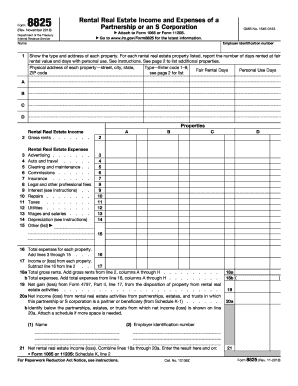

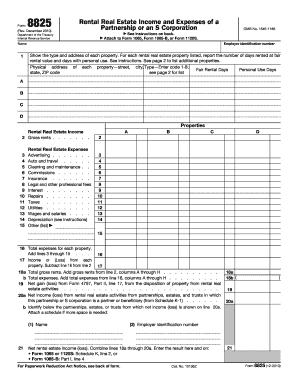

IRS 8825 2017 free printable template

Instructions and Help about IRS 8825

How to edit IRS 8825

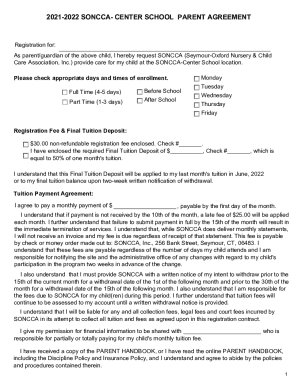

How to fill out IRS 8825

About IRS 8 previous version

What is IRS 8825?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

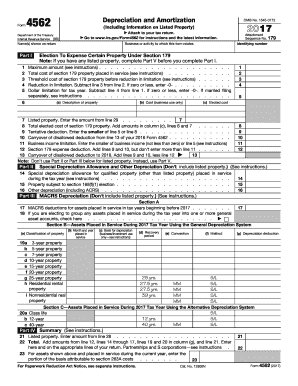

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

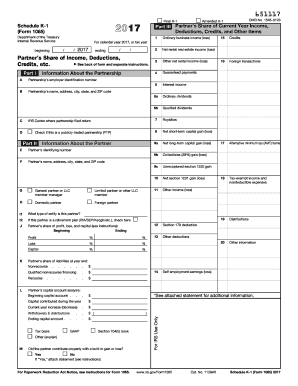

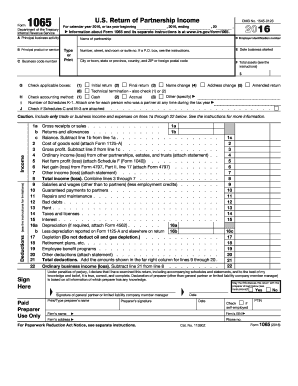

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8825

What should I do if I need to amend my IRS Form 8825 after submission?

If you discover an error after submitting your IRS Form 8825, you can file an amended return. Use the same form, clearly mark it as 'Amended,' and adjust the figures as necessary. It’s crucial to retain copies of any submitted forms for records and to ensure all corrections are documented properly.

How can I verify the status of my filed IRS Form 8825?

To verify the status of your filed IRS Form 8825, you can use the IRS online tracking tool available on their website. Additionally, you can reach out to the IRS directly via phone for updates on processing and any potential issues with your submission.

What are common mistakes to avoid when filing IRS Form 8825?

Common mistakes include inaccurately reporting rental income or expenses, failing to include all necessary information, or neglecting e-signature requirements for electronic submissions. Double-checking figures and ensuring all information aligns with supporting documents can help reduce errors.

Are there service fees associated with e-filing IRS Form 8825?

E-filing IRS Form 8825 may involve service fees, especially if you use third-party software or tax preparation services. It's essential to check the fee structure of the chosen platform as these costs can vary, and consider any potential benefits of faster processing times.

See what our users say