the entries in your books and on your tax return.

How do I submit documents to the IRS?

Send Your Document You may use your existing email account to send your encrypted documents to your assigned IRS employee at the email address they gave you. If you're uncomfortable emailing your documents, you can send them to your assigned IRS employee with eFax, established secure messaging systems or mail.

What is the document that you fill out to complete your tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What do I need to do to prove my identity to the IRS?

Before calling the IRS, people should know what info they'll need to verify their identity Social Security numbers and birth dates for those who were included on the tax return. An Individual Taxpayer Identification Number letter if the taxpayer has an ITIN instead of an SSN.

What form do we use to complete a tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How do I fill out IRS forms online?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer. Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.” Get Registered. Select Your 1040. Fill Out Your Tax Forms. E-File Your Tax Form. CREATE AN ACCOUNT. Complete Your Account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send internal revenue service documents for eSignature?

Once your internal revenue service documents is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out internal revenue service documents on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your internal revenue service documents. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete internal revenue service documents on an Android device?

Use the pdfFiller app for Android to finish your internal revenue service documents. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is IRS 886-L?

IRS 886-L is a form used by the Internal Revenue Service to document the acceptance of a tax return for a specific tax year, often issued in cases of tax adjustments or when an individual has applied for a tax refund.

Who is required to file IRS 886-L?

Taxpayers who have received notification from the IRS regarding the acceptance of their return or are inquiring about adjustments related to their tax filing may be required to file IRS 886-L.

How to fill out IRS 886-L?

To fill out IRS 886-L, taxpayers should carefully follow the instructions provided on the form, entering required personal information, tax details, and any other information as prompted, ensuring accuracy and completeness before submitting.

What is the purpose of IRS 886-L?

The purpose of IRS 886-L is to provide documentation regarding tax return acceptance and to facilitate communication between the IRS and taxpayers regarding their tax liabilities or refunds.

What information must be reported on IRS 886-L?

IRS 886-L requires the taxpayer to report personal identification information, tax year in question, details of the tax return being discussed, and any adjustments or explanations related to the tax filing.

Fill out your internal revenue service documents online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service Documents is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.