Get the free Card account opening

Show details

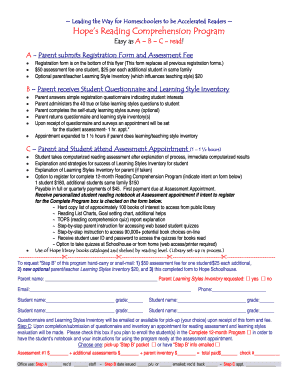

FEE TYPE

Card account opening

Card issue Visa Business Silver

Card account annual administration

Card account loading

Transfer from the card account to the companies current account

Fee for cash operations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign card account opening

Edit your card account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your card account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit card account opening online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit card account opening. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out card account opening

How to fill out card account opening

01

Gather all the necessary documents such as identification proof, address proof, and income proof.

02

Visit the bank or financial institution where you want to open a card account.

03

Fill out the account opening form with accurate and complete information.

04

Provide the required documents for verification.

05

Submit the filled form and documents to the concerned authority.

06

Pay any applicable fees or charges, if necessary.

07

Wait for the bank or financial institution to process your application.

08

Once approved, you will receive your card account details and card by mail or in person.

09

Activate your card as per the provided instructions.

10

Start using your card account for various financial purposes.

Who needs card account opening?

01

Anyone who wants to have a secure and convenient way of managing their finances.

02

Individuals who need to make online purchases or payments.

03

People who want to separate their personal and business finances.

04

Those who require access to various financial services and benefits offered by card accounts.

05

Individuals who travel frequently and need a reliable payment method.

06

Entrepreneurs and business owners who want to streamline their financial transactions.

07

Students or young adults who want to start building their credit history.

08

Individuals interested in improving their financial discipline and budgeting skills.

09

People who prefer cashless transactions for safety and convenience.

10

Those who want to take advantage of rewards and loyalty programs provided by card issuers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete card account opening online?

Completing and signing card account opening online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the card account opening in Gmail?

Create your eSignature using pdfFiller and then eSign your card account opening immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the card account opening form on my smartphone?

Use the pdfFiller mobile app to complete and sign card account opening on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is card account opening?

Card account opening is the process of opening a new credit or debit card account with a financial institution.

Who is required to file card account opening?

Individuals or businesses who are opening a new card account are required to file card account opening.

How to fill out card account opening?

You can fill out a card account opening form provided by the financial institution with all the required information.

What is the purpose of card account opening?

The purpose of card account opening is to establish a new line of credit or payment method for the account holder.

What information must be reported on card account opening?

Information such as personal details, contact information, financial history, and identification documents must be reported on card account opening.

Fill out your card account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Card Account Opening is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.