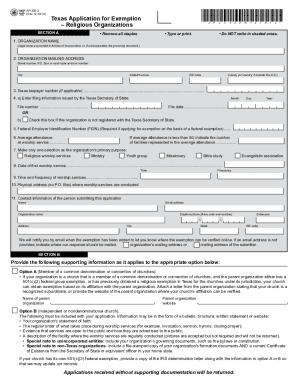

TX Comptroller AP-209 2017 free printable template

Show details

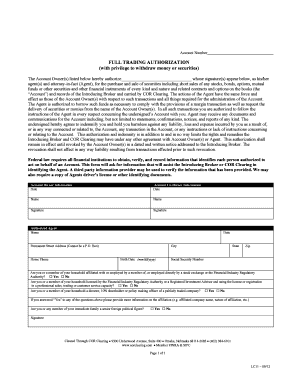

Texas Application for Exemption Religious Organizations GLENN HEGAR TEXAS COMPTROLLER OF PUBLIC ACCOUNTS Nonprofit religious organizations should use this application to request exemption from Texas sales tax hotel occupancy tax and franchise tax if applicable. Organizations that qualify for exemption based on a federal exemption are not exempt from hotel occupancy tax. The laws rules and other information about exemptions are online at www. Comptroller. Texas. Gov/taxes/exempt/. You can...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-209

Edit your TX Comptroller AP-209 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-209 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller AP-209 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller AP-209. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-209 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-209

How to fill out TX Comptroller AP-209

01

Begin by downloading the TX Comptroller AP-209 form from the official website.

02

Fill in your name, address, and other contact information in the designated fields.

03

Provide the relevant tax account number associated with your business.

04

Clearly specify the type of tax for which you are seeking exemption.

05

If applicable, include any supporting documents that justify your exemption claim.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the appropriate Texas Comptroller office either by mail or electronically, as instructed.

Who needs TX Comptroller AP-209?

01

Businesses seeking exemption from certain Texas sales and use taxes.

02

Organizations that meet specific criteria for tax exemption as outlined by the Texas Comptroller.

03

Nonprofits and other entities that require a formal exemption status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when you put exempt on your tax form?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

What is the difference between a w9 and tax exemption certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

Is it better to claim 0 or exempt?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do I become tax exempt in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What does IRS tax-exempt mean?

A "tax-exempt" entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

Is 0 the same as exempt?

For a “zero-rated good,” the government doesn't tax its sale but allows credits for the value-added tax paid on inputs. If a good or business is “exempt,” the government doesn't tax the sale of the good, but producers cannot claim a credit for the VAT they pay on inputs to produce it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX Comptroller AP-209 online?

Completing and signing TX Comptroller AP-209 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out TX Comptroller AP-209 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TX Comptroller AP-209 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out TX Comptroller AP-209 on an Android device?

Use the pdfFiller app for Android to finish your TX Comptroller AP-209. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is TX Comptroller AP-209?

TX Comptroller AP-209 is a form used by businesses in Texas to report information related to sales and use tax exemption.

Who is required to file TX Comptroller AP-209?

Businesses and organizations that claim a sales tax exemption must file the TX Comptroller AP-209 form.

How to fill out TX Comptroller AP-209?

To fill out TX Comptroller AP-209, you need to provide your business information, the reason for the exemption, and details about the transactions.

What is the purpose of TX Comptroller AP-209?

The purpose of TX Comptroller AP-209 is to document and communicate the reasons for claiming sales tax exemptions in order to comply with Texas state tax regulations.

What information must be reported on TX Comptroller AP-209?

The information that must be reported on TX Comptroller AP-209 includes the entity’s name, address, type of exemption being claimed, and specific details about the purchases related to the exemption.

Fill out your TX Comptroller AP-209 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-209 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.