Get the free Note: This voucher should accompany any payment submitted for Form 20S or Form PTE-C...

Show details

FORMPTEV6/14AlAbAmA Department of revenue Individual And CorPorATE Tax Divisions Through Entity Payment voucherNote: This voucher should accompany any payment submitted for Form 20S or Form PTC income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign note this voucher should

Edit your note this voucher should form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your note this voucher should form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit note this voucher should online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit note this voucher should. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out note this voucher should

How to fill out note this voucher should

01

Write your name and contact information at the top of the voucher.

02

Fill in the date and time of the event or transaction for which the voucher is being used.

03

Provide a brief description of the purpose or reason for the voucher.

04

Include any relevant details or instructions related to the voucher.

05

If applicable, specify the amount or value associated with the voucher.

06

Sign and date the voucher before submitting it.

07

Keep a copy of the voucher for your records.

Who needs note this voucher should?

01

Anyone who wants to keep track of a particular event or transaction can use a note voucher.

02

It can be used by individuals, businesses, organizations, or institutions.

03

For example, if you want to document a payment, a service provided, or an item purchased, you can use a note voucher.

Fill

form

: Try Risk Free

People Also Ask about

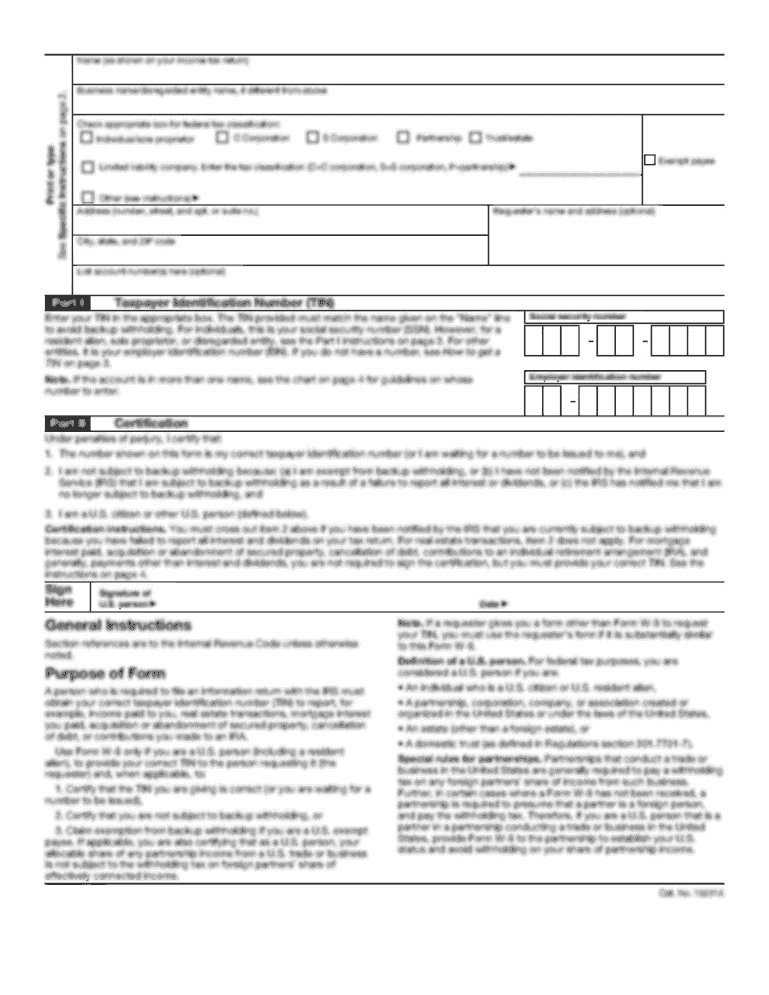

What are PTE payments?

PTE elective tax calculation The elective tax is 9.3% of the entity's qualified net income, which is the sum of the pro rata or distributive share and guaranteed payments of each qualified taxpayers' income subject to California personal income tax.

What is the purpose of PTE tax?

The key benefit to a PTE election is the full federal deductibility of the entity's state income taxes paid with a PTE tax. While the income and tax reported is dependent on each state's rules, there is no federal limit to the amount of PTE tax that is deductible.

What is the meaning of PTE in tax?

The pass-through entity (PTE) tax strategy is a work around to the limitation on the State and Local tax (SALT) deduction created by the Tax Cuts and Jobs Act (TCJA).

Why pay PTE tax?

The biggest benefit is that the PTE payment is a business deduction at the entity level, thus making this state income tax payment deductible on the federal tax return. This workaround is only in place for taxable years beginning on or after January 1, 2021, and before January 1, 2026.

What is a voucher on tax return?

Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. The IRS has different filing centers where taxpayers can send their payments and 1040-V forms depending on where they live.

Who benefits from PTE tax?

Overview of PTET The PTET is levied on an entity classified as a partnership or an S corporation for federal and state income tax purposes. The entity can reduce its ordinary income by the amount of the income tax paid, just as they do for payroll taxes and other state and local taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in note this voucher should?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your note this voucher should to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit note this voucher should on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign note this voucher should right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out note this voucher should on an Android device?

On Android, use the pdfFiller mobile app to finish your note this voucher should. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your note this voucher should online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note This Voucher Should is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.