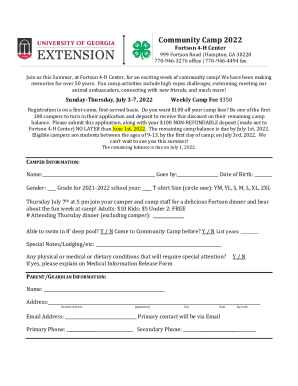

WI DJ-LE-FH2 2015-2025 free printable template

Show details

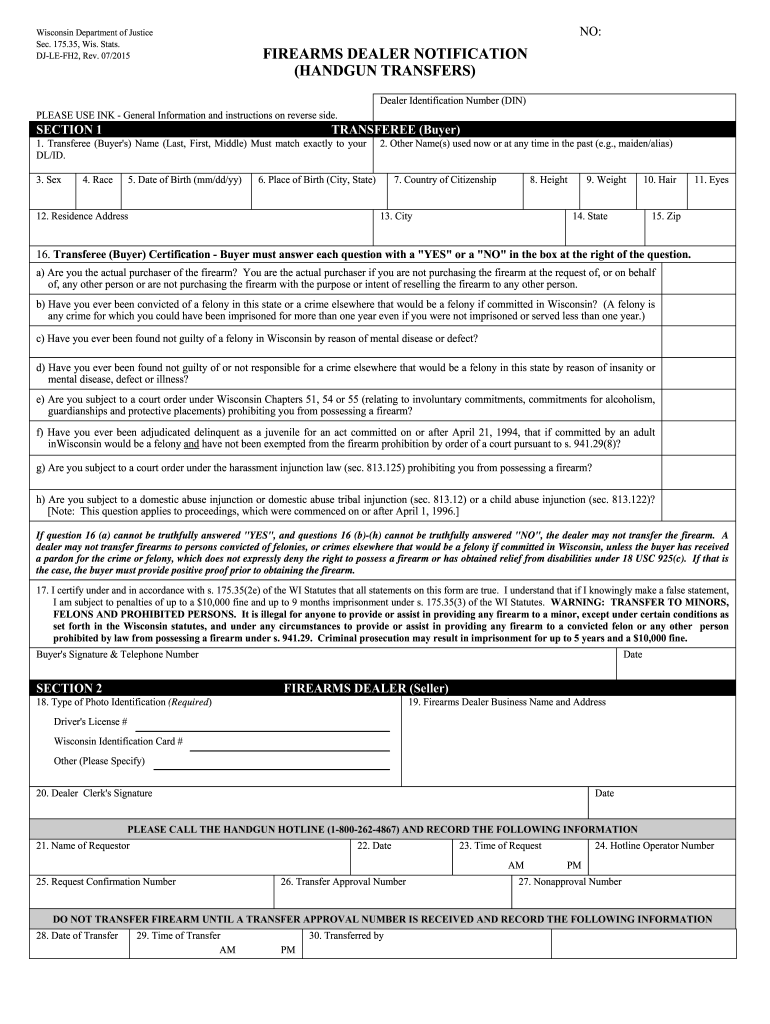

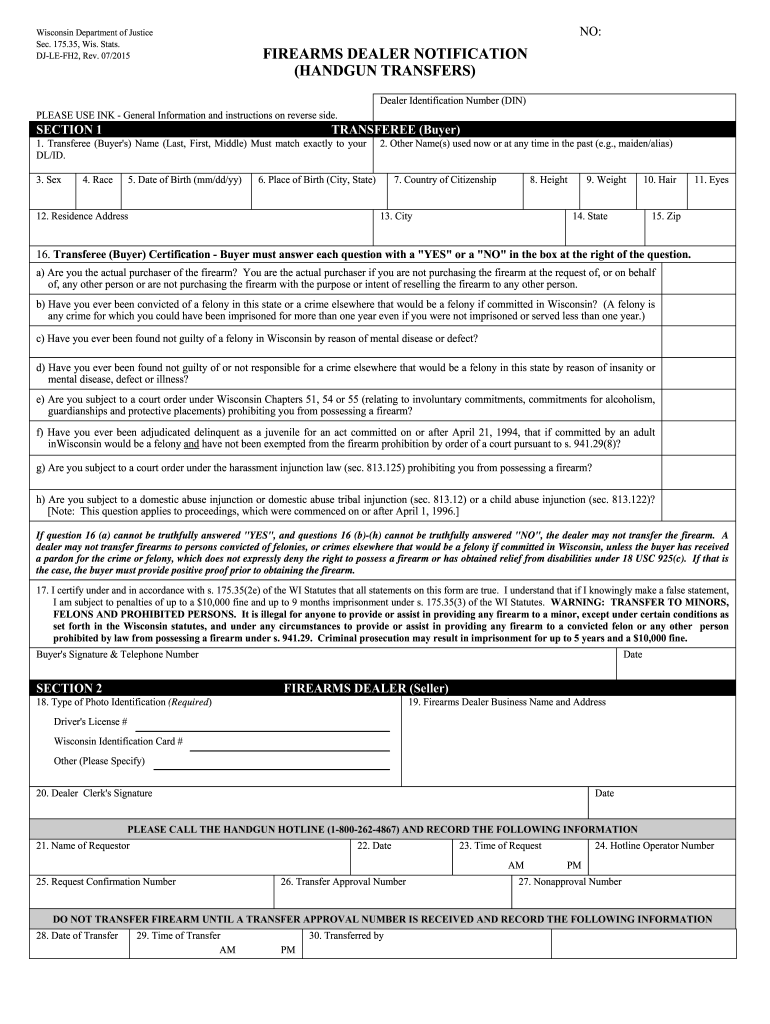

Wisconsin Department of Justice Sec. 175.35, Wis. Stats. DJLEFH2, Rev. 07/2015NO:FIREARMS DEALER NOTIFICATION (HANDGUN TRANSFERS) Dealer Identification Number (DIN)PLEASE USE INK General Information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign firearms djlefh2 get form

Edit your email wisconsin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wi wisconsin vehicles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit email wisconsin vehicles online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pursuant wisconsin vehicles form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out atf firearm form

How to fill out WI DJ-LE-FH2

01

Begin by entering your personal information in the designated fields, including your name, address, and contact details.

02

Provide relevant information regarding the child, including their name, date of birth, and place of birth.

03

Fill out sections related to the child's health, including any medical conditions or special needs.

04

Complete the questions regarding the child's academic and social history.

05

Review all information for accuracy before submitting.

06

Sign and date the form at the designated section.

Who needs WI DJ-LE-FH2?

01

Individuals applying for a child welfare services program.

02

Parents or guardians seeking assistance for their children.

03

Professionals working within the child welfare system who require detailed information for case assessment.

Fill

number identification

: Try Risk Free

People Also Ask about

How do I pay my Wisconsin state income tax?

Wisconsin law requires that you pay tax on your income as it becomes available to you.There are several options available for making estimated payments. Payments can be made via Quick Pay or in My Tax Account. Complete and print the interactive Form 1-ES Voucher. Call us at (608) 266-2486 to request vouchers.

What is the state income tax rate in Wisconsin?

How does Wisconsin's tax code compare? Wisconsin has a graduated individual income tax, with rates ranging from 3.54 percent to 7.65 percent. Wisconsin also has a flat 7.90 percent corporate income tax rate.

How do I become exempt from Wisconsin withholding?

Employee is a resident of a state with which Wisconsin has a reciprocity agreement. Wisconsin currently has reciprocity agreements with Illinois, Indiana, Kentucky, and Michigan. If you employ residents of those states, you are not required to withhold Wisconsin income taxes from wages paid to such employees.

What is the standard deduction for Wisconsin income tax?

For the 2021 tax year, your allowable standard deduction will fall within one of the following ranges: Single fillers: $0 – $11,200. Married filing jointly: $0 – $20,730. Married filing separately: $0 – $9,850.

Is there a standard deduction for WI state taxes?

Wisconsin offers taxpayers the opportunity to take a standard deduction. Standard deduction amounts are based on your taxable income and filing status. In general, the lower your taxable income is, the higher your standard deduction will be.

Who must file a Wisconsin income tax return?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vehicle id form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your vehicle id form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find vehicle id form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the vehicle id form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit vehicle id form on an iOS device?

Create, edit, and share vehicle id form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is WI DJ-LE-FH2?

WI DJ-LE-FH2 is a form used in Wisconsin to report certain types of income or wages for individuals, particularly in relation to taxes.

Who is required to file WI DJ-LE-FH2?

Individuals who have earned income or wages that fall into specific categories as defined by Wisconsin tax regulations are required to file WI DJ-LE-FH2.

How to fill out WI DJ-LE-FH2?

To fill out WI DJ-LE-FH2, gather all necessary income documents, enter personal information, report income amounts, and follow the instructions provided on the form.

What is the purpose of WI DJ-LE-FH2?

The purpose of WI DJ-LE-FH2 is to ensure that Wisconsin residents accurately report their income and wages for tax purposes, facilitating proper tax assessment and collection.

What information must be reported on WI DJ-LE-FH2?

The information that must be reported on WI DJ-LE-FH2 includes personal identification details, income amounts, types of income, and any applicable deductions or credits.

Fill out your vehicle id form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vehicle Id Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.