Get the free MISSISSIPPI LOAN ORIGINATOR LICENSE - NMLS Resource Center - mortgage nationwidelice...

Show details

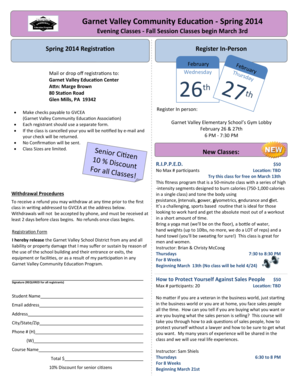

New Application Checklist MS JurisdictionSpecific Requirements MISSISSIPPI LOAN ORIGINATOR LICENSE Instructions 1. Total cost of the license request is $231.00 including the NLS processing fee. A

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mississippi loan originator license

Edit your mississippi loan originator license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mississippi loan originator license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mississippi loan originator license online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mississippi loan originator license. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mississippi loan originator license

How to fill out Mississippi loan originator license:

01

First, gather all necessary documents and information. This may include your personal identification, employment history, education background, and any other relevant information.

02

Next, complete the Mississippi loan originator license application form. Ensure that you provide accurate and up-to-date information in all sections of the form.

03

Be prepared to pay the required application fee. The fee amount and payment method can typically be found on the licensing authority's website or in the application form instructions.

04

As part of the application process, you may need to undergo a criminal background check. Follow the instructions provided to complete this step, which may involve fingerprinting and submitting the necessary forms.

05

If applicable, complete any required pre-licensing education courses or training. These courses are designed to provide you with the necessary knowledge and skills to be a loan originator in Mississippi.

06

Submit your completed application form, along with any supporting documents and the required fee, to the appropriate licensing authority. Be sure to double-check that you have included all required materials before submitting your application.

07

Allow sufficient time for your application to be processed. This may vary depending on the licensing authority's workload and the completeness of your application. During this time, you may be contacted for additional information or documentation.

08

Once your application is approved, you will receive your Mississippi loan originator license. Ensure that you keep this license in a safe and accessible place, as you may be required to present it in various professional settings.

Who needs Mississippi loan originator license:

01

Individuals who intend to work as loan originators in Mississippi need to obtain a loan originator license.

02

This includes individuals who will be involved in the origination or processing of mortgage loans, and who will be interacting with borrowers, lenders, and other parties in the loan process.

03

The requirement for a loan originator license applies to both residential and commercial loan originators in Mississippi.

04

Whether you work for a mortgage company, a bank, or as an independent contractor, if your role includes loan origination activities, you will likely need to obtain this license.

05

It is essential to check with the Mississippi licensing authority or regulatory agency to determine the specific requirements and qualifications for obtaining a loan originator license in the state.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mississippi loan originator license online?

With pdfFiller, you may easily complete and sign mississippi loan originator license online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit mississippi loan originator license on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mississippi loan originator license on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out mississippi loan originator license on an Android device?

Use the pdfFiller mobile app and complete your mississippi loan originator license and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is mississippi loan originator license?

Mississippi loan originator license is a state license required for individuals who work in the mortgage industry and originate mortgage loans.

Who is required to file mississippi loan originator license?

Individuals who work as loan originators in Mississippi are required to file for a loan originator license.

How to fill out mississippi loan originator license?

To fill out Mississippi loan originator license, individuals need to complete an application, provide supporting documentation, and pay the required fees.

What is the purpose of mississippi loan originator license?

The purpose of Mississippi loan originator license is to ensure that loan originators meet the necessary qualifications and standards to protect consumers in the mortgage lending process.

What information must be reported on mississippi loan originator license?

The information that must be reported on Mississippi loan originator license includes personal information, employment history, education, and any criminal history.

Fill out your mississippi loan originator license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mississippi Loan Originator License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.