Get the free Personal Finance Statement - Region 9 Economic Development ... - scan

Show details

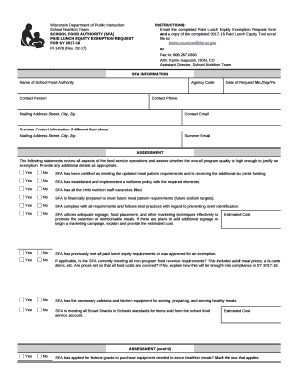

PERSONAL FINANCIAL STATEMENT Region 9 Economic Development District of Southwest Colorado, Inc. As of, 20 U.S. SMALL BUSINESS ADMINISTRATION Complete this form for: (1) each proprietor, or (2) each

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal finance statement

Edit your personal finance statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal finance statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal finance statement online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit personal finance statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal finance statement

How to fill out a personal finance statement:

01

Gather all necessary financial documents: Start by gathering all your financial documents such as bank statements, credit card statements, investment statements, and loan statements. These documents will help you accurately track and record your financial information.

02

Record your assets: Begin the personal finance statement by listing your assets. This includes any valuable possessions you own such as property, vehicles, investments, and savings accounts. Be sure to include the current market value of each asset.

03

List your liabilities: Next, list all your liabilities or debts. This includes any outstanding loans, credit card balances, mortgages, or other forms of debt. It is crucial to include the current outstanding balance of each liability.

04

Calculate your net worth: Subtract your total liabilities from your total assets to determine your net worth. This will give you a clear picture of your overall financial health and where you stand in terms of wealth accumulation.

05

Analyze and categorize your income: After calculating your net worth, focus on your income. Categorize your sources of income such as salary, rental income, dividends, or any other forms of earnings. Record each source separately and specify the amount received from each.

06

Track your expenses: It is vital to track every expense you incur. Categorize your expenses into fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment). Record the amount spent on each expense category.

07

Calculate your cash flow: Subtract your total expenses from your total income to calculate your cash flow. Positive cash flow indicates that you have more income than expenses, while negative cash flow indicates the opposite. This analysis will help you evaluate your financial situation and identify areas where you can make adjustments if needed.

Who needs a personal finance statement?

01

Individuals looking to track their financial progress: A personal finance statement is essential for anyone who wants to monitor their financial progress. It provides a detailed overview of their assets, liabilities, and overall net worth.

02

Individuals planning for their financial future: Creating a personal finance statement helps individuals plan for their financial future. It allows them to identify areas of improvement, set financial goals, and establish a budget to achieve those goals.

03

Individuals seeking financial advice or assistance: Financial advisors often require a personal finance statement to assess a client's financial situation and provide appropriate guidance. It helps them understand the client's financial goals, analyze their current net worth, and develop strategies for wealth management.

In summary, filling out a personal finance statement requires gathering and organizing your financial documents, recording your assets and liabilities, calculating your net worth, tracking your income and expenses, and analyzing your cash flow. Anyone looking to monitor their financial progress, plan for the future, or seek financial advice can benefit from having a personal finance statement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal finance statement?

Personal finance statement is a document that provides a summary of an individual's financial situation, including income, expenses, assets, and liabilities.

Who is required to file personal finance statement?

Certain public officials and government employees are required to file personal finance statements to disclose their financial interests and potential conflicts of interest.

How to fill out personal finance statement?

Personal finance statements can typically be filled out online or on paper forms provided by the relevant government agency. Individuals must accurately report their financial information, including sources of income, investments, and debts.

What is the purpose of personal finance statement?

The purpose of personal finance statement is to promote transparency and integrity in government by disclosing potential financial conflicts of interest among public officials and government employees.

What information must be reported on personal finance statement?

Information such as sources of income, investments, real estate holdings, business interests, and debts must be reported on a personal finance statement.

How do I edit personal finance statement online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your personal finance statement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the personal finance statement in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your personal finance statement in seconds.

How do I fill out the personal finance statement form on my smartphone?

Use the pdfFiller mobile app to complete and sign personal finance statement on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your personal finance statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Finance Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.