Get the free BVI Companies ActChina Tax & Investment Consultants Ltd

Show details

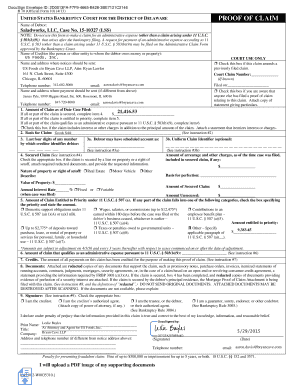

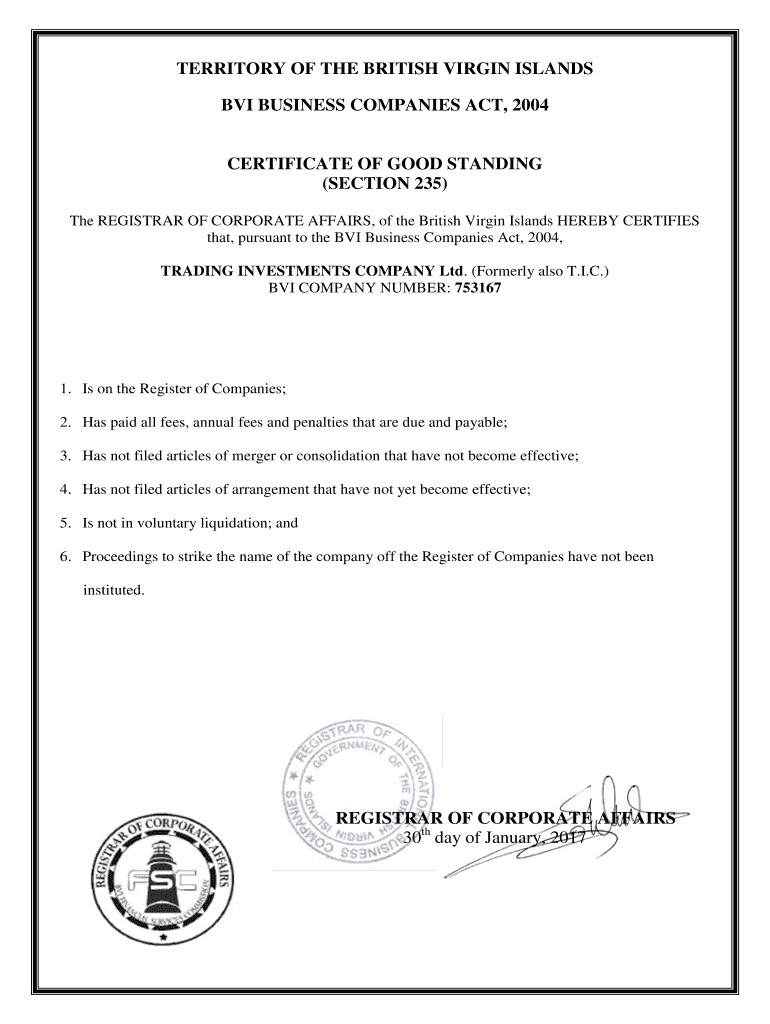

TERRITORY OF THE BRITISH VIRGIN ISLANDS

BVI BUSINESS COMPANIES ACT, 2004CERTIFICATE OF GOOD STANDING

(SECTION 235)

The REGISTRAR OF CORPORATE AFFAIRS, of the British Virgin Islands HEREBY CERTIFIES

that,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bvi companies actchina tax

Edit your bvi companies actchina tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bvi companies actchina tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bvi companies actchina tax online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bvi companies actchina tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

Do BVI companies file tax returns?

Filing date Companies are required to file their annual financial returns with their Registered Agent within nine months of their due date. Companies with a calendar year financial period are therefore required to file their first annual return with their Registered Agent, no later than 30th September 2024.

Why is British Virgin Islands a tax haven?

The Council of the European Union has placed the British Virgin Islands (BVI) on its "Blacklist" of Non-cooperative Jurisdictions for tax purposes. The British Overseas Territory has been named as a Tax Haven for its failure to meet OECD requirements on transparency and the exchange of information for tax purposes.

Do companies pay tax in BVI?

International tax agreement BVI Business companies are exempt from any taxation, regardless their source of income. The only tax existing in the BVI is payroll tax for companies employing local working force; the current rate is 8%, first USD 10 000 are tax exempt.

Is the BVI no longer a tax haven?

The EU tax haven blacklist now includes 16 countries: American Samoa, Anguilla, the Bahamas, the British Virgin Islands, Costa Rica, Fiji, Guam, the Marshall Islands, Palau, Panama, the Russian Federation, Samoa, Trinidad and Tobago, the Turks and Caicos Islands, the U.S. Virgin Islands and Vanuatu.

What is BVI tax advantage?

BVI has a “Territorial Tax System” which means IBCs (International Business Companies) that incorporate in the BVI but do business outside of the country are not taxed. Companies don't have to pay taxes on items, including income, capital gains, customs duties, sales, profits, inheritances, dividends and interests.

What is the BVI International companies Act?

The most recent legislative update includes amendments to the BVI Business Companies Act, Revised Edition 2020 made by the BVI Business Companies (Amendment) Act, 2023 and the addition of the BVI Business Companies (Financial Return) Order, 2023, issued 1 March 2023, and both are deemed to have come into force on 1

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bvi companies actchina tax from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including bvi companies actchina tax. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send bvi companies actchina tax to be eSigned by others?

To distribute your bvi companies actchina tax, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my bvi companies actchina tax in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your bvi companies actchina tax and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is bvi companies actchina tax?

BVI Companies Act is a legislation that governs the registration, operation, and dissolution of companies in the British Virgin Islands.

Who is required to file bvi companies actchina tax?

All companies registered in the British Virgin Islands are required to file BVI Companies Act tax returns.

How to fill out bvi companies actchina tax?

To fill out BVI Companies Act tax returns, companies need to provide information on their financial activities, shareholders, directors, and any other relevant details.

What is the purpose of bvi companies actchina tax?

The purpose of BVI Companies Act tax is to ensure transparency and compliance with company laws in the British Virgin Islands.

What information must be reported on bvi companies actchina tax?

Information such as financial statements, shareholder details, director information, and any changes in company structure must be reported on BVI Companies Act tax returns.

Fill out your bvi companies actchina tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bvi Companies Actchina Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.