Get the free Supplemental Insurance for Retirees - Lake County Schools - lake k12 fl

Show details

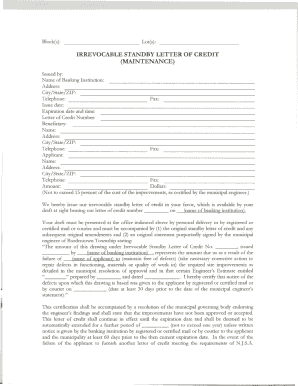

LAKE COUNTY SCHOOL BOARD Group Medicare Supplement VALERY INSURANCE 2113 Gulf Blvd., Indian Rocks Beach, FL. 33785 Phone (727) 5178888 Fax (727) 5178887 Email: valeryagency Verizon.net Toll-free (800)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental insurance for retirees

Edit your supplemental insurance for retirees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental insurance for retirees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental insurance for retirees online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supplemental insurance for retirees. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental insurance for retirees

How to fill out supplemental insurance for retirees:

01

Gather necessary information: Before filling out the supplemental insurance forms, make sure to gather all the necessary information such as personal identification details, retirement plan details, and any existing insurance policies.

02

Understand the coverage options: Supplemental insurance for retirees offers additional coverage to fill in gaps left by original insurance plans. It is important to understand the various coverage options available and choose the ones that best meet your needs.

03

Compare different insurance providers: Research and compare different insurance providers to find the one that offers the best supplemental insurance plans for retirees. Look into factors such as coverage options, cost, customer reviews, and reputation.

04

Consult a financial advisor: If you're unsure about the supplemental insurance options or the impact they may have on your retirement plan, consider consulting a financial advisor specialized in retiree insurance. They can provide valuable guidance and help you make informed decisions.

05

Fill out the application form: Once you have selected the supplemental insurance plan that suits your needs, carefully fill out the application form provided by the chosen insurance provider. Pay attention to accuracy and provide all the required information, ensuring that you don't miss any important details.

06

Review the terms and conditions: Before submitting the application, carefully review all the terms and conditions of the supplemental insurance policy. Understand the coverage limits, exclusions, deductibles, and any other relevant information.

07

Submit the application: After completing the application form and reviewing the terms and conditions, submit it to the insurance provider either online or through mail. Keep a copy of the application form and any other submitted documents for your records.

Who needs supplemental insurance for retirees?

01

Retirees with limited healthcare coverage: If your retirement plan or original insurance policies do not provide sufficient healthcare coverage, supplemental insurance can help bridge the gaps and provide additional financial protection.

02

Those with high out-of-pocket expenses: Supplemental insurance for retirees can be beneficial for individuals with high out-of-pocket expenses, such as copayments, deductibles, and prescription drug costs. It can help alleviate the financial burden of these expenses.

03

Individuals seeking additional coverage: Some retirees may prefer to have more comprehensive coverage than what their original insurance plan offers. Supplemental insurance can provide additional benefits such as vision care, dental coverage, or long-term care coverage.

04

Those looking for peace of mind: Retirement is a time to relax and enjoy life. Having supplemental insurance can offer peace of mind, knowing that there is added protection against unexpected medical expenses and potential gaps in coverage.

05

Individuals considering healthcare needs in the future: As retirees age, their healthcare needs may increase. Supplemental insurance can provide coverage for services like home healthcare, hospice care, or rehabilitation, ensuring that retirees have access to the care they may need in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is supplemental insurance for retirees?

Supplemental insurance for retirees is additional insurance coverage that can help with healthcare costs not covered by Medicare.

Who is required to file supplemental insurance for retirees?

Retirees who wish to have additional insurance coverage beyond what Medicare provides may choose to file for supplemental insurance.

How to fill out supplemental insurance for retirees?

Retirees can fill out supplemental insurance forms either online, through the mail, or with the assistance of an insurance agent.

What is the purpose of supplemental insurance for retirees?

The purpose of supplemental insurance for retirees is to help cover healthcare costs that are not covered by Medicare, such as copayments, deductibles, and services not covered by Medicare.

What information must be reported on supplemental insurance for retirees?

Information such as personal details, healthcare providers, medical history, and desired coverage levels must be reported on supplemental insurance for retirees forms.

How do I execute supplemental insurance for retirees online?

With pdfFiller, you may easily complete and sign supplemental insurance for retirees online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my supplemental insurance for retirees in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your supplemental insurance for retirees and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit supplemental insurance for retirees on an iOS device?

You certainly can. You can quickly edit, distribute, and sign supplemental insurance for retirees on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your supplemental insurance for retirees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Insurance For Retirees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.